Have you ever wondered why every Target you walk into has a familiar feel to it? Whether you are in Chicago or L.A. or in one of the 41 Springfields dotted across the U.S., the Target experience is the same. The company goes to great lengths to achieve that consistency, from the layout to the music to smell of coffee wafting from the in-store Starbucks. Familiarity helps us relax, puts us in a positive state of mind, and boosts our confidence and trust in a brand.

Achieving this singularity in service is easier said than done, especially when it comes to financial services. In mortgage lending in particular, the experience may differ greatly from one loan to another, based on the performance of the staff involved and even the consistency of the brand from one branch to another. And some lenders have multiple channels, so the difference between CD and Retail could be substantial.

To achieve consistency in customer experience, you need two things; a clearly stated set of cultural values and employees who buy into those cultural values. The first part is easy. The second, not so much. This is what has always made franchise models — or in the case of mortgage lending, the distributed Retail model — so challenging.

For example, centralized operations like consumer direct lending may take their cultural queues directly from corporate leadership and are more easily carbon-copied to replicate corporate ideology. In a distributed Retail model, however, adoption of the company culture, including commitment to customer satisfaction standards, can be varied. Each mortgage store may be more like a boutique than the consistent experience offered by Target. In cases where corporate leadership has limited cultural oversight, the culture of the branch may be established by the branch manager, or even have a subculture established by one or more high-producing originators who become the ‘‘tail that wags the dog.”

Tackling this culture challenge can be difficult, and my colleague Jim Cameron has a lot to say about this in article about distributed Retail in the June STRATMOR Insights Report. However, there is one way to ensure that the customer continues to be at the center of the cultural priorities at your organization, and that is to ensure that you are looking at the customer experience across the organization.

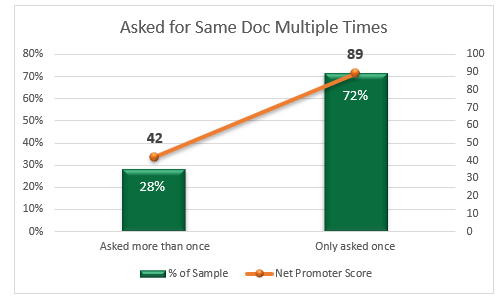

Consider this: originators are consistently beloved by their borrowers (95/100 average score over the past three years based on MortgageSAT data), but those high marks can be misleading, as they often fail to translate to repeat and referral business. Both a borrower’s Likelihood to Recommend and Likelihood to Use Again can swing downward dramatically when any part of the loan process goes awry. It could be something as seemingly innocuous as asking the borrower for the same document twice, but that small miscue will quickly flip a raving fan into someone who will badmouth you. In this case, the cost is 47 NPS points on nearly 30 percent of your loans. Originators who lack visibility into the loan process are most at risk of forfeiting future business.

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=142,845).

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=142,845). Achieving consistency in experience does not necessarily require consistency in approach. Different breeds of originators and teams will react differently to calls to embrace cultural values. For example, call center originators who are used to and thrive in an environment of high accountability and structure might respond well to inclusion of customer experience KPIs in their performance evaluations and even compensation drivers. Distributed Retail originators, however, might bristle at that high level of oversight. They will likely respond better to clear and convincing evidence of how miscues in the back office can cost them referrals and why keeping a close eye on the entire loan process is key to accelerating their personal portfolio growth.

Employee buy-in to cultural values and standards is crucial not just at the originator level, but for all team members including processors, underwriters, closers. And they should share in accountability, too. How can an underwriter be accountable to a customer experience score if they never interact with the borrower, you ask? It may be indirectly, but when you look at all the loans an underwriter touches in a given month, certain themes tend to emerge, like a high percentage of the borrowers thinking document requests were unreasonable or citing slow response time. If these metrics vary greatly from one underwriter to another, you know you have an issue.

Whether the employee is customer-facing or not, they have an impact on the customer experience. In STRATMOR’s experience, simply creating awareness of this — backed by empirical data, of course — can dramatically shift culture in a positive direction.

Here are three action items for creating a consistently delightful customer experience across your lending organization:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.