My wife likes to tell the story of how we first met, which culminates in a teeter-totter moment of decision where she very nearly “swiped left.” To this day, I’m not sure exactly what it was that tipped the scales in my favor, but I do know this: First impressions are important.

In the mortgage industry, and in the loan origination process specifically, there is a critical first impression created when the borrower has completed a loan application and is asked to provide supporting documentation. The way that moment is handled has strong and lasting effects. Is there a “needs list” provided? Is it verbal or written? If it is emailed, is there any guarantee it won’t get stuck in a junk or spam folder?

First impressions are lasting. Providing borrowers with an initial checklist of the documents they will need to provide during the loan process is your first chance to set proper expectations. We’ve learned through the recent refinance surge and COVID-19 experience that setting expectations goes a long way toward helping borrowers feel comfortable, reassured, and safe, which is essential in giving them a delightful loan experience.

The number one complaint that borrowers have about the loan process is poor communication. Starting on the right foot with communication means providing your borrowers with a clear (and preferably complete) list of items they will need to provide. It seems like a no-brainer that every borrower should receive one of these, yet borrowers continue to check the “No” box when asked if they got one.

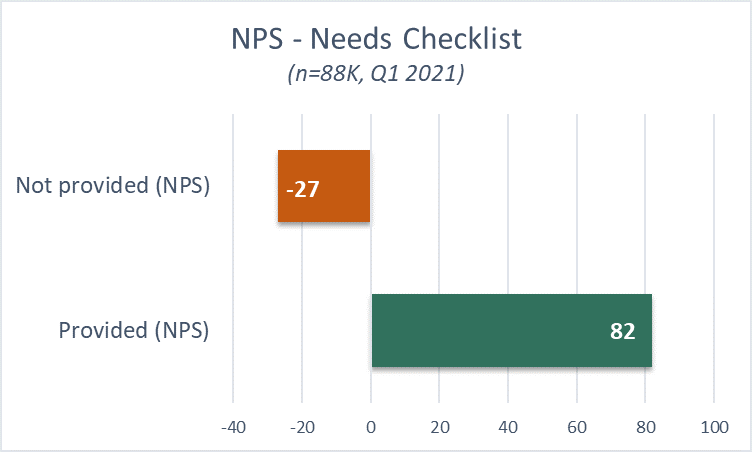

In our increasingly paperless world, more and more lenders are employing automated checklists. While this list may evolve as the information provided is reviewed, when lenders give the borrower a checklist at the beginning of the process, the Net Promoter Score (NPS) the borrower gives the lender is a very high 82.

Borrowers who do not receive an upfront checklist quickly get confused and frustrated and NPS plummets to -27. While this does not happen often (less than 5% of the time in our most recent survey period) it means the difference between a borrower who will promote you to friends and family and one who will instead badmouth you.

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.When it goes wrong:

“The overall process would have gone more smoothly if an application checklist had been provided. At times, I felt bombarded by the numerous emails that [my loan originator] sent regarding missing items.”

Borrower, Texas

Custom Satisfaction Score: 6.7/1

Ensuring paperless communications reach the borrower, including an initial checklist, is paramount throughout the loan process. If a borrower misses an automated email that they either didn’t see or that went to their junk folder, it’s just as damaging as not receiving a checklist at all. STRATMOR recommends having standard procedures include a follow-up call from either the loan originator or processor to make sure that the customer received and viewed their initial checklist and understands what to provide.

Gaining a referral from your loan process is much like having someone swipe right rather than left on a dating app. Here are three things you can do to make sure your communication starts and goes “right”:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.