Steve Ballmer, CEO of Microsoft from 2000 to 2014 and current owner of the Los Angeles Clippers once said that the number one benefit of information technology is that “It empowers people to do what they want to do. It lets people be creative. It lets people be productive. It lets people learn things they didn’t think they could learn before, and so in a sense it is all about potential.”

Potential is what STRATMOR is sharing in this article with key takeaways from our 2019 Technology Insight® Study — the potential in data that shows mortgage technology enables a better borrower experience. And yet, even as technology enables, it is mortgage professionals, empowered by technology to do what they do, who have the greatest potential to make the borrower’s experience delightful.

“The online digital experience doesn’t negate the need for human interaction,” says STRATMOR CEO Lisa Springer. “At the MBA Tech Solutions Conference earlier this year, Grace Qi, product manager of Intelligence with Blend, shared a fantastic analogy about how Artificial Intelligence (AI) was able to beat a Grand Master at chess, but, when the combination of Grand Master and AI played AI, the combined computer/human team won.

“The optimal borrower interaction should combine automation with human cognitive abilities, such as emotional intelligence (EQ) with borrower-facing interactions,” says Springer. “That’s how the mortgage industry will truly optimize the borrower experience.”

Here are the six key takeaways from the 2019 Technology Insight® Study.

In the last four years, the number of LOS identified as the primary system has dropped 36 percent, from 33 to 21 LOS platforms. What’s driving the consolidation?

The study also shows that most lenders use a single LOS. Only eight percent of lenders report having multiple systems and only half of these lenders (or four percent total) run multiple systems within a single channel. Lenders with a correspondent channel often report using a separate LOS, primarily because the workflow for purchasing loans is different enough from Retail, Consumer Direct (CD) and Wholesale to warrant the second system.

Additionally, the study asked each lender to score the effectiveness of their LOS in providing specific functionality, including 1003 data collection, document generation and delivery, eSignature capabilities, and compliance validations, among others. The top three most effective functionalities on a scale of 1 to 4 were:

The lowest scoring functionalities were:

These low-scoring functionalities are at the forefront of the movement to a more digital mortgage process and a better borrower experience, indicating there is an opportunity for vendors who can provide ancillary systems that can accommodate these digital capabilities.

This gap in LOS support has certainly led to the growth in the ancillary systems, so while the number of LOS options has decreased the number of options for the full end to end transaction has increased dramatically in the past few years. As each of the product segments (POS, CRM, Closing Platforms) mature the number of vendors in those spaces may also decrease, much as the LOS space has begun to consolidate.

In 2018, STRATMOR added a new scoring analysis to the study process. The Lender Loyalty Score® (LLS) analysis provides another view into how lenders feel about their technology by asking “How likely are you to continue to use this system?” In conjunction with the market share and overall satisfaction data collected, the LLS paints a clearer picture of the lender’s system experience.

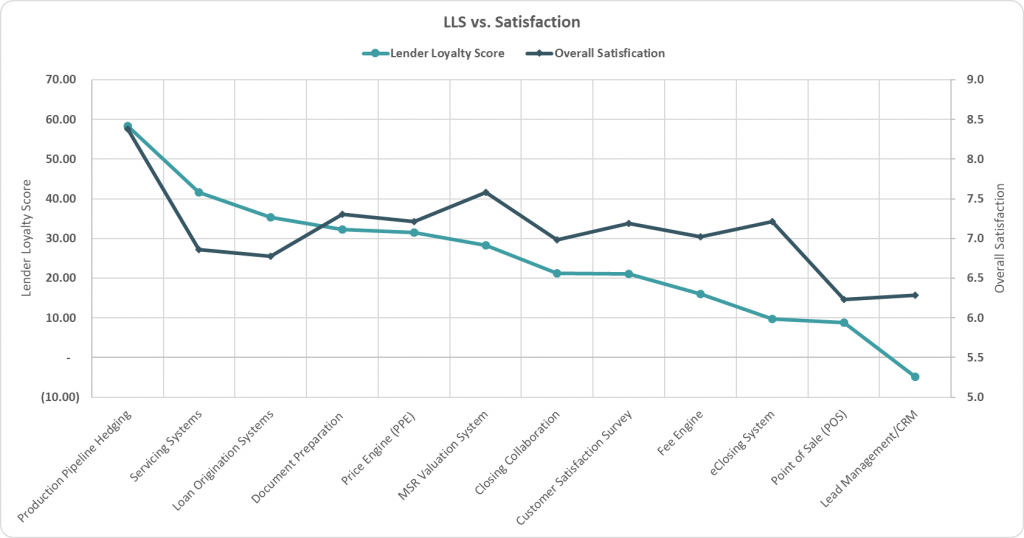

In 2019, the group of systems with the highest Lender Loyalty Score® — the pipeline hedging systems — have the highest overall satisfaction score. This indicates that lenders on these systems are happy with the functionality, and the vendors, and because they are satisfied, are more likely to stay with these systems. If we look a the scores for all the systems in the study, we generally see that those with high satisfaction scores do have high LLS and that there is a relationship between the two. However, the systems with the second highest LLS — servicing systems — do not have the second highest overall satisfaction score. The servicing systems have an LLS of 42 but a satisfaction of 6.9/10, ninth place in a field of 12. Chart 1 shows the Lender Loyalty Score® and overall satisfaction data for all categories surveyed in the 2019 study.

Chart 1

Lenders will stay with a functional system even if they are only moderately satisfied because the risks in switching to a new system are high in both dollars and borrower disruption. “Servicing systems are a great example,” says STRATMOR CEO Lisa Springer. “Think about the number of potential borrowers who will have their servicing statements impacted in a change to a new system. What would happen if statements can’t be sent, or aren’t correct or you don’t process the payment in a timely fashion? It affects the borrower. And, it affects the investor, and it is highly regulated. It’s a tough switch, so it’s easy to understand why lenders would say they are staying with a system even when they rate overall satisfaction with that system low. The borrower relationship is paramount, and risk to that relationship is a strong barrier to change.”

We also see the newer, evolving technology has lower scores and lower quality. CRM, digital POS, and eClosing have the lowest LLS and are the newest systems, which leads to our third observation.

For the fifth year in a row, Ellie Mae holds the top spot in POS with customers using both the native Encompass Web Center and the newer Consumer Connect. Other systems are gaining ground, including Blend, which finished second again this year. The trend in POS lender share indicates a maturing of the market, and STRATMOR expects that the evolution in POS solutions will begin to slow even more in the next three years.

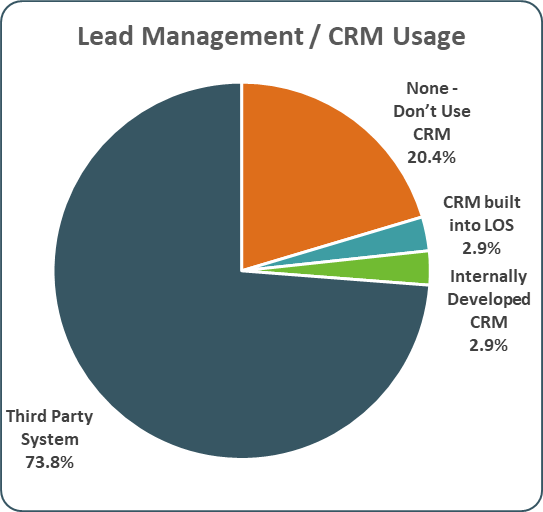

This is not the case in the Lead Management/CRM market. More than 20 percent of respondents said they do not use a company-sponsored lead management tool, and almost six percent said they use either a CRM built into their LOS or use an internally-developed CRM. Of the almost 80 percent of lenders using a CRM, 74 percent use one or more of the 25 third-party systems sharing the CRM market. Of those 25 systems, Top of Mind, Velocify and Salesforce hold the top three spots, with Salesforce gaining almost five points this year, followed by Velocify which gained two. Top of Mind holds 20 percent of the market.

Chart 2

During STRATMOR’s conversations with our clients, many lenders tell us there are multiple, “user preference” CRM systems being used within their organizations. One lender reported a startling 13 CRM systems in use. Unlike servicing or origination systems, CRM and lead management systems do not carry the “borrower disruption” risk, which contributes to lender willingness to try a new CRM entrant more easily. Lower costs and quicker ‘bolt-on” implementation also adds to the attraction of switching to a new CRM for many lenders. With all of the switching, it is no surprise the CRM/Lead Management category ranks lowest in Lender Loyalty Score® analysis and overall satisfaction.

The CRM space is also where the loan originator has the most sway over the selection and the adoption of the system. It is also where the LO might even be willing to buy their own system to meet their needs so they can keep their customer database (a valuable asset) more portable in the event they leave their current lender. This also shows up in the survey when we view CRM adoption — when lenders adopt an enterprise CRM, not all of the LOs will necessarily use it.

With so many CRMs out there, it’s critical to make sure that what you choose works with your POS/Loan Origination System (LOS).

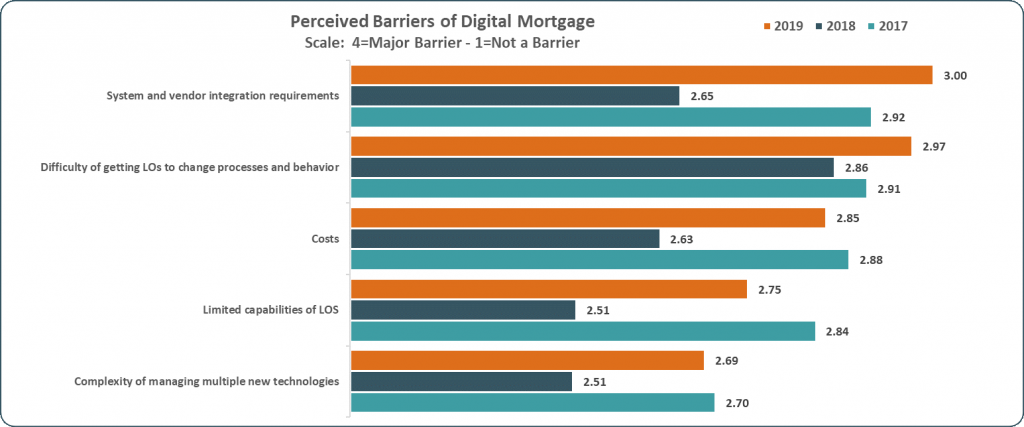

Technology limitations impact many of the barriers to digital capabilities from integration challenges to management complexity and security. In 2019, system and vendor integration moved to the top of the barrier list, switching places with the category now in second place — the difficulty of getting originators to change processes and behaviors. The cost of implementing and maintaining digital rounds out the top three.

Chart 3

“One of our key recommendations to lenders when implementing technology is to have a defined process to measure the needs and desires of LOs, and then have a key process to drive the change and adoption of the system,” says STRATMOR Senior Partner Garth Graham. “Also, be sure to measure the needs and input of not just the most vocal LOs, but also those who might be the high producers and are too busy to get involved in another “tech” project. We often recommend a formalized survey process with the LOs, and then aggregating the data based on their individual demographics and their production. For example, you might find that the top producers have a very different need, or that newer LOs have some of the best ideas. That might be what is key at the beginning, and then it may becontinuing the training and the evangelism of the solution after implementation.”

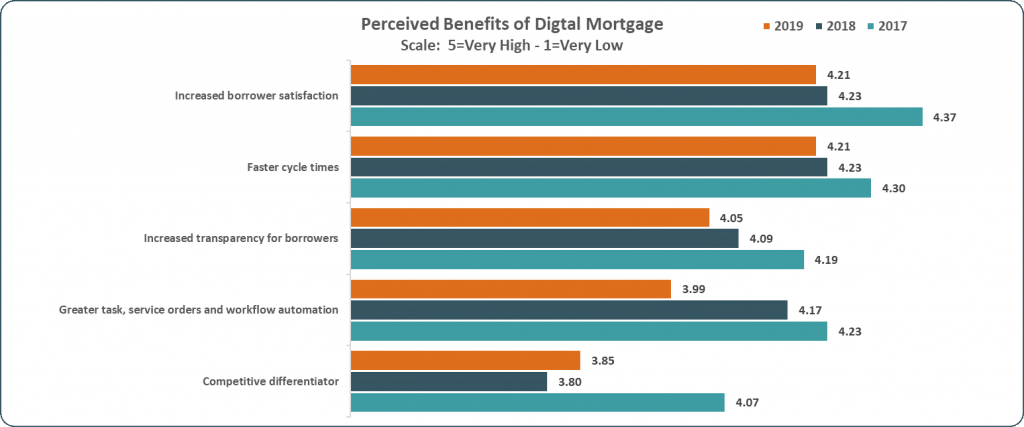

As with years past, the top perceived benefits of new digital capabilities are focused on enhancing the borrower experience.

Chart 4

“What is interesting is that lenders say that borrower satisfaction is a key driver of their reason to implement technology, but not all lenders have a robust method to measure borrower satisfaction,” says Graham. “If it’s the most important reason, then borrower satisfaction ought to be the most important measure.”

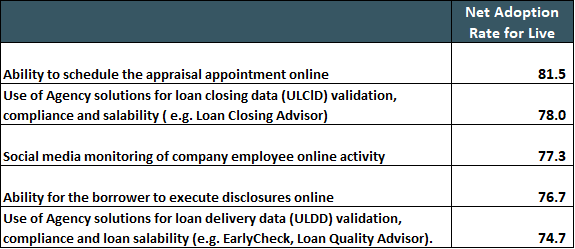

For the lenders reporting live digital capabilities we calculated a net adoption rate based on the ratings. The capability to schedule appraisals online tops this list, and among lenders who report that this capability is live the adoption rate is 81.5 percent. This means that this capability is used by the lender more than 80 percent of the time. Chart 5 shows the net adoption rate for the top scoring capabilities.

Chart 5

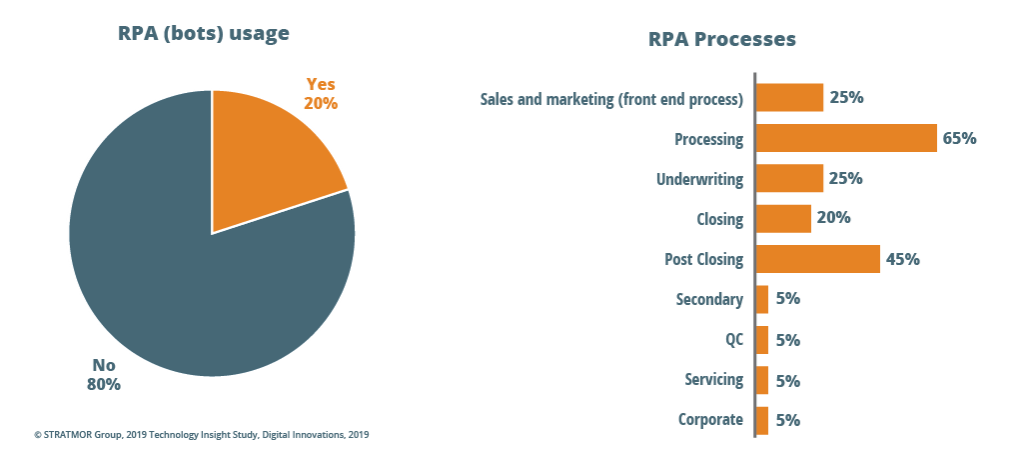

In the 2019 study STRATMOR asked lenders whether or not they utilize RPAs (Bots) to automate business processes. Twenty percent of those responding said yes, and most are using them in the processing and post-closing areas.

Chart 6

“Robotic Process Automation is more than the latest trend,” says STRATMOR Senior Partner Michael Grad in his article, “I Robotics: Robotic Process Automation (RPA) in the Mortgage Industry” “RPA is helping to eliminate tedious tasks, dramatically increase efficiency and reduce costs in processes across many industries. In mortgage, RPA resonates with the most forward-thinking lenders, and it is helping these companies re-engineer processes and transform the customer experience. RPA is going to change the way the mortgage industry conducts business,” Grad says.

In STRATMOR’s experience, there are five noteworthy benefits to RPA:

Improves the customer experience: Automation can reduce the time to close loans — good news for the borrower. According to Ellie Mae’s August 2019 Origination Insight Report, the time to close a purchase loan is at 45 days (42 days for all loans). Combining shorter turn times with faster identification of issues in the process makes for happier borrowers.

“The payback with RPA is often immediate,” says Grad. “Once you understand the process and the detailed processing steps you are working within, it all comes down to dotting the i’s and crossing the t’s within an RPA programming environment.”

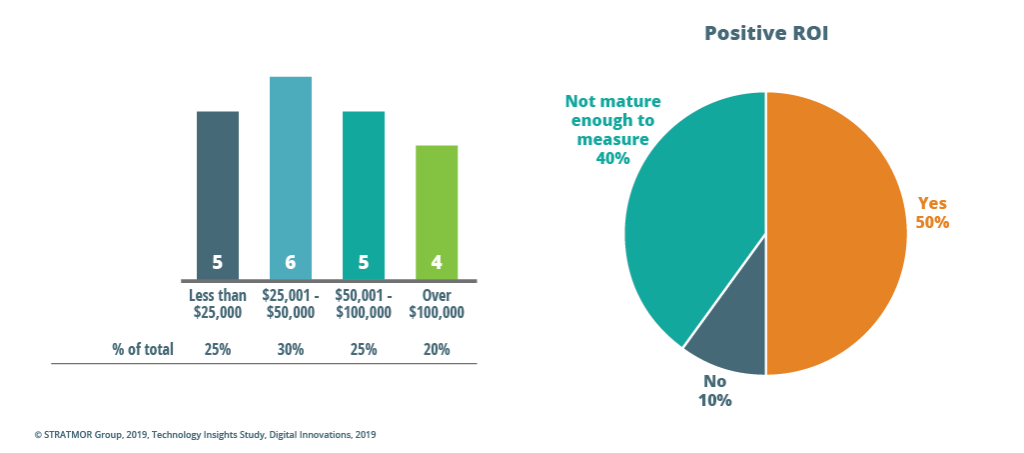

Eighty percent of the lenders in the survey reported investing under $100,000 in RPA, and 50 percent said they saw a positive ROI for their efforts.

Chart 7

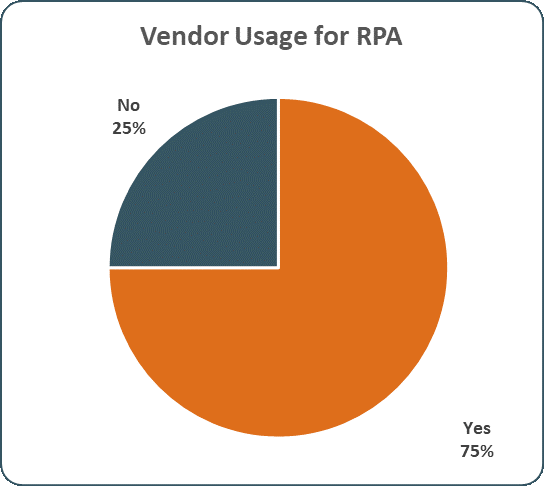

The study also shows that 75 percent of lenders use a third-party provider to implement RPA in their businesses. UI Path, Blue Prism and AIF are the most popular third-party providers, and all offer training and certification in RPA through their websites. STRATMOR can assist in selecting a provider from the growing list available.

Chart 8

As lenders implement RPA technology, consideration of the human part of the process is needed. The 100 people who were performing a task before a bot took it on might wonder if a bot is going to be able to perform their tasks. “Like other technology used with digital mortgage solutions, RPA is just one of many technology components that has a role to play,” says Grad. “Lenders need to educate their staff about RPA and its role in helping to retool their POS and LOS and deliver a benefits-laden message to employees explaining that RPA is positive step in the evolution of the mortgage process.”

STRAMOR is expecting to see a significant increase in the number of lenders implementing RPA technology in 2020, the results of which will be reported in the 2020 Technology™ Insight Study.

The 2019 Technology Insight® Study provides insight into the technology in use, how likely lenders are to stay with the technology they have and how quickly they are adopting new capabilities. Woven throughout the study is the borrower experience, captured in the top perceived benefits of new digital capabilities where lenders give the highest marks to increased borrower satisfaction.

Ensure that you are driving high borrower satisfaction and an enhanced borrower experience before you pick your technology tools by asking these six questions:

Get the answers to these questions from your team and your vendors, and if you need help, give the STRATMOR team a call at 303-486-6823 or email us at info@stratmorgroup.com. Yung

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.