Are you using technology to drive a better end-to-end loan experience for your borrowers?

At the 2019 MBA Technology Solutions Conference, presenters and attendees alike were focused on an improved “customer experience” as the driving force behind new and needed technological changes. During his presentation at the conference, STRATMOR Senior Partner Garth Graham reviewed the 2018 STRATMOR Technology Insight® Study, which asked industry executives what they perceived to be the benefits of digital mortgage. The top answers were:

1. Increased borrower satisfaction

2. Faster cycle times

3. Greater task, service orders and workflow automation

4. Increased transparency for borrowers

In other words, the benefits either directly referenced improving the borrower experience, or indirectly referenced it by way of making the whole process faster and easier for the borrower. Equally interesting are the answers that were NOT at the top of the list:

This de-emphasis of overhead costs and product differentiation is reflective of an understanding that borrowers rank cost and product features low on their list of primary reasons for choosing a lender. It is also further confirmation that lenders are beginning to understand that when you take a customer-centric approach to lending and provide a world class borrower experience, the rest has a way of working itself out. This is great news and a great trajectory for the mortgage industry, which has a golden opportunity to transform itself from status quo behemoth to a more agile and forward-thinking system, taking a page from companies like Tesla or Apple.

Many lenders these days are making (or are preparing to make) significant investments to update their digital mortgage tools. There seems to be an industry-wide consensus that this is an important area for each lender to address, lest you fall behind the times and therefore behind the competition.

The approach you take, however, will be determined by how you answer this question: How will digital mortgage benefit our organization? Your answer may expose whether you are simply preserving the status-quo or are ready to lead the forward-thinking charge.

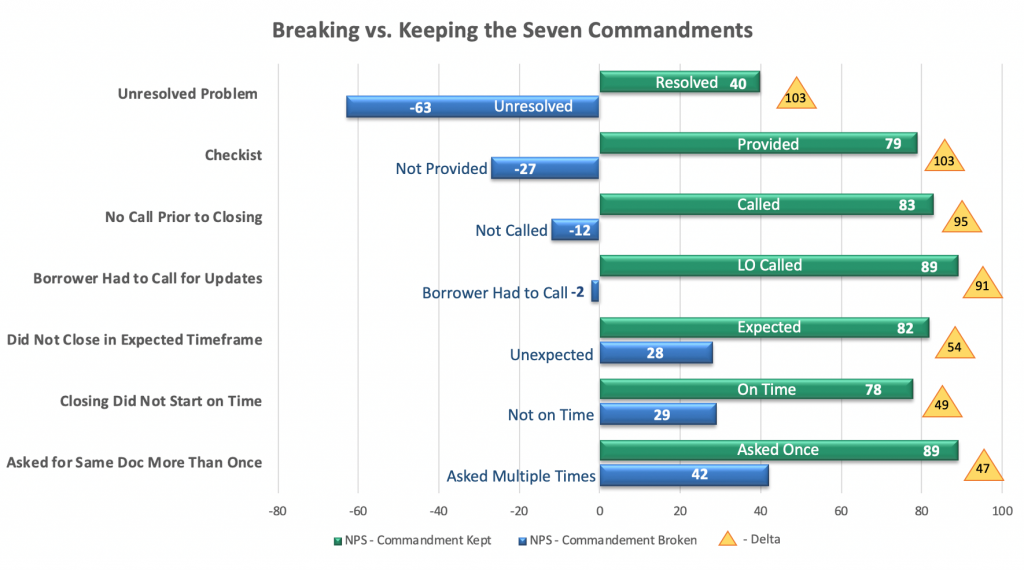

If you want to know the best ways to use technology to drive borrower satisfaction, you first need to know what the borrowers most care about. That involves asking questions about the end-to-end loan experience and weighing them to see which ones do the most to tip the customer sentiment scales. STRATMOR’s MortgageSAT Program does this on a regular basis, measuring the borrower process from application through closing for more than 100,000 borrowers annually. We specifically key in on how missteps on certain loan processes (which we call the Seven Commandments for Achieving Borrower Satisfaction) affect the Net Promoter Score (NPS), which indicates borrowers’ willingness to recommend to friends and family.

Here are some of the results:

Source:MortgageSAT Borrower Satisfaction Program, 2019.

Source:MortgageSAT Borrower Satisfaction Program, 2019.

As you can see, there are several items on the list that could be addressed with digital mortgage tools, such as providing an initial checklist, reaching out proactively to provide loan updates to the borrower, and making sure you don’t ask for the same document multiple times. Knowing where to focus, however, only gets you halfway there. It’s quite another thing to take concrete steps to implement technology and processes to ensure a delightful experience for each of your clients. I’m reminded of the old G.I. Joe tagline, “Now you know…and knowing is half the battle.” The other half is the doing.

You don’t have to be the first adopter of new technology, but you also don’t want to be the last! Here are three ways you can begin driving a better loan experience for your borrowers using technology:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.