for these free STRATMOR

online publications

I had a near-death experience once that I’ll never forget. Of all the places one could end up after college, I somehow found myself in Myrtle Beach, SC. I was living a half-block from the beach and decided to take up surfing, or probably more accurately, I was attempting to surf. The East Coast not being known for its big waves, one of the better strategies was to wait for stormy weather, which made for bigger swells. One particularly stormy day, I was out on the water and saw my friends frantically paddling toward shore and waving their arms. At that moment, I looked down between my legs and saw the largest shark I’d ever seen…with his mouth open!

That was my last surfing outing for a while, but recalling that story got me thinking about the huge risk many lenders are taking waiting for the “next big refinance wave” that may or may not come (see Garth Graham’s InFocus article from June), and the sharks lurking in the waters that jeopardize success even when the market turns in our favor. Our question this month: “How can we shark-proof our business and make sure we catch the next refinance wave?”

One thing I learned after my shark encounter is that storms often drive fish to unfamiliar territory like shallower waters, which makes for fertile hunting grounds for hungry sharks. In the same way, the stormy weather we’ve seen in the past couple of years in the mortgage industry (high rates, low housing inventory, golden handcuffs, etc.) has pushed many lenders into the unfamiliar territory of selling off their servicing to hungry correspondent lenders, who are willing to gobble up as much as they can get and are often willing to pay a premium. Why? Because they have expert teams that will aggressively pursue those borrowers once the rates finally turn.

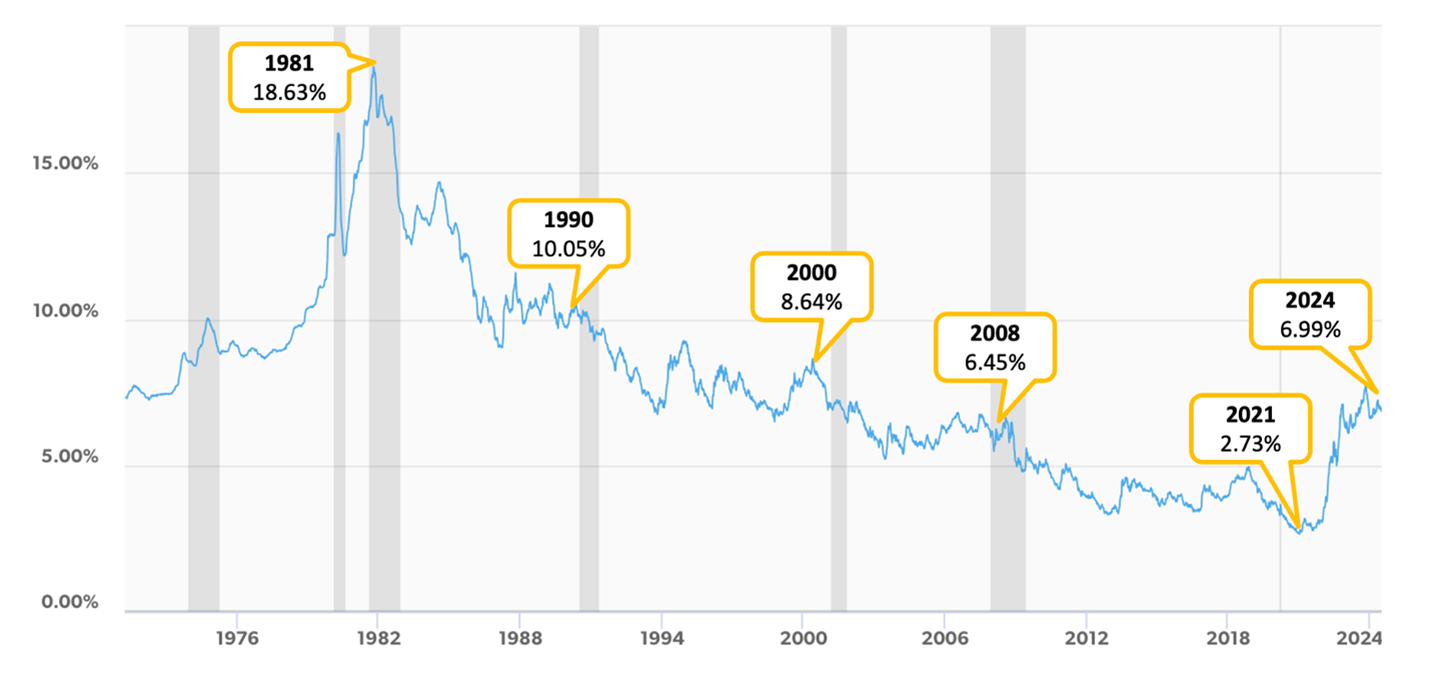

The mortgage industry has always been cyclical, but you hear a lot of people these days saying that “this one is different.” And they’re right. Consider the fact that over the past 43 years, the trend of interest rates followed one long, consistent downward slope, from a high of 18.63% in 1981 to a low of 2.73% in 2021. In short, previous cycles always had “plenty of fish in the water” even when rates crept up for a short time because there were always people who hadn’t touched their mortgages in 10 or 20 or more years.

Source: https://www.freddiemac.com/pmms

Source: https://www.freddiemac.com/pmms

The “higher for longer” rates we keep hearing about simply have not been high enough for long enough, which means that as refinances resurface, volume will more than likely creep up as opposed to bounce up. Meanwhile, loan officers will continue to battle it out to win each deal (often going up against savvy correspondent teams), which means getting the customer experience perfect the first time around has never been more important.

So how does a lender shark-proof their business? Two words: Increase loyalty.

Many lenders have great self-confidence in this area. Whether it’s warranted is another story. I’m constantly hearing lenders boast about how much their customers love them, only to find that their retention rates are dismally low. According to STRATMOR data, the industry average for borrower retention over the past five years is less than one in five loans (18%). They must not love their lenders that much.

Increasing loyalty goes much further than simply tracking a KPI like “Likelihood to Use Again.”

If you really want to inspire faithfulness in your borrowers, you need to do at least one of three things:

Here are three practical ways you can start shark-proofing your business today:

If you’d like to discuss STRATMOR’s MortgageCX program in more detail, call me at the number below or find time on my calendar to set up a free consultation.

MortgageCX is now integrated with Encompass®!

To find more Monthly Customer Experience Tips, click here.

Start receiving monthly Customer Experience Tips