Recently, STRATMOR Senior Partner Garth Graham concluded a presentation by asking the audience to vote on which of three songs from the 1990s best represents the 2019 mortgage market. The vote went to Britney Spears’ “Hit Me Baby One More Time” for lenders hoping for one more drop in rates, one more refi wave, or for FinTech to come to the rescue — all fantasy notions in our current lending environment.

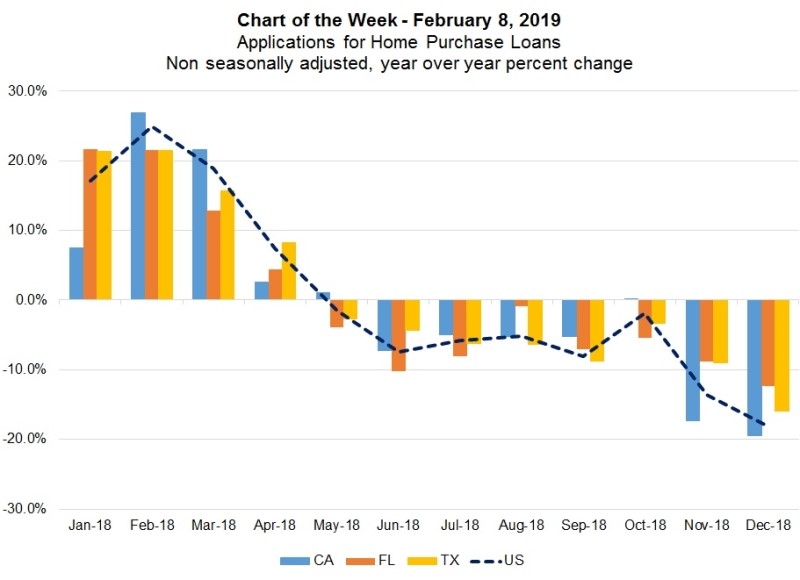

Let’s face it. The current market environment could very well be our “new normal.” Today’s lender needs to effectively shift focus to purchase versus refinance originations all while dealing with another contributing factor to today’s market dilemma — the lack of housing inventory that is keeping both buyers and sellers out of the market. The MBA’s Chart of the Week from earlier this month illustrates this well.

Illustration 1

Source: MBA State Mortgage Activity Report. MBA Chart of the Week, February 8, 2019.

Source: MBA State Mortgage Activity Report. MBA Chart of the Week, February 8, 2019.

So, while Garth was pointing out that a refi reprieve was a fantasy, and the MBA was posting pessimistic trends about the purchase market, Rob Chrisman was posting a blog on STRATMOR’s website — “How Are You Going to Compete?” That really is the big question — this is the “new normal” and lenders need to take steps to remain profitable. In fact, STRATMOR believes that lenders can stabilize in this environment and build a scalable foundation for future growth. We’re encouraging lenders to look to accomplish three objectives to help maintain profitability: optimize the borrower experience, renegotiate long-term contracts and evaluate compensation plans.

The idea that improving the borrower experience leads to growth and profitability resonates with nearly everyone. “Most lenders intuitively know they must do a better job meeting the needs of customers,” says Garth Graham. “However, they don’t always measure the impact of their technology and their system investments on the consumer. The mortgage industry is in an environment that is about stealing market share and succeeding with the tougher purchase transactions. Ultimately, that means exceeding borrowers’ expectations. Today, it’s all about customer satisfaction, maintaining the relationships and meeting the needs of borrowers and referral sources.”

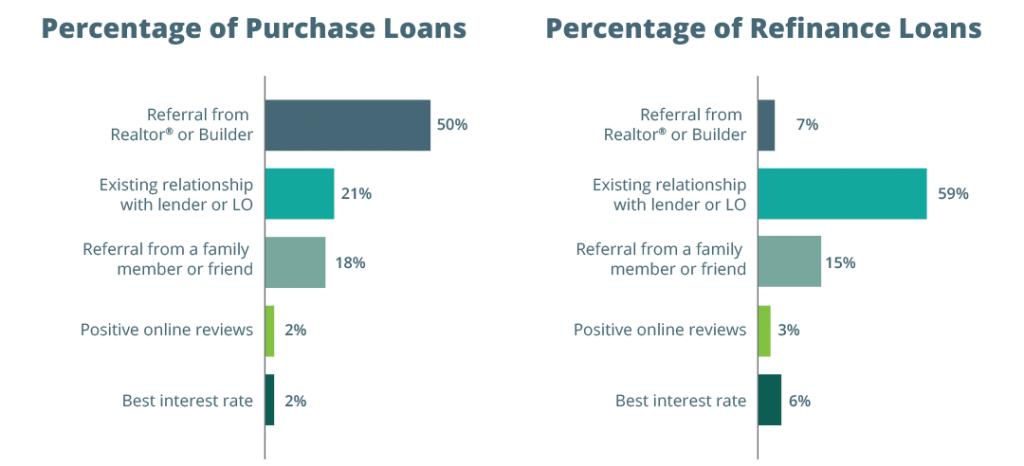

According to STRATMOR’s MortgageSAT Borrower Satisfaction Program data shown in illustration 2 for the twelve-month period ending December 31, 2018, the top three reasons borrowers choose a lender are all based on relationships. For purchase borrowers the top three reasons are: a real estate agent or builder referral (50%); an existing relationship with a lender or originator (21%); and a referral from a family member or friend (18%). For refinance borrowers the top two reasons are: an existing relationship with the lender or originator (59%) or a referral from a family member or friend (15%).

Illustration 2

Based on data from the MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.

Based on data from the MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.

STRATMOR has identified seven very important tactics lenders can employ in a strategy to create and keep happy borrowers. These tactics can be found in “The Seven Commandments for Optimizing the Customer Experience.” When followed, the tactics have been shown to increase the likelihood that borrowers will return and refer business to you. For a practical, in-action application of these commandments, read this article by Certainty Home Loans: “How Important are Satisfied Borrowers to Your Growing Business?”

If you’re asking, “How can we justify spending money on solutions to help us optimize the customer experience when we’re struggling just to stay afloat?” take advantage of another resource STRATMOR offers lenders — our MortgageSAT calculator. The calculator, developed by STRATMOR’s own Dr. Matt Lind, helps lenders visualize — in dollars and cents — the potential of gathering deeper insights into the borrower’s experience. In other words, the calculator offers lenders a way to quantify opportunity costs associated with not following the seven commandments.

Ultimately, optimizing the borrower experience is one of the drivers of process change, and STRATMOR’s Operational Review process can define what needs to change. “I seldom hear lenders say, ‘We want to build a process that is less painful for our customers,’ and yet offering superior customer service is a known competitive advantage,” says STRATMOR Principal Jennifer Fortier. “Meeting an ‘acceptable’ level of customer service doesn’t cut it with today’s borrowers — they expect such things as sound product selection advice, prompt, effective communication, closing at the expected rates and fees and closing on time. Processes created absent of the borrower point-of-view need to be refocused.”

“Lenders who focus on creating a good borrower experience will naturally end up with more effective fulfillment practices because they button up processes, systems and communications to make the borrower happy,” says Fortier. “Doing this gives these lenders an edge.”

A good first step is to analyze office lease agreements. Global Workplace Analytics notes that office space for the average worker costs about $11,000 a year. According to PGR: MBA and STRATMOR Roundtables data, lease expenses count for about 7.4 percent of total production expenses, depending on the lender’s corporate, branch and fulfillment center office locations.

Unlike most other fixed costs, a commercial lease is often negotiable. An analysis should include the following:

Consider leveraging the following negotiation tactics as part of your efforts.

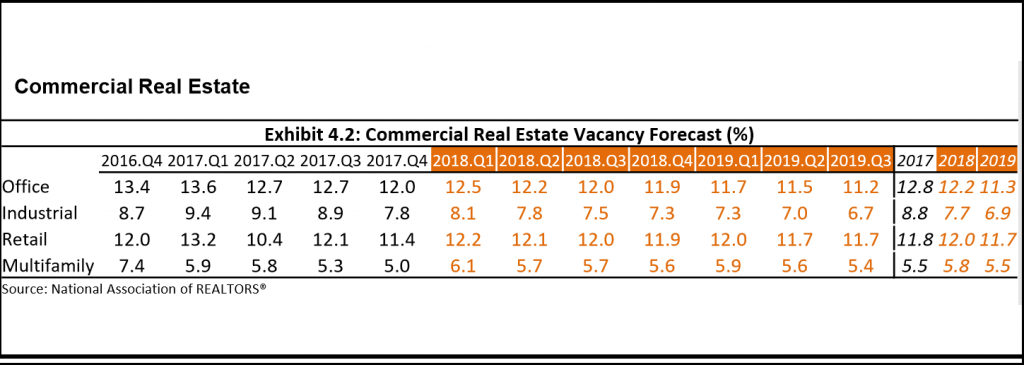

Commercial Real Estate vacancy rates across the U.S, as noted in illustration 3. are declining and are expected to continue to decline throughout this year.

Illustration 3

Therefore, landlords may be more open to discuss early termination of a lease since there is opportunity to release the same space for a higher rate to a longer-term tenant. If this is an option for your company, consider consolidation and possible hybrid telecommuting options. If relocation is not an option, discuss possible downsize opportunities (which again, frees up unused space for a new tenant who could potential be willing to pay higher rent). It’s also worth a try to propose increasing your expense stop, the fixed amount of operating expense above which you are responsible, if the landlord is charging you an overage. Leverage might include extending your lease term. The key is to understand why you need a reduction in costs, identify key negotiation options that are a win-win for you and the landlord, and write a proposal. Do not leave it in the landlord’s court to propose to you. Savings will likely be insignificant.

Consider going remote. As many of our lender clients are aware, STRATMOR has been remote since our inception in 1985. Yes, 34 years! We were “telecommuting” way before the Internet became a reality, and it has some great benefits:

STRATMOR leverages Regus™ Office Space, a national network of workspaces, to conduct meetings as needed. Our membership enables us to schedule meetings anywhere across the country with access to boardrooms, office units and amenities. It’s a great alternative for companies who can take advantage of this type of flex office arrangement.

Mortgage technology software agreements have evolved over the last decade from a traditional “per seat” licensing model to “per closed loan” subscription fees. In fact, according to STRATMOR’s 2018 Technology Insight Study, over 67 percent of all lenders who responded are paying subscription fees based on volume. This is a manageable variable cost in an up market; however, many of these contracts include a “minimum” monthly volume that can become a heavy cost burden to lenders in a downturn. STRATMOR is hearing this more and more in our current market environment. Mortgage technology providers thrive on the viability and profitability of lender customers. Therefore, both parties, lenders and vendors, should work together during tight markets to ensure both experience market longevity and profitability — a proverbial win/win relationship. To do this, lenders and vendors should work together to accomplish the following:

One of a mortgage company’s most costly expenditures is its workforce. In today’s market, evaluating existing compensation plans across roles can provide an opportunity to get creative in offering incentives to attract and retain key staff members.

The remote underwriter was born out of necessity as volumes grew and lenders were not able to find talent in their local markets. Across many industries, remote workers have become increasingly common — according to Global Workplace Analytics in their July 2018 telecommuting trends report, regular work-at-home among non-self-employed people has grown by 140 percent since 2005. The telecommuter population grew 11.7 percent from 2015 to 2016 alone.

In the mortgage industry, many see the opportunity to work from home with such perks as no commuting time or costs as a notable benefit. The trend of underwriters working remotely has continued to grow, with the percent of underwriters reported as fully remote growing from 20 percent in 2014 to more than 39 percent in 2018. While less common, there are lenders who have remote processors and closers, and job sites like Indeed.com list positions for processors, loan officers, underwriters and closers.

Remote staffing expands the pool of candidates as it reduces geographic boundaries, so lenders can recruit nationwide versus in a local market. Further, remote work offers lenders the opportunity to add and reduce staff quickly as needed, reducing the need to staff for “just in case.” And, offering remote workers more flexibility in schedule can offset the need for higher cash compensation. While remote work does not mean below market compensation, lenders may not need to pay a premium to steal talent in a local market if similar skills can be found in a remote worker.

Incentives are part of almost every mortgage banking business model. “Even in the fulfillment area, many positions pay incentives,” says Senior Partner Nicole Yung. “As you look at plans to recalibrate productivity expectations, consider looking at plan components that aren’t related explicitly to volume. Some of these factors include customer satisfaction, overall team or company performance and file quality. If, for example, the goal is to streamline processing, a measure of file quality coupled with productivity can serve to not only push staff to work quickly but encourage them to work with an eye on file quality. While you may save some in payouts, the real savings is in the downstream productivity from cleaner files by the processing group and the value that comes with higher borrower satisfaction.”

On the sales side, no lender wants to radically change commission plans. Originators are still the source of leads and a critical part of a mortgage company. However, commissions are not adjusting as margins drop. The current plans were built in an era of “big” margins and level set at a time of historic profitability. Nevertheless, there are ways to look at LO plans to better align with company performance.

One potential area where lenders can adjust are on maximum per loan payouts. In STRATMOR’s Comp Connection Study, 64 percent of lenders reported that they have maximum per loan payouts in plans. In this market, there may be an opportunity to adjust that maximum payout down. For example, Jumbo loans can require more attention, but does that requirement double when going from a $1,000,000 loan to a $2,000,000 loan?

The tiers in an originator plan are another place to look. “If the volume thresholds for these tiers were set years ago, they likely did not keep pace with the average loan size growth,” says Yung. “This inadvertently makes it easier for an originator to reach the next tiers based only on loan size growth. Resetting these tier levels can help push originators to reach for more loans and bring in more revenue.”

According to STRATMOR’s Originator Census® Study 2017, the bottom 20 percent of loan officers close, on average, less than one loan a month. Certainly, some of this group are new hires, but with an average tenure of 1.5 years, there are originators who are stuck at this level.

There are certainly tangible costs related to having sales people. The tangible costs include the Base Salary/Base Draw that most originators are paid to meet minimum wage requirements. These payouts are approximately $20,000 per year. On top of the base pay, originators are afforded benefits in terms of company subsidized health insurance plus 401k matching and other benefits. Overall, benefits are typically about 15 percent of base compensation.

Not only do these originators cost you once they are hired, but they often will require upfront costs in recruiting. More than half of the lenders in STRATMOR’s Comp Connection reported paying guarantees to new recruits. While recruiting originators is as much art as science, lenders should analyze past performance to look for trends on which LOs are successful. This would let lenders cut off guarantees faster for those originators that aren’t coming up to speed. Some key factors in this analysis should be applications taken per week and per month and conversion rate of those applications. In many cases, the writing in on the wall that an originator will not have adequate production even before their initial ramp-up period is over.

Beyond the hard costs, low producing originators can create friction with the fulfillment team. If an originator is only taking a handful of applications in a month, it is likely that the files compiled for processing are not as complete as more prolific originators. These files will require more phone calls and support from the fulfillment team to move to a stage where they are ready for underwriting.

Further, once a file gets to underwriting, the originator is likely to exert more pressure for a decision or concessions because this one deal may be the only live deal in the originator’s pipeline. There is no easy way to put a cost on this drag for the team, but it certainly costs lenders money and productivity.

“Lenders must actively manage out low producers,” says Yung. “Our data shows that even for the bottom 20 percent, almost 60 percent of terminations are voluntary, which means these originators are leaving on their own versus the company managing them out or up. If lenders are looking to cut costs, they must be more aggressive in terms of managing sales. Set expectations and stand behind them.”

Since more and more leads are coming from lender efforts, lenders should negotiate the basis points for loans originated where the lender provided the LO the lead. This means that “call center” LOs who do not generate leads are paid for converting leads to applications only. Being a servicer is also a big plus if the company excels at customer retention.

STRATMOR believes lenders should focus on marketing strategies, customer retention and the redesign of compensation programs to align with these shifts. Lenders who gain superiority in these areas will, in our opinion, be able to realize substantially improved margins.

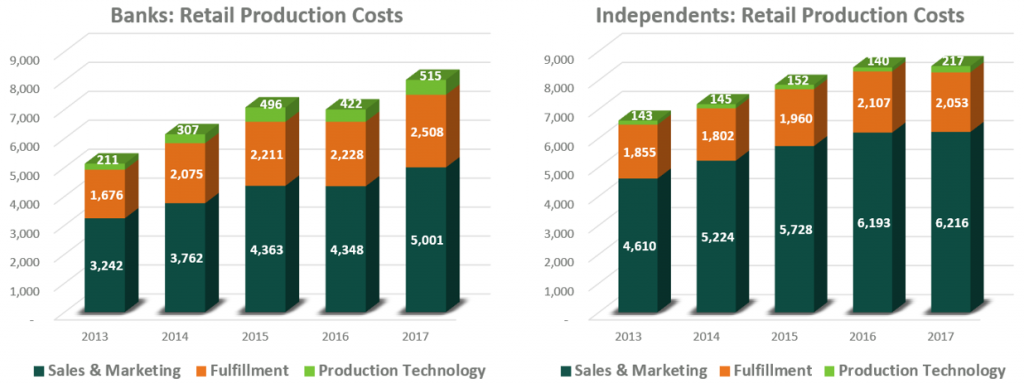

Of course, lenders cannot discuss compensation tactics, but they can agree to use good business sense when making scalable changes to compensation in their own organizations. As lenders continue to fight for the same top producing resources, these costs continue to rise. Per our 2017 PGR findings, Independent Mortgage Bankers’ depicted, on average, 73 percent of their total cost to originate was on the front end in sales and marketing costs while Banks showed 62 percent. This is the low hanging fruit, especially during a tight margin market.

illustration 4

Source: PGR: MBA and STRATMOR Peer Group Roundtables, 2018.

Source: PGR: MBA and STRATMOR Peer Group Roundtables, 2018.In a low interest rate environment with high production, these costs can be absorbed. However, as rates continue to rise, and margins tighten, these costs are creating a tangible hardship for many lenders. The mortgage industry, in looking at historical comparisons of other industries, should take note and adjust costs now. Case in point, the oil and gas industry, in both the Houston and Denver markets in the 1980s, entered recruiting wars for top petroleum engineer talent. At the time, the market was strong, and these companies felt justified in recruiting away from each other by offering higher signing bonuses and larger salary increases than competitors. Sound familiar? However, oil production decreased from 2,300 rigs in active production in 1985 to barely 1,000 in 1989. Reduced oil production combined with high costs for resources and facilities seriously compromised profitability for this industry and eventually led to “Black Monday” on October 19, 1987.

Let’s be smart. Interest rates are on the rise, overall origination production is expected to decline, and margins are tight. Following are several steps lenders can take to realign their organizations to anticipate the above and proactively adapt to this “new normal.”

1. First and foremost, determine what it will take to make and keep your borrowers happy. This will lead to more business.

2. Review long term contracts and renegotiate these where possible.

3. Reorganize, consolidate, and consider increasing the use of remote workers as both a cost savings strategy and compensation incentives for your staff.

4. Assess compensation plans across your organization, but, specifically, stop the bleeding relative to the ever-rising costs of recruiting and retaining originators and non-producing branch managers.

5. Use advanced marketing methods and tools to significantly increase the volume of lender-generated leads and base commissions on the source of a lead. Although this may lower LO commissions, it can increase the # closed loans per month for LOs who are good at converting leads to apps.

If you are contemplating how best to maintain profitability and build a scalable foundation for future growth, contact STRATMOR. We can guide your team in creating strategies to realize your objectives. Springer

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.