This article contains technical details about mortgage mergers and acquisitions, including data, charts and details. But let’s start with a story.

Once upon a time, there was a mortgage company that was one of the top consumer direct originators to go public. The company was focused on a model that delivered more transparency to consumers, was built around a plethora of technology tools, and had ridden a wave of refinance volume to report strong growth. In the consumer direct channel, this company was the largest. The penultimate strategic move was for this company to rebrand themselves, change their name and launch a nationwide advertising campaign with the overarching goal to become a household name for consumers seeking a mortgage.

At this point, you might assume I am referring to the now well-known Quicken story and its successful IPO as Rocket Mortgage this past August. However, this story is more personal than that — in fact, my story is about Mortgage.com, a company that went public in August 1999, almost exactly 21 years before Quicken. With a moniker like Mortgage.com in the dotcom storybook era, how could we miss?

So, while Dan Gilbert may be able to claim the most successful IPO in mortgage history, I can certainly claim to be the first dotcom IPO! Although I did not cash out as he has, and I don’t own any sports teams and have not branched out to become the savior of a midwestern city, I have learned a lot in the process and have some personal observations and concerns to express about the mortgage IPO mania that is sweeping our industry. It’s a story about the absolute need to focus on the fundamental factors that drive success in mortgage banking. And these considerations are not always measured in the stock price.

Ultimately, it’s all about timing.

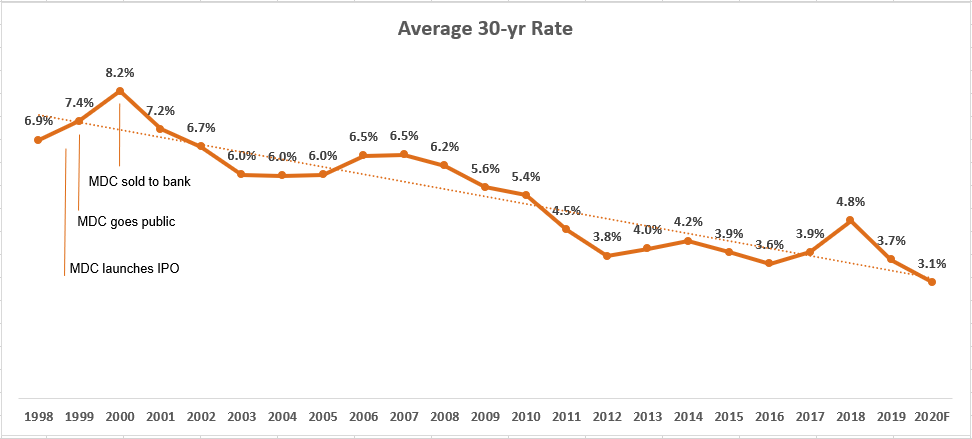

When Mortgage.com decided to go public, the mortgage industry was coming off a major year of success with a market of $1.7T in 1998, double what it was just the year before. Sound familiar? That big increase was driven by a big drop in rates to below seven percent. (The preceding sentence should give some historical perspective for newcomers to our industry who have never experienced rates above five percent!). Within 18 months, interest rates shot up to more than eight percent and refinance volume fell by more than 50 percent, resulting in a 20 percent drop in the overall origination market volume.

Chart 1

Source: Mortgage Bankers Association Historical Research, 2020.

Source: Mortgage Bankers Association Historical Research, 2020.Mortgage.com was ultimately sold to a large bank (ABN AMRO), at the end of 2000, as the market volume degradation and shrinking margins crushed the stock price. It was a wild ride, launched with much optimism, but ultimately Mortgage.com was a much better performer as part of a larger company than it was as a stand-alone entity.

What are the parallels to the current market outlook? As we approach the end of 2020, we have prospered in a market that, according to Fannie Mae, is on track to exceed $4 trillion — an all-time high in the history of mortgage banking. It’s certainly a more favorable market for investing in public mortgage companies than were conditions in 1999, when the dotcom companies had frothy valuations due to the expected unlimited growth in online businesses. (As an aside, when Mortgage.com went public, we were competing for attention with Pets.com!). However, the experts concur that we will experience a drop in mortgage market volume, likely during the next two years. In fact, the consensus forecast is for the 2021 market to decline by roughly 20 percent due refinance activity falling by half as rates creep above three percent.

Well, for Mortgage.com, the good times did not continue. Mostly because, at that time (with $1B in annual consumer originations), we were not profitable.

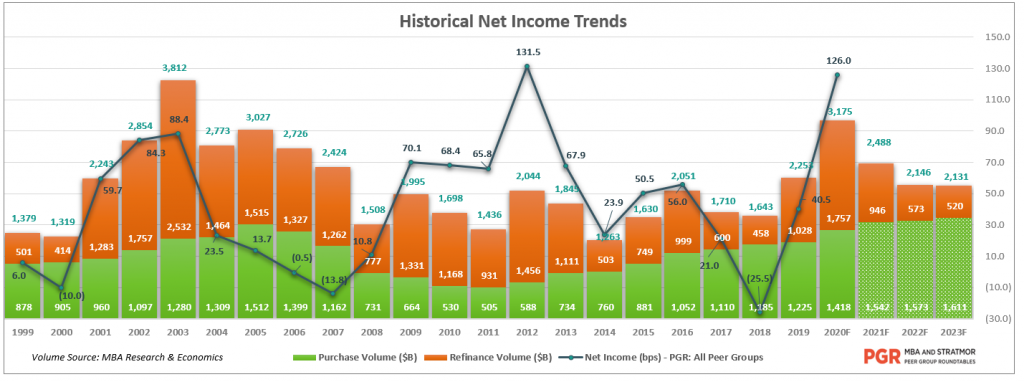

Looking back at the last 20 years tells an interesting story.

Chart 2

The previous era depicted a market drop in refinance loans, but the biggest difference between these eras is profit margins. In the early 2000s, the decline in profits caused a major stress on Mortgage.com — post IPO — and on the industry, overall. In fact, 1999 and 2000 averaged very low (or no) profits for mortgage bankers before the big increase in refinance hit in 2001, driving average profits to 60 bps.

Fast forward to Q4 2020. Lenders are generating unprecedented profit margins in 2020, with a full year forecast of over 100 bps net profit in 2020, up from an average of 40 bps in 2019. The market’s most recent IPOs of Quicken, United Wholesale Mortgage and Guild offered a very compelling value proposition to institutional investors. These mortgage banks have achieved true scale (combined market share over 15 percent for first half of 2020) coupled with impressive profitability and a positive outlook for continued success.

So, opportunistic timing and execution are certainly part of the consideration, but so, too, are some of the economic fundamentals of our industry.

Is it the right time to go public, to seek outside investment, or to sell? What if I want to sell — how long do I wait to let it be known I’m interested in talking to buyers? What if I wait a little longer, and perhaps try to ride the refi boom for a while? Market timing is a risky proposition and requires that rare skill of accurately predicting the course of interest rates. Do you really want to risk cashing in on your life’s work predicting the unpredictable?

What’s the risk if I hesitate?

With a market expected to set records for origination volume and profitability, lenders are riding high in 2020. The M&A deals we’re seeing this year are game changers. They are record-breaking deals that have investors outside the industry putting money into mortgage banks that are generating solid profits. The public company valuations are certainly helping to stimulate institutional investor attention in our sector. Meanwhile, the large Independent Mortgage Bankers (IMBs) are flush with retained earnings and are seeking to grow via acquisition to compensate for expected market volume declines. It is a robust and indisputable sellers’ market.

Despite what is maybe the most favorable M&A environment ever, prospective sellers are often resistant to explore a sale right now when they are enjoying dazzling profits every month. Why not defer until these earnings begin to fade? Of course, lenders that hesitate may be missing an opportunity to sell when they are ideally positioned to negotiate from strength.

How do you decide? Regardless of whether you are a buyer or a seller, the following are some important facts to consider in executing a successful merger or acquisition in today’s market.

This year we’ve witnessed the three biggest transactions in mortgage industry history: Quicken’s IPO in August, United Wholesale Mortgage’s September deal via the SPAC acquisition, and Intercontinental Exchange (ICE)’s acquisition of Ellie Mae. These are amazing deals in themselves, but what they mean for the rest of the industry is noteworthy.

When public or private equity comes into the market, it drives all values up, which is good news for prospective sellers. Sellers may not have a story like Quicken (Rocket), but the trickle-down effect is in having more entities interested in investing in mortgage companies, even at a higher valuation. Buyers see a strong mortgage market that is expected to continue to do well into 2021 and maybe even 2022, providing an opportunity to generate a return on their investment.

Consider Quicken. With well-developed technology, strong growth and more diversified than you’d think from their commercials, the timing for an IPO couldn’t have been better. They have achieved true scale (over $150B in production and over $400B in servicing) and impressive profitability. They have their third-party origination (TPO) channel to help drive purchase volume when refinances taper off, and they have a huge servicing portfolio which has a very high recapture rate. This should mean that they have an effective hedge when earnings from originations decline due to higher rates. And, if mortgage brokers continue to gain market share, and can grow purchase share, then Quicken is well positioned for growth through broker originations, too.

The IPO activities for a handful of the largest IMBs has accelerated with the public offering of Rocket Mortgage and United Wholesale Mortgage. In fact, STRATMOR data shows equity investors or public companies now hold interest in 17 of the top 25 IMBs, accounting for more than 40 percent of the total IMB market origination volume.

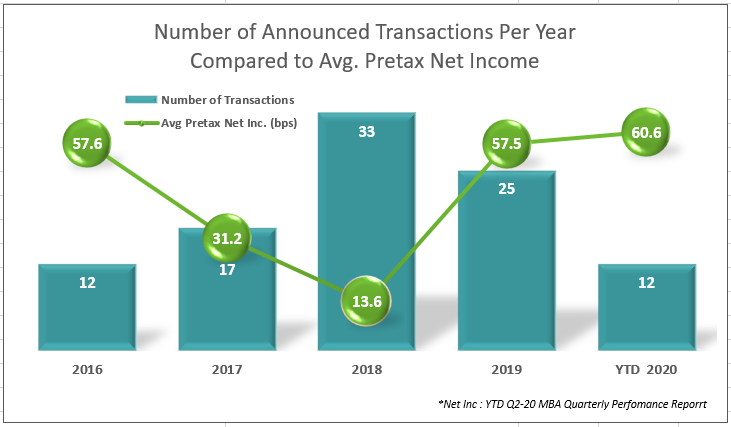

The chart below summarizes the number of announced deals per year along with the average production profits by year (excluding servicing) based on the MBA’s Quarterly Performance Report.

Chart 3

It’s all about taking one’s lead from the public markets and about the large financial investors that follow in the wake of these big deals. With top IMBs selling right now, why would any interested seller hesitate?

Regardless of how deep the forecast drops the market over the next couple of years, it will still be better than the last time we had a very robust M&A market (in 2018) in terms of the number of deals.

Sure, there are sellers thinking, “I’m making $5 million a month. I don’t have to sell.” The reality is that $5 million is probably worth more to a buyer than a seller in a consolidation purchase. Smart money on Wall Street says values are going up, aided by the results of the big three deals, and buyers realize that they must step up with very tangible offers to get sellers to exit.

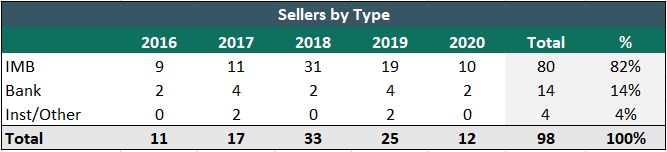

Who is selling?

Source: © Copyright STRATMOR Group, 2020.

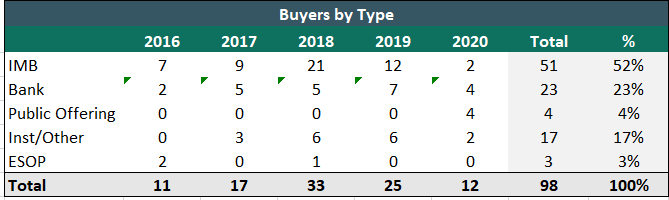

Source: © Copyright STRATMOR Group, 2020.Who is buying?

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.In years’ past, we saw strong companies buying weaker counterparts, but this year, we’re seeing strong buying strong. Buyers are willing to buy at a higher valuation because the entire marketing benefits from production momentum and because they see a multiple in the value they can add, albeit with stronger technology, better capital markets execution or consolidation savings.

Plus, most mortgage industry deals have some element of up-front cash and earn out, so if the market doesn’t do as well as expected in the original valuation pro-forma, the risk is shared between the buyer and the seller, helping both.

A key component of STRATMOR’s M&A practice is our unique expertise and experience in preparing mortgage company valuations. This specialty focus is important. STRATMOR’s in-depth mortgage experience adds a layer of insight that other M&A firms lack. Our analysis and findings are market-tested within the real world of transaction negotiations. This continuous feedback enables STRATMOR to calibrate our valuation methodology based on actual market conditions. Today, STRATMOR relies on this battle-tested expertise to ensure both buyers and sellers are at the right price point to create a win/win deal. Hats off to Jeff Babcock, senior partner and founder of STRATMOR, for setting the right stage for this success.

The economics say that the timing is perfect for the seller to achieve a great execution and for buyers to capitalize on the acquisition of strong origination partners. Sellers, at the very least, do your homework and determine your worth for estate planning, company strategic viability, and for your future retirement forecast.

There are many reasons why it’s vitally important to seek the help of an advisory firm with experience in mortgage mergers and acquisitions. If a potential buyer contacts a potential seller directly and asks, “Are you for sale?” most prospective sellers are going to say “no” whether they are or are not. No one wants a potential buyer to think they are desperate, nor do they want to inadvertently share information that could affect recruiting and retaining staff. Having an advisory firm in the middle lets buyers and sellers become acquainted with each other privately and anonymously.

An effective advisor can help with matters like due diligence and weighing risks, but without question, the greatest value provided by an effective advisor provides is determining whether the cultures of two companies are reasonably compatible. An independent advisor is often better suited to offer an objective assessment on the strategic fit for both parties, and at facilitating the discussions about culture, values, and future aspirations.

If only I had a nickel for every time I’ve heard, “If I get one more boom, I’ll sell.” Well, in 2020, you’ve got your boom. Multiple booms. A Fourth of July, end-of-the-fireworks-display boom. We had historic profitability in July — highest ever —and then came August, higher yet. September and even October — another record. The usual Q4 seasonality make take a holiday in 2020, and more records may be coming this winter. Boom, Boom, Boom!

Where will the market go next?

According to the MBA’s Economic and Market Outlook forecast published this last week at the 2020 Annual Conference, this year is going to be the best year for our industry since 2003 in terms of both volume and profitability.

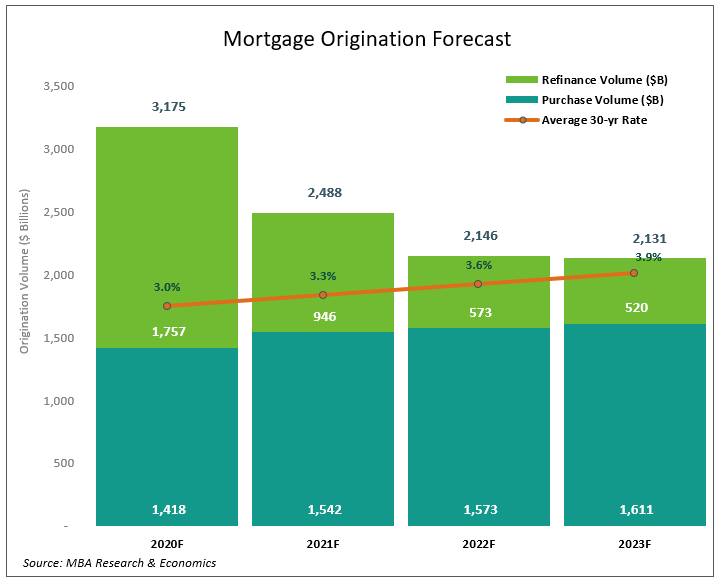

For the past two years, refinances have dominated the market, driven forward by low interest rates and lack of housing inventory. But the MBA is predicting downward pressure in 2021 — purchase originations are expected to grow by 8.5 percent to a record $1.54 trillion. After the 70.9 jump in refinances (yes, 70.9 percent) in 2020, the MBA expects refinances to decrease by 46.3 percent to $946 billion. At $1.54 trillion, next year’s purchase originations would eclipse the previous record-high $1.51 trillion in 2005.

Chart 6

Now that you’ve gotten the huge payoff, do you really want to hang on until the market consolidates again? Think about where you are now, staffing up to meet production — it’s great when the wind is in your sails but it’s not so great when the market turns choppy and you must lay off those people you hired in response to capacity issues.

If the consensus market forecast is reasonably accurate, consumer demand may fall below origination capacity at some point over the next one to two years. We all learned during 2018 that excess capacity compresses profit margins, resulting in downward pressure on enterprise valuations. So, the timing is right to explore your options if you want your mortgage story to have a happy ending.

Lenders, if you are contemplating an M&A move, STRATMOR highly recommends that now is the time to act. But don’t act alone. What goes up, always comes down, so timing is truly everything.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.