If you pay attention to the industry news, you likely have a sense that mortgage merger and acquisition (M&A) activity is hot right now. But is that factual or just a fiction told by buyers trying to attract sellers?

Our insight into this topic comes not only from STRATMOR Group’s client base, but also from collaboration with the Mortgage Bankers Association. The PGR: MBA and STRATMOR Peer Group Roundtable Program provides us with a significant pool of information to help make sense of the fast-changing mortgage lending business.

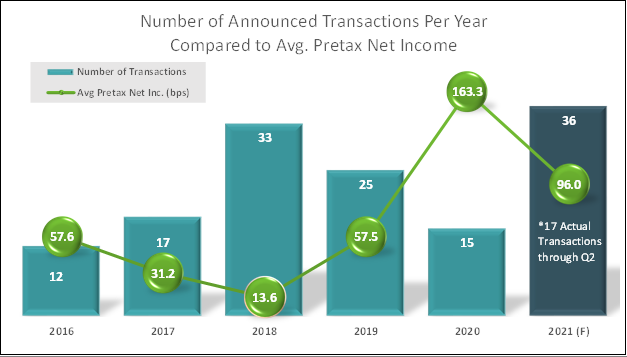

2018 saw a historic level of M&A activity in our industry with 33 deals consummated. But there are year-to-date trends that suggest 2021 will record even more M&A transactions, perhaps more than we have seen in years. Current data indicates that we are amid some level of an industry consolidation.

However, it should be noted that none of the prospective sellers we are talking with are pursuing a sale out of fear of failure. Quite the opposite. Some logically entered this process as the next step towards their planned retirement, while most others recently entered conversations simply out of entrepreneurial curiosity. They are discovering meaningful, strategic synergies with select buyers (those who are like-minded and operate complimentary business models). These consolidation opportunities position the combined companies for better performance and financial returns and they also provide growth and upside for their collective employees. If done right, one plus one can equal three.

At STRATMOR, we have found a direct correlation between the number of M&A deals that occur in our industry annually and the average pretax net income of mortgage lenders. As margins tighten and lenders earn less, more will look to sell. When profitability is high, few want to sell.

In Chart 1, we plot the number of M&A deals in each year relative to the industry’s average pretax net income for that year.

Chart 1

Source: Source: Mortgage Bankers Association Quarterly Performance Report, STRATMOR.

Source: Source: Mortgage Bankers Association Quarterly Performance Report, STRATMOR.The historical relationship is clear. When profitability increases, owners hold onto their companies. When it falls, more look to sell. As noted earlier, the biggest year in recent history for M&A was 2018, when the industry only made 13 bps of net income. Then, in 2020, which was the most profitable year for mortgage originators in decades at close to 160 bps, M&A fell to less than half of what it was just two years earlier.

Where are we in 2021? So far, as we work through the third quarter, profitability is still high, although dropping from the highs of 2020. We expect lender income this year to average about 90-100 basis points by year’s end. But this is far below what lenders earned last year, and when profitability falls, we see owners start to consider selling. And, we’re seeing buyers with war chests earned when profits were high looking to leverage their earnings and tech investments. It can be a win for both.

By the end of the second quarter 2021, the industry had already closed 17 deals. We expect to see at least 36 deals close by the end of the year, making this even bigger than the consolidation of 2018. Net income is a big driver, but we have identified other drivers that we expect to contribute to high levels of M&A activity over the next 12-18 months.

Another driver is the exponential aging of industry leadership. As company owners are nearing retirement, due to age and / or financial goal achievements from 2020, we can expect more lenders to seek exit strategies. Selling their company is an excellent path to retirement. Getting an upfront premium, plus liquidating their balance sheet, is a really nice way to formalize a retirement plan.

Finally, there is one more driver that executives should carefully consider this year — how capital gains are taxed. There will be new tax implications in buying or selling a business during the coming years. While the exact situation is not yet clear, many are certain that taxes will increase and are therefore seeking to sell sooner rather than later.

Beyond these industry drivers are the individual reasons buyers and sellers bring to the table. Chart 2 shows what we’re seeing in the current market.

Chart 2

Source: © Copyright STRATMOR Group, 2021.

Source: © Copyright STRATMOR Group, 2021.Increasingly, we’re seeing the pursuit of company growth to be a major factor in buyer interest. If you look at the value of economies of scale in a down market you can easily see why. Then the only question is how to scale — build or buy.

If a lender wants to build (or add) $1 billion to its annual origination volume, it can begin recruiting and building out the infrastructure to support the new staff. Within a couple of years, given good execution, skilled management and a little good luck and timing, the company could achieve its production growth goal. Of course, for the first six months, there will be very little new production through this build approach.

Alternatively, management can go to market, find a well-suited acquisition target and buy the company. Our analysis indicates that after all expenses are tabulated, companies that achieve growth organically via recruiting will pay nearly 1.5 times more for that volume as those that buy it through acquisition.

When an owner begins to contemplate the sale of their mortgage company, one of the first considerations is determining its value.

Like the loan officer who is asked by a borrower for a mortgage rate, when a company owner asks us for the value of their origination business, we must reply with “it depends.”

There are certain methodologies that are used to establish a mortgage company’s current value. We look at historical, current and projected operating and financial performance; business mix (channel, product, loan purpose, state); the company’s balance sheet structure; performance versus peers; risk management controls; geographical footprint; comparable sales (public and private) and other factors.

Upfront custom benchmarking of financial and operating performance against peers, as referenced above, is a unique and valued step in the process. It enables a seller, and eventually the buyer, to focus on the identification of items that may strengthen or weaken transaction value and the integration process. It clearly identifies if operating models are compatible between the two companies, what level and type of synergies are reasonable on a combined basis and, how or if the transaction should be consummated. Some adjustments can be made before closing, some can be made post-closing, while others become a “showstopper.” The goal is to help determine the compatibility of the seller and buyer’s businesses, maximize value and potential interest on the part of buyers, and establish a roadmap for go-forward success.

Custom benchmarking by a third party can also be done without formally putting a company on the market for sale. This allows management an opportunity to compare their company’s current performance relative to their peers and get an independent view into its relative strengths and weaknesses.

Often, companies will look to the market on their own to find comparable sales as a tool for setting a value for their company. This is very difficult. First, there are typically only a small number of deals to judge by, and the chances of any of them being fundamentally similar to the seller’s company are very low.

However, with a good advisor who is tracking the market, sellers and buyers will have access to not only the sales price of these transactions but also the various bids placed before one was accepted, making it easier to use this data effectively.

How the valuation is completed is itself a complex process that can be conducted using different tools and models. In our opinion, some of the traditional valuation tools in use in the mortgage industry today are outdated and no longer reveal the real value of mortgage companies.

We have developed a formula that allows our clients to estimate what kind of a premium above their book value they are likely to see from the market.

There is a very specific process that companies should follow as they navigate their M&A journey. We break it down into five critical steps, each with its own set of benefits and challenges. Done right, each step in the process takes a few weeks, not months, and so the sooner a company begins the better the results.

From our experience, there are several challenges must be kept in mind as you consider acquiring or selling a company.

While there are many mistakes that can turn a merger or acquisition into an expensive mistake, it is possible to get the deal done right. When that happens, everyone wins.

In the fourth quarter of 2020, STRATMOR Group was approached by Guild Holdings Company, owner of Guild Mortgage, a 61-year-old independent mortgage bank. CEO Mary Ann McGarry and her team were well aware of the trends we’ve discussed in this article and wanted to get ahead of them to position Guild for continued growth in 2021. The company is no stranger to M&A and was in search of a potential new target that would further leverage the investments the institution had already made in its technology and operations.

The question was what company could serve as the missing puzzle piece in Guild’s evolution. Based on STRATMOR’s peer group experience, Guild felt certain we could identify a good candidate. Since we knew Guild was interested in expanding into the Northeast, one obvious opportunity we immediately identified was Residential Mortgage Services Holdings (RMS), a fairly large independent mortgage lender based in Portland, Maine.

The RMS management team averaged more than 30 years of industry experience and like Guild, specialized in conventional and government lending. In 2020, RMS generated $8.5 billion of loan originations, achieving a compounded annual growth rate of 26% since 2010. After engaging with RMS, we confirmed the opportunity and made the introductions.

In a May 2021 press release announcing the signing of the merger agreement to acquire RMS, McGarry had said, “We have a history of growing through targeted acquisitions, and the transaction with RMS supports our strategy to expand into the Northeast. Our close cultural alignment and commitment to strong values across both organizations, combined with a retail and purchase market focus provide us with confidence that this acquisition will contribute to our ongoing success. With both teams dedicated to providing exceptional customer service, and the many synergies between our products, sales tools, and servicing teams, this is a natural fit. We expect the combination will result in an even stronger platform that will continue to deliver profitable sustained growth, as we create long-term value for all our stakeholders. We look forward to welcoming RMS to the Guild team.”

The acquisition was completed on July 1, 2021, making it the largest in Guild’s history.

Why did it work? Because Guild went into the deal well prepared, performed its diligence and found a good fit. And the company had STRATMOR advisors in its corner.

It’s a fact: consolidation has begun. Look for three to four deals a month through the end of the year and remember that valuations matter, even if you are not selling.

Be wary of the fiction out there that there are no premiums being paid for mortgage companies, that it doesn’t matter when you sell and that it is remotely possible to grow into a down market with no risk. Our experience and data confirm these are all fiction, particularly in this environment.

Meeting the needs of buyers and sellers requires a strategic discussion, and a competent advisor can help frame the conversation to reveal both opportunities and pitfalls for both. STRATMOR has helped many executives work through the M&A process, and we can help you determine whether a merger or acquisition is a good strategic move for you company. If you are attending the MBA’s 2021 Annual Conference in San Diego in October and would like to meet with the STRATMOR team to discuss your company’s business strategy, send us a note through our Contact Us form and we will set up a time to meet with you there. David Hrobon

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.