Lenders are spending more than ever before on tech as a percentage of loan costs, yet according to STRATMOR data, most lenders are not exactly satisfied with the technology choices they’ve made. And to make matters worse, most lenders have no idea how their customers feel about their technology choices.

How important is the borrower’s perception when it comes to implementing new technology?

According to STRATMOR’s 2019 Technology Insight® Study, lenders’ number one expectation when they invest in new technology is that it will improve customer satisfaction. So why is it that once the technology is implemented, most lenders fail to measure whether that happened?

Perhaps the answer is that they’re not focusing far enough down the road. If you’ve ever implemented a new technology at your company, you know that success is critically dependent on adoption by your employees. It is essential that your internal staff uses the new tools, but fostering internal adoption should not become and end unto itself, such that you lose sight of the broader goal of improving the customer experience.

A rocky borrower experience with new technology can immediately affect revenues in terms of a loss of referrals and poormouthing of the company to prospective customers. Ultimately, the voice of the customer will tell you whether your investment of time and money in new technology was worth it. If your shiny new tools are not perceived by customers as simple, intuitive and helpful, then you’ll need to right the ship quickly before you sink in a sea of negative sentiment.

Arguably, providing the best possible borrower experience should be at the top of each lender’s priority list and all other systems and spending should support that goal. According to data from MortgageSAT, which measured the loan experience for more than 133,000 borrowers in 2019, interaction with online tools can very much make or break the chance of repeat or referral business.

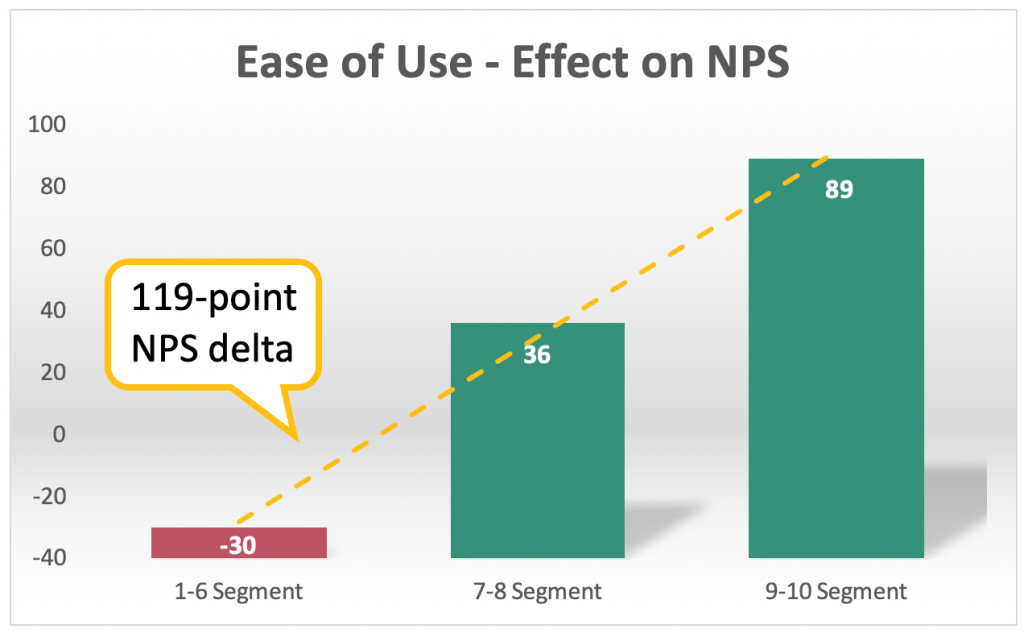

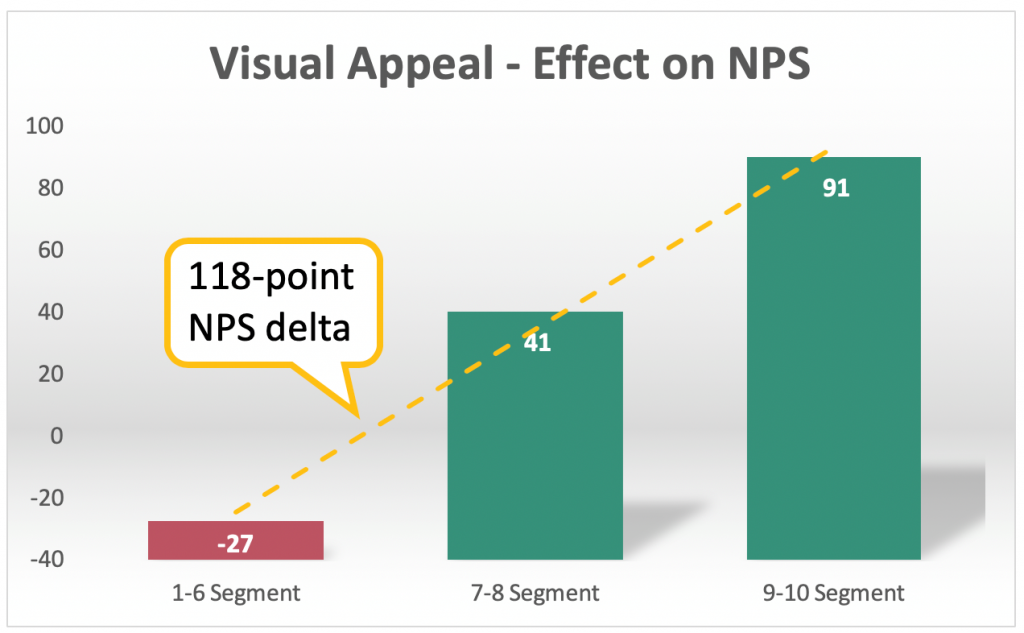

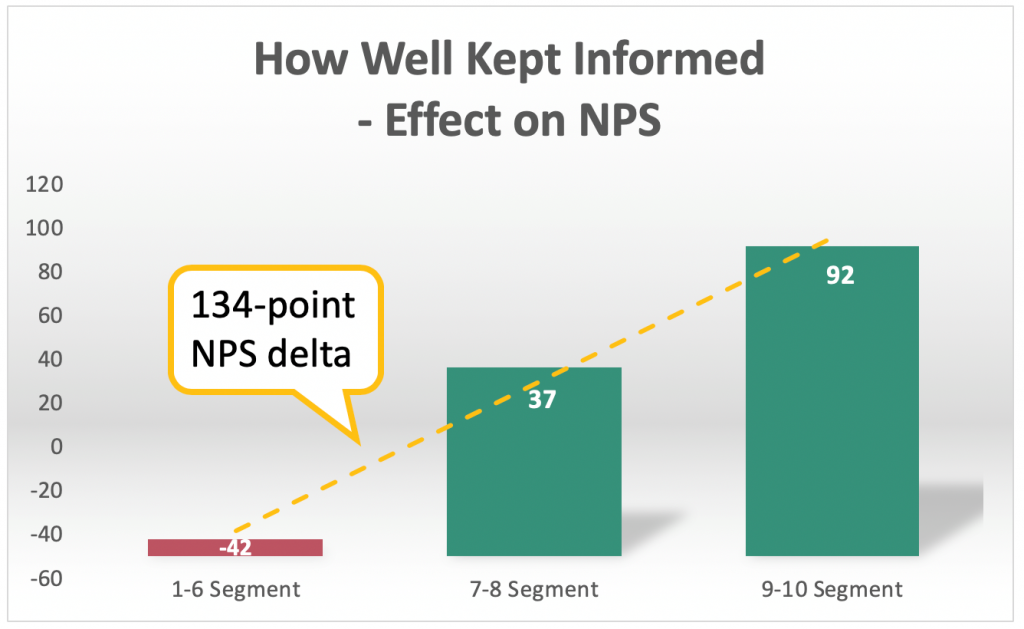

Consider what happens to Net Promoter Score (NPS), which measures likelihood to recommend to friends and family, when borrowers have a less than stellar experience with a lender’s online tools:

Chart 1

Chart 2

Chart 3

In conclusion, while internal adoption is extremely important to the successful rollout of a new technology, it’s only the first stop along the route to success. Lenders need to remember why they purchased the new technology in the first place and keep their eyes focused on consumer adoption — and the ultimate prize, consumer delight.

Here are three ways you can begin to tap the voice of the customer for feedback on your consumer-facing technology:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.