The outlook for lenders in 2020 is a mix of sunshine and rain showers, depending on where you are standing.

According to the Mortgage Bankers Association 2020 Forecast, the MBA anticipates refinance originations will slow this year, decreasing by 24.5 percent. Purchase originations, on the other hand, are expected to increase by a modest 1.6 percent. The forecast also predicts margin pressures like those seen in 2018 are likely to reappear in 2020, and that the industry will continue to be challenged by higher costs.

While most lenders were happy — and relieved — to ride the unexpected refinance wave this past year, the savviest lenders continued to push forward with strategic moves and infrastructure designed to thrive in a purchase-heavy market. Now, as we ease back into an environment where lenders will live or die by their focus on purchase volume, successful lenders will be those who are laser-focused on creating delight for homebuyers from the start of the loan process to the finish.

As purchase business once again dominates the lender loan mix, referrals become key factors of revenue growth. Understanding how to create “raving fans” from the closed loans and the delighted referral sources who will send referral business your way is paramount to surviving and thriving in a flat market.

Providing a delightful experience that customers can’t help but talk about involves more than getting a testimonial statement. It’s about creating “raving fans,” borrowers who will drive actual growth.

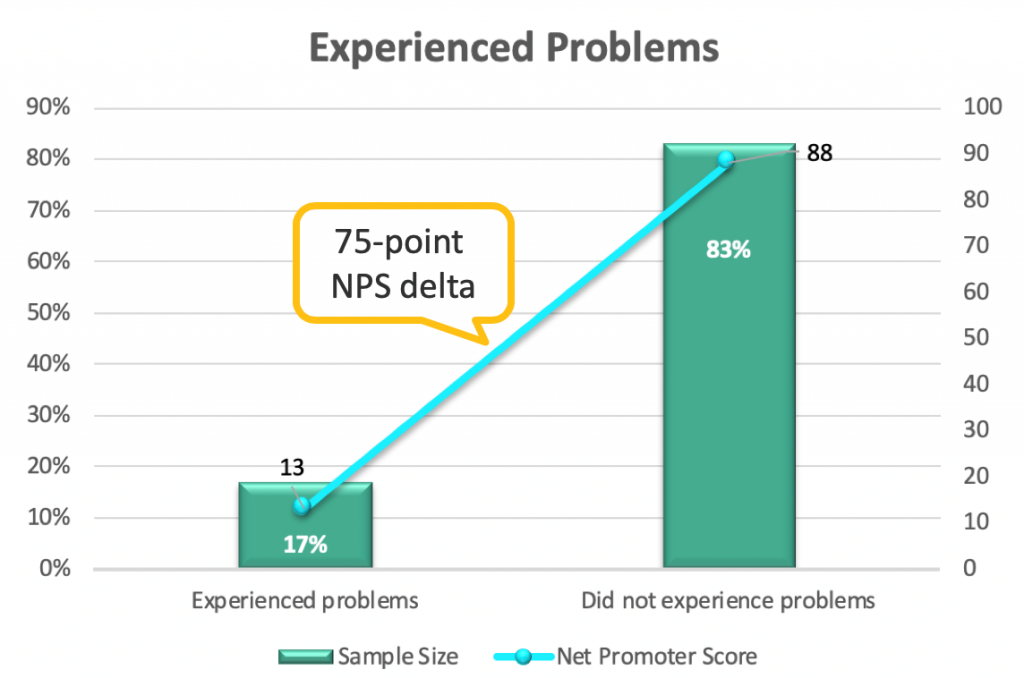

When it comes to creating a “raving fan,” most lenders assume that it takes extraordinary acts of service that go above and beyond expectations. According to data from STRATMOR’s MortgageSAT Program that measures the loan experience for more than 130,000 borrowers annually, the Net Promoter Score (NPS) that measures a borrower’s likelihood to recommend falls 75 points when there is a problem with a loan. That’s the difference between a referral and someone who badmouths you.

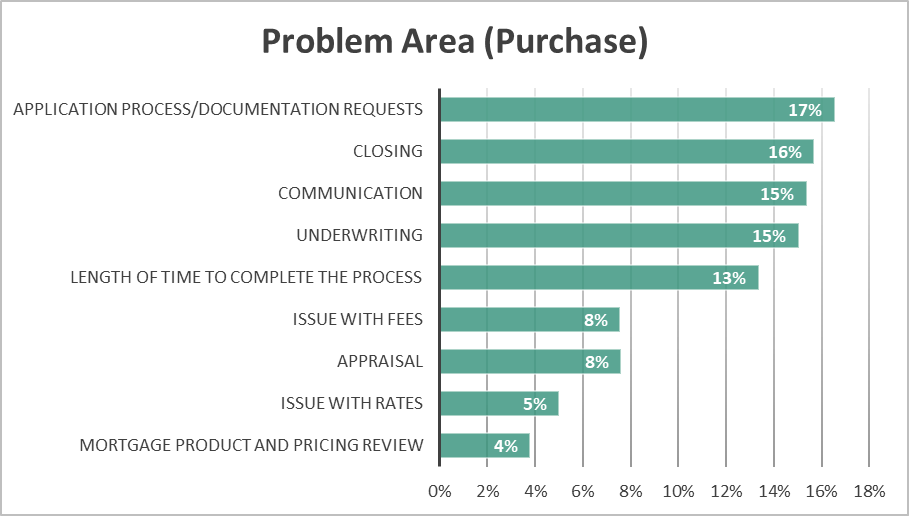

This chart shows the areas where problems occurred most often on purchase loans in 2019:

Notably, less than 20 percent of the issues are related to cost. Document collection and underwriting issues comprise roughly a third of the problems, while several other, including issues with rates and fees and communication, could be grouped into another third involving communication breakdowns. To address these issues, a lender needs further transparency into where exactly missteps occurred. Did the loan officer or processor forget to call to go over closing figures? Was the borrower asked for the same document multiple times? Did the closing start late? These are the types of questions that MortgageSAT asks borrowers, so lenders can pinpoint and fix process issues while, at the same time, identify coaching moments for their personnel.

If your intent is to thrive in a flat market in 2020, here are three tips for creating a delightful purchasing experience for your borrowers:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.