Have you ever seen the television show, American Ninja Warrior? It’s one of those thrilling-yet-agonizing competition shows where contestants race the clock while traversing an obstacle course gauntlet of intimidating physical challenges. One wrong step, one slip of the hand, and it’s over for them. They don’t get a second chance. Only the elite contestants make it all the way through and triumphantly press the buzzer at the end — to everyone’s great relief and satisfaction!

Shepherding a borrower through the mortgage loan process can feel a lot like one of these competitions, having similar high stakes and plenty of potential pitfalls. And the moment you let the customer fall from the so-called “happy path,” along with them goes any chance of getting a referral. How can you ensure your borrowers stay on the “happy path” and finish as triumphant, raving fans?

How many times have you seen an originator email signature that says, “Your satisfaction is my greatest compliment” or something to that effect? If we’re being honest, the true sentiment here is “Your satisfaction with me is my greatest compliment.” Generally, originators believe that their own personal rapport with the borrower — i.e. likability, personal brand, trust, protection — will dictate that borrower’s likelihood to refer them future business. The data unfortunately disagrees. Over the past three years, originators have consistently scored 95 out of 100 on Satisfaction, while Net Promoter Scores (which measure likelihood to recommend) have come in significantly lower — just 68 in our most recent calculations for Q2 2021. Originator likability does not drive referrals any more than a great waiter makes you recommend a subpar restaurant.

Instead, it’s the ups and downs and bumps and bruises of the loan process that ultimately determine if a borrower will recommend you to friends and colleagues. What these email signatures really ought to say is, “Your satisfaction with the entire loan process is my greatest compliment.”

Loan officers are notoriously distancing themselves from, and are at odds with, the fulfillment process. Finger-pointing along these lines is as old as the mortgage industry itself. However, building a culture that champions an elite customer experience starts with creating originator buy-in regarding visibility and personal investment in the entire loan process. What most originators don’t realize is that their next referred deal quite literally depends on it.

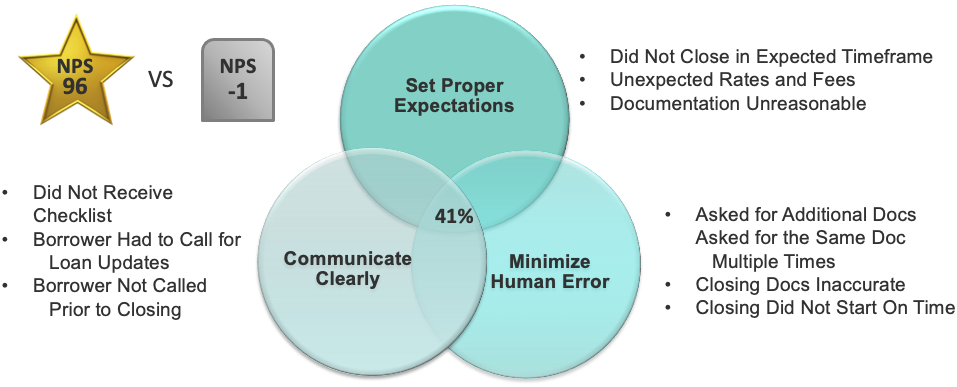

According to MortgageSAT data, with a year-to-date sample size of more than 164,000 borrowers, a pristine process, one without any of the below miscues, generates an NPS of 96. Contrast that with the average NPS of -1 when any one of these miscues is present:

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=164,024).

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=164,024). In other words, let the borrower get tripped up by one of these obstacles in the mortgage loan process and they’re more likely to badmouth you than they are to refer their friends and colleagues.

The first thing an originator may say when presented with this data is that some of those things “are not my job” and others are “out of my control.” The thing is, it doesn’t matter whose job or whose fault it is. A referral hangs in the balance, and as we head back into a purchase market, referrals and repeat business are going to be the lifeblood of originators for some time to come. Originators must find ways to insert themselves where needed to ensure their business survives and thrives.

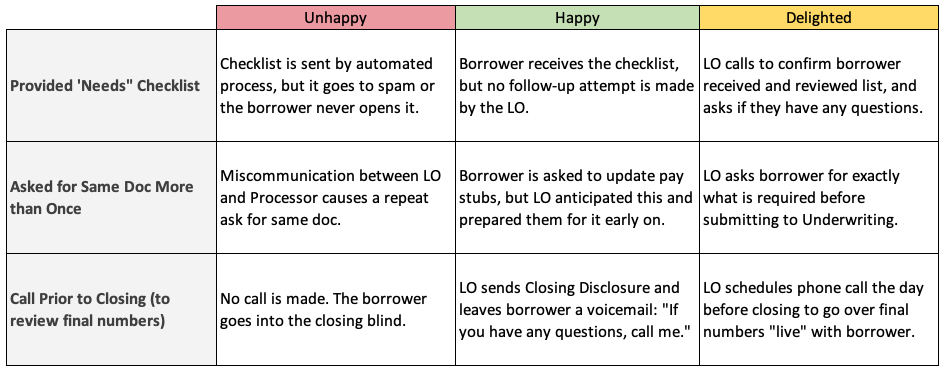

Here’s a quick start guide with three examples of how originators can begin to think more proactively about managing a delightful loan process and creating raving fans.

Source: © Copyright STRATMOR Group, 2021.

Source: © Copyright STRATMOR Group, 2021.STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.