Recently, Brett McCracken and I discussed technology innovations. Blockchain and eClose advancements were at the top of our topic list. These discussions reminded me of a time early in my mortgage career when I led a sales team for a mortgage software company.

At that time, the industry was obsessed with a “touchless” process. In other words, that meant a way to originate a loan via combined technologies that could be completely automated (no human intervention needed) if the data was provided in its recommended format and there were no exceptions to manage. Competition and a keen eye on creating this fully automated process drove the desire to constantly innovate to achieve that end. Yet, a true “touchless” mortgage process has still not fully come to fruition.

Those days are reminiscent of what we are now experiencing with eClosings. Before the COVID pandemic hit, eClosings were a notion that lenders understood, but few believed offered tangible ROI. Therefore, lenders were not pushing to incorporate this functionality into their processes.

That changed with the pandemic. According to STRATMOR’s 2019 Technology Insight® Study, lenders’ focus on eClosing capabilities was limited to closing collaboration, eSignature, and eRecord capabilities. As the pandemic took hold and lenders scrambled to provide remote closing capabilities, priorities changed and eClosing capabilities became a necessity.

Our 2021 study shows all categories of eClosing functionality made progress in terms of both lender and user adoption, with eSignature, hybrid eClose and eRecord at the forefront.

Chart 1

Additionally, Chart 2 below from the Digital Innovations section of our 2021 Technology Insight® Study shows that the top five largest gains in live digital capabilities (e.g., lender deployment AND adoption) included eNotes, eClose, online dynamic checklists (easy for the borrower and originator to check status), eSignature, and electronic recordation.

Necessity is the mother of innovation, and COVID pushed innovation into high gear.

Chart 2

These days, we’re hearing more and more about blockchain technology. Is necessity driving this innovation as well? As we enter this business cycle of higher rates and lower volumes, where lenders are more focused on survival and less on innovation, why should we even think about blockchain?

In this article, STRATMOR Senior Advisor Brett McCracken and I offer the following considerations as we continue to assess this innovative technology, even as we move through our industry down cycle.

Today, lenders are struggling with high costs to originate, shrinking margins, complex untrustworthy processes, and slow investor delivery. Blockchain is positioning to become a viable technology to address these issues. While blockchain technology is just beyond the cutting edge for most lenders, so too, was eClosing just a couple of years ago.

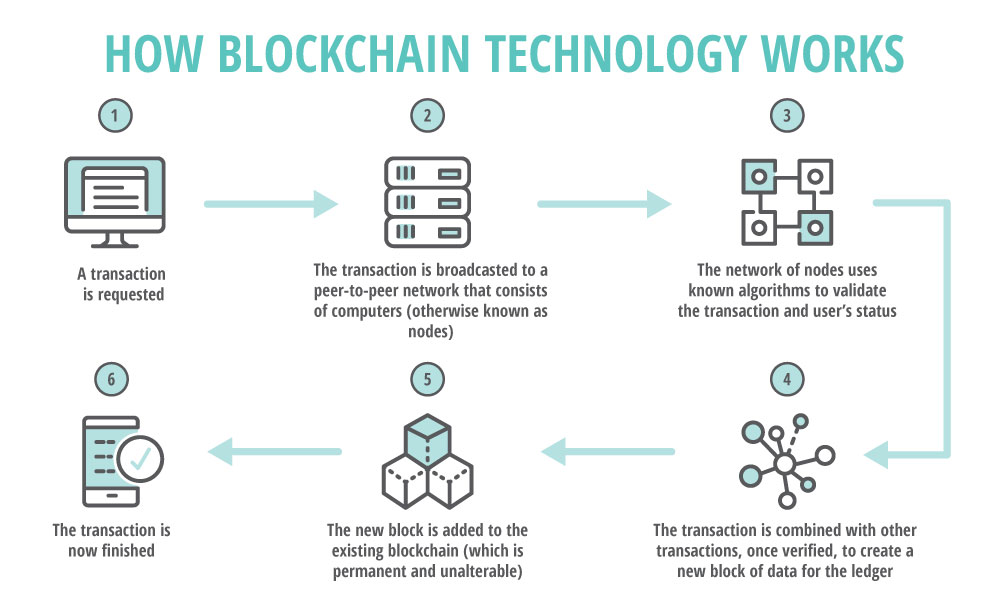

As a reminder and to set the stage, the core value blockchain technology offers is a secure, transparent, publicly distributed, decentralized digital transaction ledger. This means a series of blocks, digitally encrypted and chained together for security, that store details of all transactions added to the chain which are authenticated and then verified by the platform’s validators who approve the transactions using their computational power through computer system nodes. Market participants can replace trust with truth as counterparties to a transaction — a transaction whose information is immutable. This concept of “trust” versus “truth” has potentially deep cost savings implications that haven’t yet been quantified.

Chart 3

© 2022 STRATMOR Group.

© 2022 STRATMOR Group. Further, Blockchain is inherently secure and creates a transparent audit trail. Each block added to the chain is a snapshot of a data point that prevents fraud and eliminates the ability to change that data. And the block becomes a permanent, irrefutable record.

To fully experience the substantive cost savings tied to a more streamlined process, blockchain ultimately will require wide adoption by lenders, by the ecosystem of data partners who can digitally sign for the source data’s accuracy, and by investors. However, early adopters still have the opportunity to reap the benefits of pioneering blockchain-enabled mortgages and will enjoy the upside of those competitive advantages, which will likely include wider profit margins before mainstream adoption occurs.

“It is important to note that, for now, blockchain for lenders is just one component of a more comprehensive technology stack,” says McCracken. “Today, lenders would keep their current technology in place. Technologies such as the Point-of-Sale and LOS would continue to function as designed, perhaps with some LOS integrations to third-party risk partners for digital due diligence while blockchain is used towards the end of the origination process as is the case with eNotes. It stands to reason that, over time, the core platforms lenders use will find innovative ways to bring more aspects of blockchain technology and principles towards the front of the process — hopefully to the benefit of consumers.”

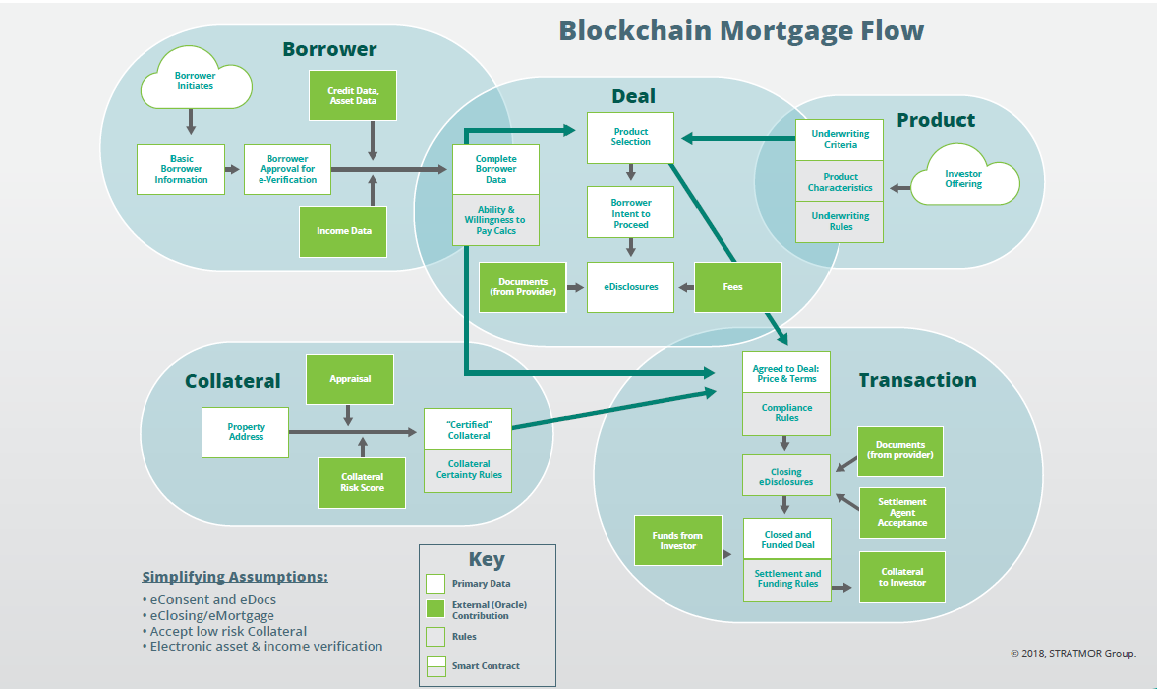

In a STRATMOR Insights Report article written several years ago, “Connecting the Blocks: Practical Applications of Blockchain for the Mortgage Industry,” we looked forward to the year 2026 and predicted that, “Starting at the back of the mortgage flow at shipping and delivery to the investor, Blockchain would work its way upstream to incorporate the entire mortgage origination process, including the integration of Smart Contracts in real estate transactions.”

Further, this is what STRATMOR envisioned as Blockchain Mortgage Flow:

Chart 4

As predicted, we’re seeing blockchain technology implemented at the end of the loan process, in shipping and delivery. On March 17, 2022, Figure Lending and Apollo Global Management announced that they used blockchain technology — namely eNotes and eRegistry — to transfer ownership of digital mortgage loans. According to the press release on this achievement:

Figure has begun originating eNote mortgages that are on-boarded as unique digital assets on the Provenance Blockchain. At the same time, they are auto registered with Digital Asset Registration Technologies, Inc. (DART), a combined lien and eNote registry system developed by Figure Technologies, Inc. and used in place of the “MERS” databases. DART monitors blockchain-based asset transfers and offers a streamlined and more efficient alternative to the existing loan tracking database systems and the often delayed, weeks-long settlement process for paper promissory notes.

While this news may be a surprise to many, Figure has been working on blockchain technology since 2018 when it launched Provenance, which, at that time, was a permissioned blockchain. In 2021, it morphed into the Provenance Blockchain Foundation, a public, open-source distributed ledger technology platform allowing anyone to develop DeFi apps placed on its blockchain.

The key point is that Figure developed an alternative to MERS for its integrated eNote registration. This transaction included eNote mortgages that were on-boarded as unique digital assets on the Provenance Blockchain and then, simultaneously auto-registered with Figure Technologies, Inc. Digital Asset Registration Technologies, Inc. (DART).

“Blockchain does two things well: it displaces trust with truth, and it creates native digital assets with a full chain of immutable history, data and ownership which directly impacts counterparty risk. This combined lien and eNote registry system is designed to monitor blockchain-based asset transfers — continuously listening for who the owner of the note is and proposing to provide a more streamlined and efficient alternative to existing loan tracking database systems,” says McCracken. “The benefits articulated are compelling: less expensive, more efficient, fewer humans are required which reduces errors, there is more inherent value due to liquidity and transparency, and there are overall better economics being proposed with the takeout of the loan.”

STRATMOR is curious to see how lender adoption follows this model.

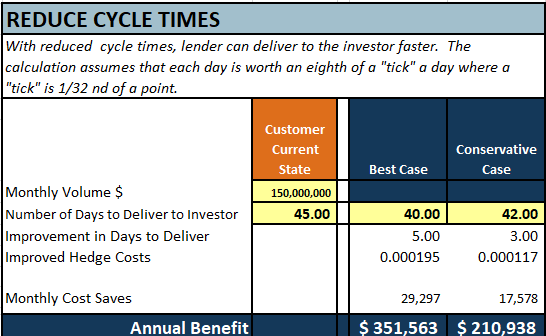

The first steps to applying an operational blockchain strategy today would likely start with an eNote and registry into an electronic technology. As eNotes become mainstream, technology vendors such as Wolters Kluwer integrate with eRegistry solutions like MERS to automate the registration process, and lenders can expect to see significant reductions in time to deliver to the investor.

Blockchain technology takes this one step further. Instead of a shortened delivery time, Figure’s DART is now available to provide real-time electronic delivery to investors. Again, this step into blockchain technology does not impact the borrower experience but could offer a significant competitive advantage to the lenders that adopt early. Delivery to agencies and investors happening real-time would reduce time on warehouse lines greatly, thereby improving lender liquidity.

“As an eNote is signed and then recorded via the DART registry, auditing requires joining the blockchain network. In aggregate, there is significant cost for capital market participants that audit the same loans over and over,” says McCracken. “One key point is that those buyers will need to be comfortable with DART. The genius of blockchain is that it offers no reason to re-audit if the chain shows nothing has changed (trust versus truth). If something did change, it will be known.”

Figure Technologies cites that its pilot has resulted in great savings based on its specific loan products (HELOCs as an example). That said, based on STRATMOR studies, most of the costs to originate a conventional first mortgage are at the front end of the process. Therefore, it is less likely that we will see significant cost savings in the short run. Support costs like Post Closing and Shipping are between $100-$130 per loan. The lower cost per loan tends to be for the large TPO lenders.

Chart 5

The promised pickup, however, would be from potential faster delivery to the investor. An efficiently run operation should be able to get a paper note from a settlement agent, warehouse it, and get it out to an investor in three to five days, although it might take longer depending on circumstances. With the eNote, there is no waiting for the paper note to get to the lender, then to be sent out to a warehouse, and then be sent to the investor. An eNote eliminates this added travel time.

If the note can be sent to an investor faster, the loan can be sold and off the lender’s warehouse line faster, reducing warehouse carry cost and freeing up the line to originate more loans. Depending on how to commit mandatory locks, the lender could potentially take shorter commitments (thus getting higher prices) because they won’t have to wait for the paper note to be delivered. This depends on time commitments and is also tied to the warehouse cost issue.

Therefore, lenders who tend to take down commitments when the loan closes might take a fifteen-day lock, which allows time for the note to travel around. If lenders use eNote capabilities, they might be able to take a three-day commitment because the note is ready. However, this benefit may not apply if the note is in-house as a three-day commitment.

Chart 6

© 2021 STRATMOR Group.

© 2021 STRATMOR Group.It’s difficult to say with any conviction where the industry is headed next in terms of blockchain evolution and adoption. One interesting example of blockchain in use in the financial community comes from Redwood Trust, Inc. and its vendor partner Liquid Mortgage, a digital asset and data platform

In an article from late fall 2021, Ian Ferreira, founder and CEO of Liquid Mortgage, discussed his company’s role acting as a distributed ledger agent on Redwood Trust, Inc’s implementation of blockchain technology. He noted that the first phase of the rollout was to create transparency at the loan level, giving investors daily access to payment information where they now wait 55 days. Phase two to be completed mid-2022 will create payment rails via blockchain for borrowers to make payments that will be distributed to the portfolio or trusts that own the loans; phase three of the plan is to build a trading platform for digital assets backed by loans or fractionalized loans.

“Information and documentation will always be with the loan, and you can always validate loan, document and payment data,” Ferreira said in the article. “The ultimate goal is to be able to trade these digital assets on a blockchain, where parties can easily trade assets back and forth within seconds.”

At STRATMOR, we have a unique perspective on the industry based on the nature of our work. While our clients and the broader lending community we speak to daily spend most of their time focused inside of their four walls, we can aggregate the conversations like pieces of a puzzle to see the broader picture.

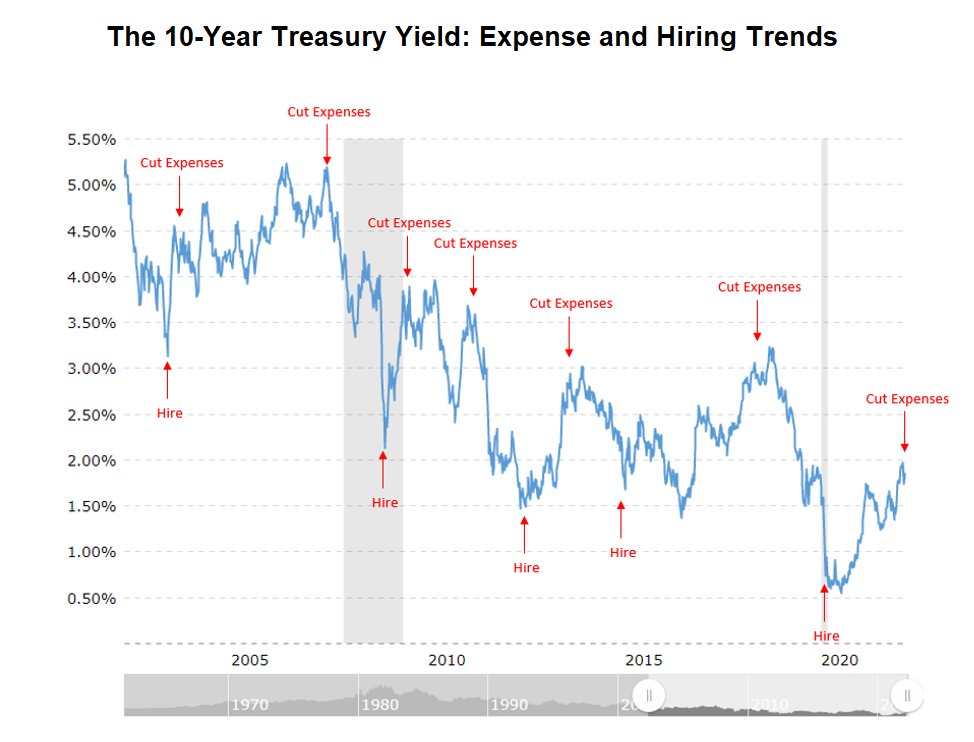

Given the challenges of today’s market, we see many lenders focused on preservation instead of innovation. This is completely understandable; however, we’ve noted that when we bring up the concept of blockchain, most lenders have not seriously considered its application to their business. “It is interesting to look at the ebb and flow of the 10-year treasury yield,” says McCracken. “When rates rise, lenders start to lay off employees and cut costs associated with any R&D budget. Then when rates unexpectedly drop significantly as was the case during COVID, they furiously hire just to tread water.”

Recently, we have not seen extended times of stability with enough profitability for most lenders to commit the resources to big, industry changing ideas like blockchain. “Right now, most lenders are just trying to not throw up on the roller coaster ride that is the modern-day mortgage industry,” says McCracken. “To have the mental space, patient capital, subject matter experts and time to pursue big ideas can certainly seem like a luxury given the ups and downs of the market.”

Source: Microtrends, 10-year treasury bond rate yield.

Source: Microtrends, 10-year treasury bond rate yield.When we ask lenders about their thoughts on blockchain being deployed in the industry, we often hear them say they need more research and education to truly understand the depths of the opportunity — for now they say it just feels like hype.

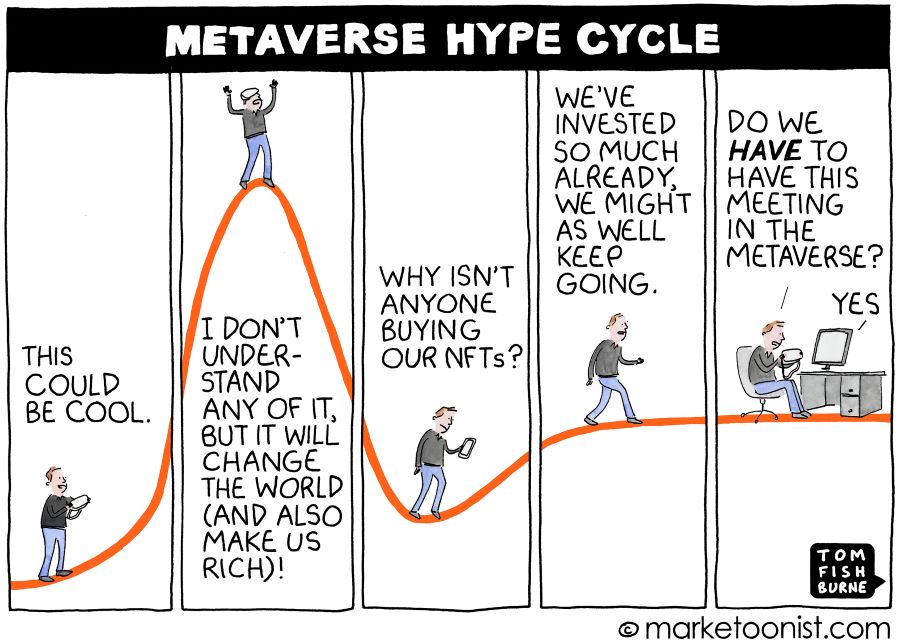

The following illustration from Tom Fishburne, internationally known speaker and cartoonist is a great representation of Garner’s “Hype Cycle” methodology:

Source: Source: Tom Fishburne, Marketoonist. Licensed permission.

Source: Source: Tom Fishburne, Marketoonist. Licensed permission. For the mortgage banking community, we are still in the “This could be cool” stage of this Hype Cycle. STRATMOR believes it will take a handful of innovative lenders to demonstrate, at scale, this iterative process. Once small and mid-sized originators, who often don’t have the capital or resources to experiment like Figure has, see tangible results, it will greatly increase the probability loans onboarded to the blockchain will have the significant support the industry needs to adopt this new technology option. Lisa Springer Brett McCracken

To discuss the possible impact of blockchain on your mortgage operations, contact the STRATMOR team. We welcome the opportunity to discuss business strategies and would like to hear your perspective on blockchain’s feasibility and future in the industry.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.