In 2018, I spent a great deal of my time talking technology with lenders. Anyone who has engaged in a technology conversation with me knows that I have lots of thoughts on a wide variety of technology solutions available in the market. And, that I’m not shy about talking about the good and the not-so-good of what’s out there on the market today.

But as much as I like to share what I think, what I like even more is to hear what lenders think about the technology they are using. Even as lenders tell me about their experiences, they are all asking me the same questions: What technology is everyone else using? Is there any comparative information out there about the systems that isn’t generated by the vendors? Where can I get the straight story on technology? And what should I do next?

For the last four years, STRATMOR has sought to answer these questions and more for lenders through our Technology Insight® Study. We’ve recently released the 2018 study with more information than ever on a wide range of technologies that lenders are using — today. In this article, I’ll share some of the key findings of the report, bring in additional details from the insights provided to STRATMOR by our clients and offer advice on meeting the technology challenges in 2019.

One of the most noteworthy findings of the 2018 study is that digital is no longer a competitive advantage — it’s the new reality. Borrowers expect a digital experience, and lenders who are not offering their customers options for executing disclosures, uploading docs and other origination steps are falling far behind their peers.

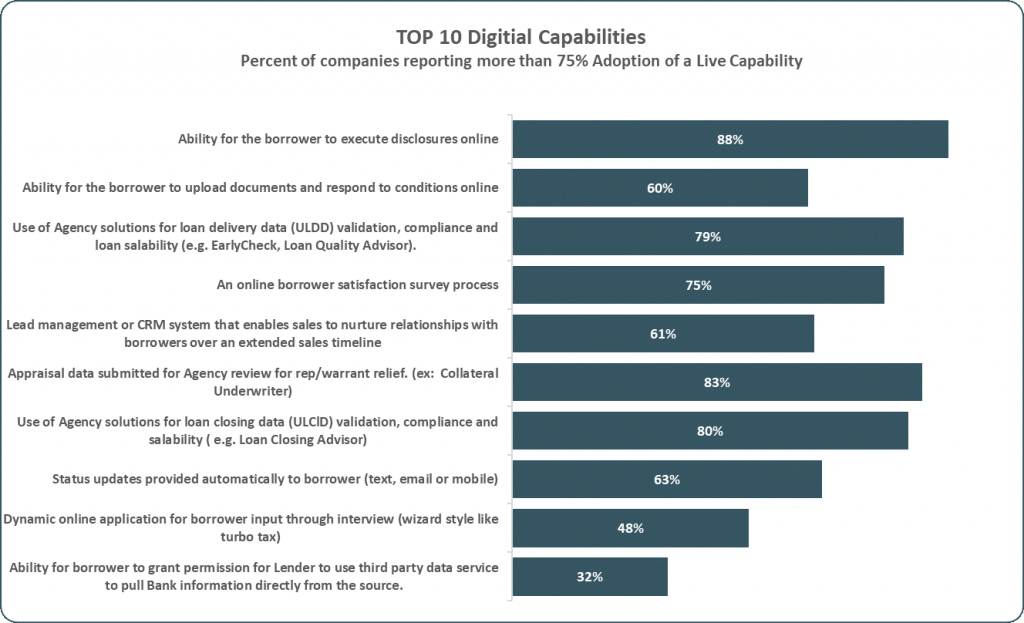

Most of the available digital capabilities are being deployed and utilized on the front end of the origination process, leaving great opportunities for efficiency gains on the back end. In fact:

Source: Technology Insight® Study, 2018 © STRATMOR Group 2019.

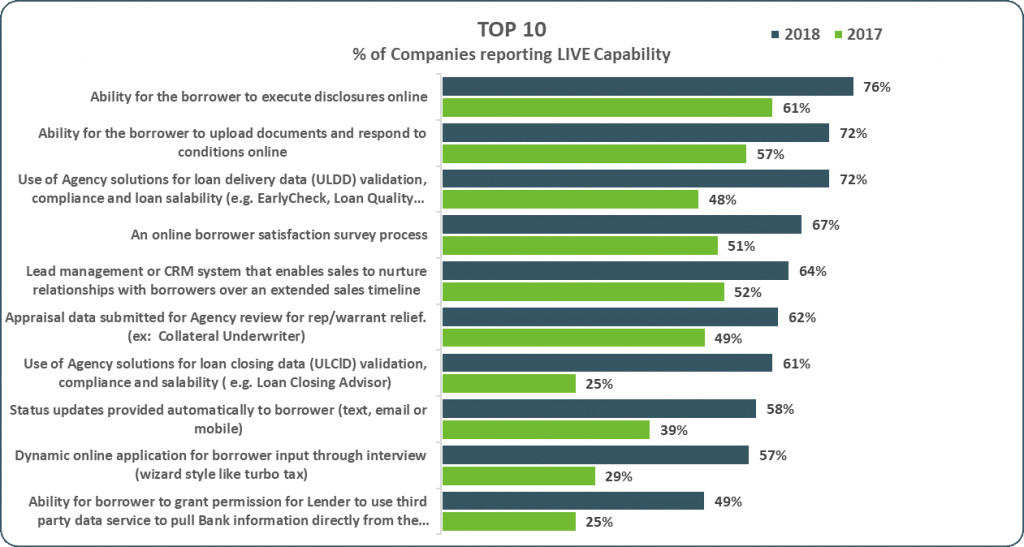

Source: Technology Insight® Study, 2018 © STRATMOR Group 2019.The increases in digital capabilities listed in Chart 1 are directly related to the top perceived benefits of digital:

This list speaks to not only the benefits for the customer but also to benefits that the lender gains from enhanced digital processes. The capabilities at the top of the list are ones that serve the customer and make the workflow better and faster for the lender.

You know how it is when you buy a new phone and three days later you see an even cooler one in an ad? It’s a little like that for some lenders after they commit to spending thousands — and in some cases, millions — of dollars and hundreds of resource hours to bring a new system online. At STRATMOR, we work closely with clients who are looking at their technology options to help them pick the right tool for the right reasons, at the right time. We turn to the Technology Insight® Study for lender feedback on systems because it gives us a clear picture of who is using what as well as how lenders really feel about the technology and the vendors.

If you’re considering upgrading your Point of Sale system (POS) or purchasing a totally new one, I can tell you that for the fourth year in a row, Ellie Mae’s Encompass is still the most used POS, although other new entrants are gaining ground, including Blend, which finished second.

If you’re thinking lead management or CRM, good for you! In our study, 18 percent of respondents said they do not use a company-sponsored lead management tool. Of the 81 percent who do, 78 percent use one or more of the 24, third-party systems sharing the CRM market. Of those 24 systems, Top of Mind, Salesforce and Velocify hold the top three spots, with Total Expert gaining share. During our conversations with our clients, many lenders tell us there are multiple, “user preference” CRM systems being used within their organizations, so adoption of specific systems within each of those lenders differs. With so many CRMs out there, it’s critical to make sure that what you choose works with your POS/Loan Origination System (LOS).

When it comes to Pricing and Production Engines (PPE), Optimal Blue dominated among study respondents.

Like the 2017 study, the 2018 study includes findings on Doc Prep, Fees and Closing Collaboration systems. New for 2018 are the addition of Production Pipeline Hedging and Servicing systems. With these additions, the 2018 study covers the full “tech stack.”

In addition to helping lenders with the challenge of integrating various solutions, another key component of the work we do with clients is evaluating each lender’s ability to support multiple integrations, as well as each vendor’s integrations with the other key systems. For example, does the PPE work well with the LOS, and does the POS really drive data into the LOS? Does the CRM effectively capture leads and push them to the POS?

When we talk about the adoption of a new technology, it is important to note that there are two different groups of adopters — lender personnel (industry adoption) and borrowers (consumer adoption). Here, we’re talking about lender adoption.

Five out of the top eight live digital capabilities report at least 75 percent adoption (see Chart 2). This means that lenders not only have the capabilities, but these capabilities are being widely adopted by the lender’s personnel. The capabilities that have lower adoption — dynamic online app and third-party data services — are relatively new in the market. We expect to see usage of these types of capabilities grow as both originators and borrowers gain confidence in the technology.

Technology Insight® Study, 2018 © STRATMOR Group 2019.

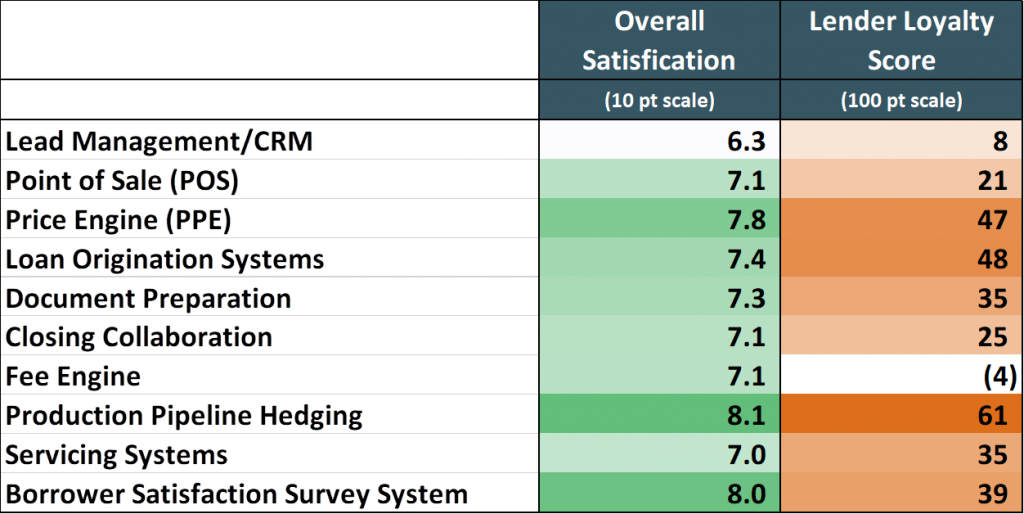

Technology Insight® Study, 2018 © STRATMOR Group 2019.It’s one thing to have and use a technology. It’s another to use and intend to keep using a technology.

We decided to use a 1-to-10 rating scale, calculated like a Net Promoter Score (NPS) and asked the question “How likely are you to continue to use this system?” We’re calling this analysis the Lender Loyalty Score® (LLS) and it provides an indication of satisfaction as well as the lender’s intention to continue to use a given technology.

In terms of the Lender Loyalty Score® analysis, Production Pipeline Hedging, LOS and PPE are at the top of the list (see Chart 3).

Systems have high LLS values for two reasons — their customers are satisfied with their performance or the cost of switching to a new systems (whether financial or opportunity costs) is high. The switch cost holds particularly true for the LOS. While lenders are generally satisfied with their LOS, it does not rank as high in terms of overall satisfaction as it does in the LLS value. In other words lenders will remain with a “good enough” LOS because the cost of implementing a new solution is so high in terms of licensing, development and training, not to mention the intangible costs of employee resistance to change.

© STRATMOR Group 2019.

© STRATMOR Group 2019. When STRATMOR did our first extensive tech survey four years ago, the C-level respondents overwhelming said that regulation was the primary driver of their tech investments. This is easy to understand — after all, TRID and other requirements of the post-meltdown regulatory mandates were certainly NOT optional. Lenders HAD to be compliant, and they spent their money accordingly. Of course, the post-Dodd Frank environment was also driven heavily by refinance activity, and by an increased demand for loans that drove the revenue necessary to fund tech investments. This is certainly not the case today, as regulatory pressure has decreased. But, so too has refinance volume. Now, we have an environment that is about stealing market share, and succeeding with the tougher purchase transactions. Ultimately, that means meeting borrowers’ expectations — today, it’s about customer satisfaction, maintaining the relationships and meeting the needs of borrowers and referral sources.

Measuring borrower satisfaction — which includes asking the right questions — and then taking action based on borrower feedback is the new differentiator in the market. Most lenders intuitively know they must do a better job meeting the needs of customers. However, they don’t always measure the impact of their technology and their system investments on the consumer. Consider this: we recently did an analysis for a client related to the impact of one element that impacts customer satisfaction. For a lender doing 5,000 units annually, we found that asking for the same document multiple times cost $243,000 in lost referrals and repeat business, and in negative mouth.

This is a missed opportunity, and STRATMOR encourages our clients to be sure to measure borrower satisfaction at a deep level to quantify the impact of any tech investments on customer satisfaction.

So, we know who is using what technology, the adoption rate of that technology and even how likely lenders are to stay with the technology they have. However, we also know that just buying the product — the new shiny tool — without designing a process or having the right change management discipline in place does not always lead to great results. Integrating technology solutions into the sales and fulfillment cycle and ensuring that you are driving high borrower satisfaction is a big challenge.

Before you pick technology tools, ask these six questions:

Get the answers on these questions from your team and your vendors. And, if you want help from me and the STRATMOR team, give us a call. We’ll give you straight answers to help you make the right decisions. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.