As most mortgage industry veterans know, lenders hate to be first. Lenders are not “early adopters” and tend to avoid taking risks, especially when it comes to technology. However, this paradigm must change.

At this year’s MBA Technology Solutions Conference and Expo in Dallas, Texas, George Blankenship, keynote speaker and a former Tesla and Apple executive, set the stage to do just that with some compelling stories about what it takes to transform a company from a status quo market contender to a forward-thinking and dynamic player of the future. He spoke first of Tesla’s mission to accelerate the world’s transition to sustainable energy. Tesla was the brainchild of a tiny band of obsessive Silicon Valley engineers who would go on to collaborate with — and collide with — the young billionaire, Elon Musk. Tesla’s goal was to create an entire sustainable energy ecosystem and, today, the company makes affordable energy products, such as electric cars and high-efficiency batteries, that are accelerating the advent of clean transport and clean energy production.

Blankenship followed the Tesla story with “Apple and the “iEcosystem.” The iMac was just the beginning of a new focus on elegant electronics and an innovative user experience. Following the iMac, Apple introduced iBook, the iPod, the iPhone, the MacBook Air, and the iPad. With the launch of the iPhone, Apple became the dominant force in the smartphone market, and it is estimated that Apple now has 1.3 billion active devices worldwide.

Blankenship’s message was clear: the mortgage industry, like Tesla and Apple, must transform from the status quo. Lenders need to become more forward-thinking and dynamic and be willing to cater to a new digital era that removes the complexities of getting a mortgage.

In this article, we share what we learned both as speakers and listeners at the MBA conference about up-and-coming technology innovations, a renewed focus to drive a positive borrower experience, tying the borrower experience to technology (and digital strategies), incorporating robotics and AI into the mortgage process, and an alternative to the traditional loan origination system (LOS).

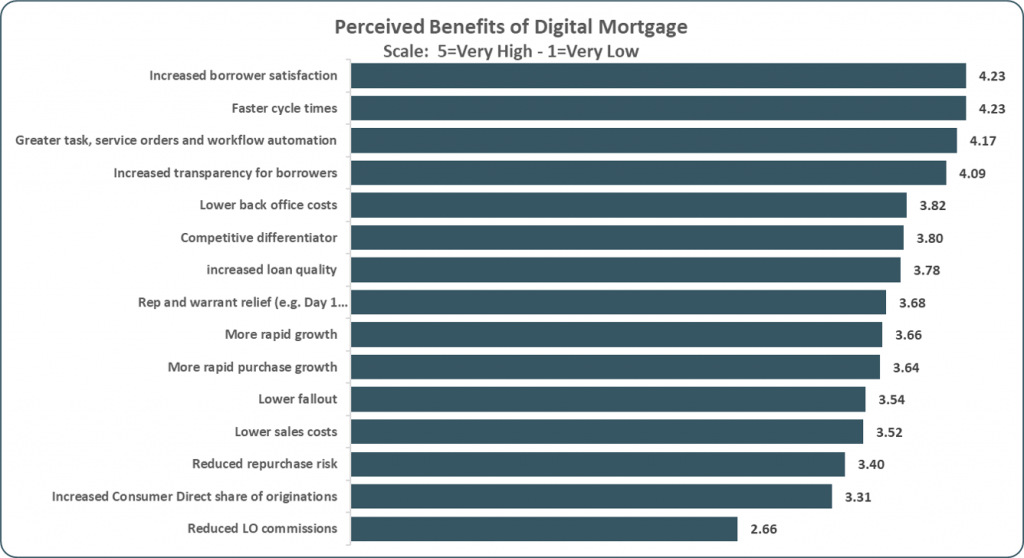

The borrower experience was at the forefront of many sessions at MBA’s Technology conference, including the one moderated by STRATMOR Senior Partner Garth Graham. In “The Consumer at the Center: Rethinking the Business Process from the Consumer’s Perspective,” 58 percent of the attendees gave “borrower satisfaction” as their primary reason for investing in technology. This conference poll agrees with STRATMOR’s findings in our 2018 Technology Insight® Study which shows increased borrower satisfaction as the number one driver for investing in digital technology. Running a close second was faster cycle times, which is really a key strategy for improving the borrower experience and increasing borrower satisfaction.

Source:STRATMOR Group Technology Insight® Study,© 2018.

Source:STRATMOR Group Technology Insight® Study,© 2018.Mike Fratantoni, Ph.D. and the Mortgage Bankers Association’s chief economist and senior vice president of research & technology, affirmed during one of his sessions that the origination cost per loan in 2018 rose again, and is now over $8,600 per loan. STRATMOR’s Graham indicated that more than 50 percent of these costs are in the sales part of the origination process. That’s right — sales, not marketing. And, according to MBA and STRATMOR Peer Group Roundtable results, only about two percent of these costs are attributed to generating new leads. In a later MBA session, only 12 percent of participants cited “attracting new customers” as a primary business driver.

“Lenders need to invest more in both marketing and technology to support efforts to drive more business, Graham says. “If a lender can generate more high-quality leads than competitors, thereby enabling their originators to do more volume, commissions and sales costs can ratchet down to allow lenders to price their loans more competitively. In our industry 80 percent of the volume is done by the top 40 percent of originators, so focusing on how to make them more productive gives lenders the ability to drive down the cost per loan.”

During my session, Residential Closing Super Session: Listen up! Emerging Technologies and Innovations, most participants prioritized improving the customer experience as the primary business driver to invest in technology. Much of the industry, and rightly so, is focusing on the borrower experience. In 2018, STRATMOR received comprehensive feedback about the loan experience from more than 115,000 borrowers. By optimizing their experience and generating happy borrowers, lenders can generate more business. These positive experiences are readily shared on social media, which is only one factor that can impact the lender’s brand.

STRATMOR believes the impact is much deeper than that. Mapping out the entire origination experience from initial contact through the borrower’s post-close and servicing experience enables lenders to identify each technical and human interaction that the borrower undergoes throughout the process. The lender can then shore up any gaps to continuously improve that overall experience and retain more borrowers from a servicing perspective.

In the next several years, the borrower experience will evolve to be comparable to other on-line experiences such as Apple, Amazon, and Uber. Borrowers’ personal data will be secure, but also more easily accessible to the lender — it will be aggregated and available to make qualification and approval decisions in a quicker, more streamlined fashion. Frankly, this is why blockchain has our industry’s attention, but it still requires significant vetting before it will be market-ready. Partners and third-party service providers will interact seamlessly. Several lenders in today’s market are already touting an “eight-to-ten-day close.” Often there is a tremendous amount of manual activity behind the curtain to make this happen. Within the next three to five years, this flurry of manual activity will be increasingly automated with shorter cycle times and the resulting benefits of better customer experience and decreased costs. In fact, it’s already starting to happen now.

“Going Digital” means that lenders are rapidly adopting a customer-focused business strategy with a customer-first mentality entrenched in their corporate culture.

Technology is only one component of this strategy and specifically, of the “people, processes and systems” equation. Michael Grad opened our March 2018 InFocus article by stating, “Adopting sound digital solutions that support lenders growth strategies can be as transformative to the mortgage industry as Uber was in revolutionizing the transportation industry and Amazon was in transforming the supply chain. For lenders to effectively grow and scale, a well-executed digital strategy should greatly improve the customer experience.”

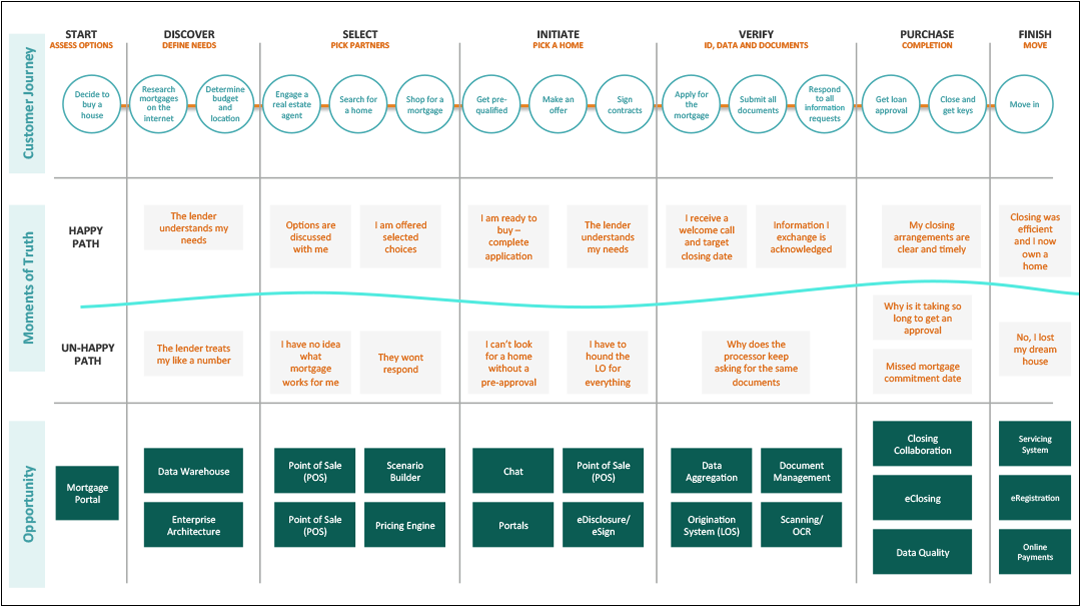

In the March 2018 issue, STRATMOR shared the graph below that illustrates the customer’s journey, from a customer’s view. The lender has many opportunities to greatly enhance the experience for the customer along the entire loan origination continuum.

Source: STRATMOR Group, © 2018.

Source: STRATMOR Group, © 2018.Why is the customer journey prioritized as the industry’s number one business driver now? The sustained downturn we are facing as an industry is new to many in the latest generation of leaders. The market now is about stealing share, and about driving purchase transactions and retaining borrowers in servicing portfolios. So, one key is to have great collaboration tools that enable the whole mortgage ecosystem — borrower, Realtor or referral source, the consumer, the lender and the vendors that support the lender — to all work together to close the transaction faster and ultimately more inexpensively.

In today’s environment, lenders invest in digital capabilities on the front end of the origination process, in CRM to track opportunities and communicate with the borrower, in POS and portal capabilities to ensure the borrower’s mobile and online experience are optimized, and in pricing engines to maximize the ability to compare loan products prior to application. To reiterate, mapping out the entire origination experience from initial contact through the borrower’s post-close and servicing experience enables lenders to identify each technical and human interaction that the borrower undergoes throughout the process. The lender can then shore up any gaps to continuously improve that overall experience.

Robotic Process Automation (RPA, also known as Bot) is a software-based technology utilizing software robots to emulate human execution of a business process. The Bots can perform automated tasks using the same interface a lender employee would, including opening applications, taking keyboard shortcuts, entering scanned data, and so on. RPAs can also interpret and trigger responses and communicate with other systems.

One of the biggest advantages is RPAs’ ability to perform on a vast variety of repetitive tasks, thereby improving the human employee experience by eliminating mundane components of their jobs. Further, RPAs never sleep, do not make mistakes and typically cost much less than an employee. In fact, since Bots function by simulating human activities, one lender STRATMOR interviewed for our 2018 Technology Insight® Study said that his company includes RPAs in their organizational chart. This makes sense. The RPA needs the same log-in access and assigned security rights as human employees and “reports” up to a designated department head. In other words, the RPA needs to be tracked and accounted for like any other user accessing the lender’s technology.

There are great examples of lenders using RPAs to automate work, especially repetitive work that becomes mundane for many employees, and to reduce human error and cost. The RPAs often work within the lender’s existing IT infrastructure and they are non-invasive.

Bots are not a silver bullet, however. They operate at the whim of any changes to the underlying application to which they are attached and therefore need frequent maintenance. As a lender builds up an inventory of Bots — and we are starting to see lenders with hundreds of Bots in operation — the ongoing support load can become material.

Gabe Minton, EVP & CIO at Guild Mortgage, submitted this LinkedIn post after the conference:

There is a lot of discussion around robotics process automation (RPA), machine learning (ML) and artificial intelligence and deep learning. RPA is making serious headway in our industry and is here to stay. Companies have been investing in RPA for over two years now and are seeing good ROI. Once you have a repeatable process established around RPA and you have multiple processes implemented, it would not be a stretch to attach ML to the “bots” to make them smarter. If a bot does a specific process and set of steps 1,000 times in a row, it could make recommendations of how to run more efficiently, then you would have Lean bots.

Based on this “robotic” concept, a common theme in many of the conference sessions questioned the future of the loan originator. Would the online digital experience negate the need for human interaction provided by this role? Grace Qi, product manager of Intelligence with Blend, shared a fantastic analogy about how Artificial Intelligence (AI) was able to beat a Grand Master at chess, but, when the combination of Grand Master and AI played AI, the combined computer/human team won. In short, the optimal borrower interaction should combine automation with human cognitive abilities, such as combining emotional intelligence (EQ) with borrower-facing interactions, to truly optimize the borrower experience.

At the conference, STRATMOR Principal Andrew Weiss talked with lenders who are taking a different route with their loan processing systems. Andrew writes:

It is no surprise to anyone who knows mortgage technology that the LOS has been the dominant application and the centerpiece to most lenders’ technology platforms. However, there are chinks in the LOS armor visible as CRM and Point of Sale (POS) solutions gain momentum in their prominence within lenders’ technology solutions. And Application Programing Interfaces (APIs) are all the rage for application service providers, and some lenders are seeing that they can assemble that customer-focused, end-to-end experience from the best of breed parts offered by several vendors and/or by developing components themselves.

Even the “traditional” monolithic LOS has been a primary integration point for many third-party services spanning from first borrower contact to closing (and everything in between — credit, AUS, MI, Docs, QC, etc.). Add to this fact that in the LOS’s role of integration, more and more of the information required to manufacture a loan is being provided digitally, such as Verification of Income and Verification of Assets. One pivotal role played by the LOS is to be the system of record — the one centralized place where the current state of the loan can be found. But increasingly, other functions performed by LOS — including workflow, document and data capture (inclusive of imaging, document recognition and data recognition), and business rules — can be better performed by external components. Additionally, specialized portals for borrowers, loan officers, underwriters, and closers are diminishing the need for a traditional LOS.

There are several industry-leading lenders that are pursuing this strategy of assembling an end-to-end platform rather than relying on a traditional LOS to be provided by a single vendor. We know it can be done, and we know that if done well lenders can break through some of the traditional cycle-time and customer service barriers. But adopting the strategy of assembling a best-of-breed platform from internally-built and vendor-purchased capabilities is not for the faint of heart. It requires a strong commitment to investing in and nurturing a world-class Information technology team. It also requires a well thought through, long-term plan (this type of capability is not created overnight), and management who will accept the risks and the inevitable bumps in the road in trade for the potential for true competitive advantage. A future In-Focus article will drill into the issues, risk, and benefits of creating the right end-to-end platform to match your business strategy.

In the end, even if a lender has the technology capabilities necessary to provide a seamless, paperless, digital mortgage transaction, there is one more major hurdle: adoption. Adoption — by the borrower as well as the lender’s staff — from origination to processing/underwriting through to post-closing must take place. Lenders should ensure that the new, automated processes are adopted and “sticky” so that, under a crunch, their team doesn’t revert back to old processes just to “get it done.” In STRATMOR’s 2018 Technology Study, lenders say one of the key obstacles to getting a digital mortgage done is originator adoption.

Our industry has evolved from a compliance- and process-driven mindset to a customer-focused business. This is a great first step toward optimizing the borrower experience. Lenders are also taking risks and stepping into new technology realms to accomplish this. RPAs (bots) are actively being incorporated into the origination routines to streamline work processes. More investment needs to be made in marketing and quality lead generation to gain market share and to set the stage to address origination compensation issues. Mortgage services are a continuum: from the initial contact with the borrower through servicing their loan. Great communication and high touch service with the borrower across this continuum will assure new business and improved retention.

Source: STRATMOR Group, © 2019.

Source: STRATMOR Group, © 2019.First, make sure your company has a valid business case for investing in technology. Second, make sure you don’t scrimp on this investment — be all-in in terms of people, processes and systems and make sure that implementation and execution are in line with the company’s overall business strategy. And third, ensure adoption. Do this by involving your people in the solution early on and throughout the rollout and deployment processes. Training, documentation and performance metrics are also critical to measuring the success of your technology investment. Finally, be sure to measure the impact on the CONSUMER since many of the solutions are about making the process better for them, so it’s very important to measure whether the solutions do make it better.

Each organization is different. Each has different strengths, and each can capitalize on low hanging fruit at their company. To affect real change, conduct a benchmark of your metrics compared to peers to determine where to focus your energies to have the highest impact on your investment in these resources. And once again, compare your customer satisfaction with peers. Raving fans drive referrals and repeat customers. Garth Graham

Do your part to help keep information flowing on in-use mortgage technology. Take part in STRATMOR Group’s 2019 Technology Insight® Study And, best of all, lenders who participate will receive the reports for the surveys they complete for FREE. Lenders, if you complete the surveys for all sections, you’ll have the entire 2019 Technology Insight® Study for the investment of your time. Take the first survey now on mortgage systems and rate the system you are using. For more information on the 2019 Technology Insight® Study, visit this page.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.