for these free STRATMOR

online publications

One day while sitting at a quaint cafe in Italy, I noticed a husband and wife walk in. He was excited to order an espresso, and his wife had a medium-sized McDonald’s cup in her hand. They sat next to my table and while chatting I had to know the backstory of how they ended up at McDonald’s … in Italy. The wife chuckled and said, “Ok, hear me out. We don’t speak Italian. Our phones don’t have coverage here unless we are on Wi-Fi so I couldn’t research restaurants nearby, and I was starving. I knew I could point and get exactly what I wanted because McDonald’s is consistent all over the world.” Valid point. While McDonald’s has special menu items local to various countries, the staples consistently taste the same across 120 countries and territories, which is remarkable given the complex supply chain requirements.

I think about that experience often as we conduct secret shopping for our clients because executives usually ask the same question: what do you notice when you secretly shop banks, credit unions, and IMBs for a home loan? What we notice is how consistently inconsistent the experience is when we shop the same lender multiple times. Sometimes we are called at the time requested, other times we never receive a single phone call from our inquiry. Some loan officers explain the process, others do not. Some loan officers tell us the value of doing business with their company, but most never mention anything special. The experience is consistently inconsistent. Most lenders have not franchised their upfront origination models like McDonald’s has around the world.

Our question this month: How can lenders leverage the franchise model concept to create consistent, positive experiences for their borrowers?

This observation about consistency led me to a simple question: what is the average failure rate of a franchised business model vs. any other business — a bar, tech company, transportation / warehouse business, construction firm, etc. — over a five-year period?

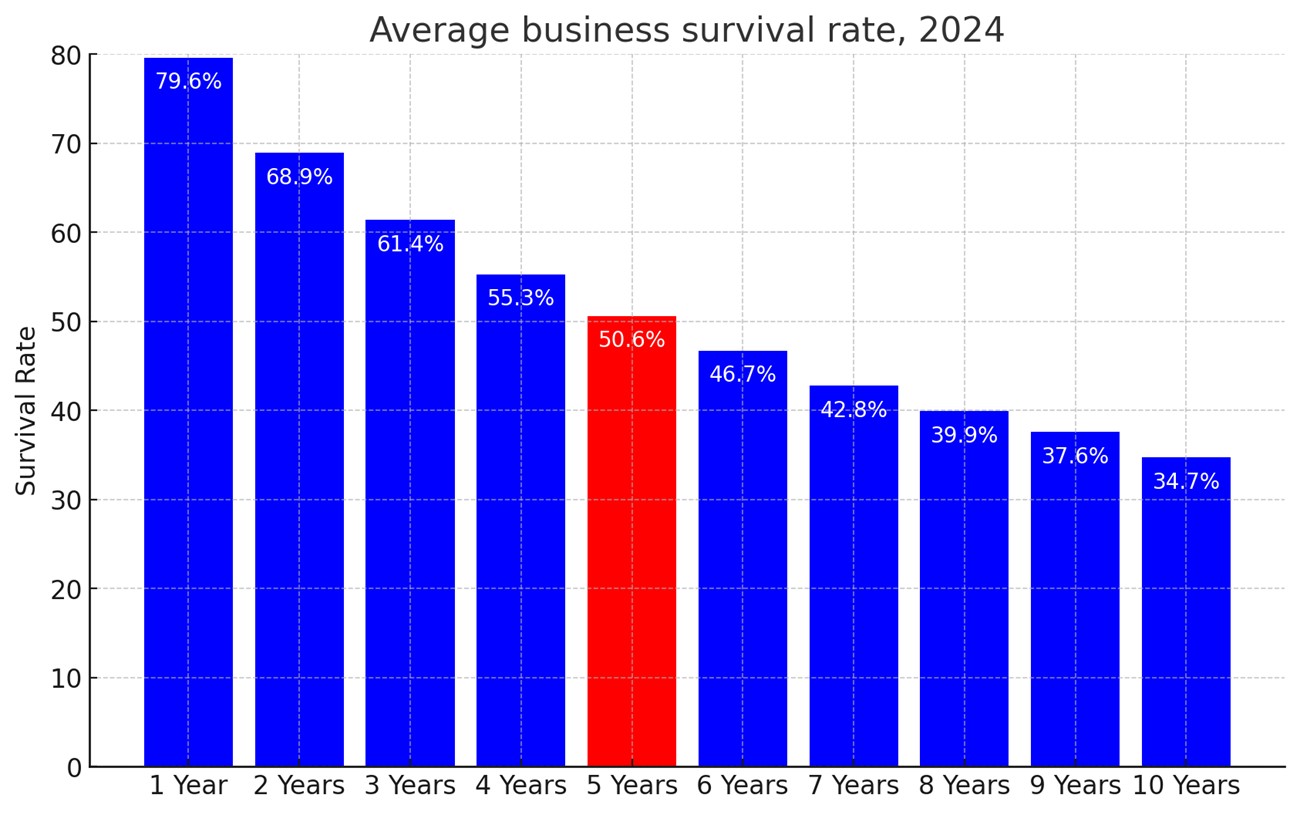

The Bureau of Labor Statistics publishes the average business survival rate. After five years, about 50% of companies survive and 50% fail.

Source: The Bureau of Labor Statistics

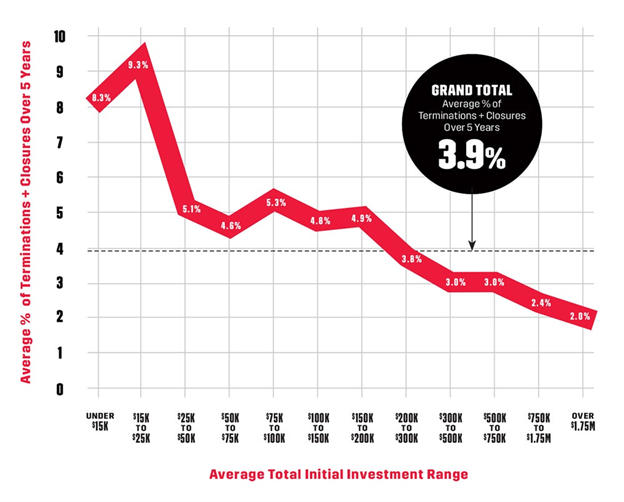

So, what about franchise business models? “Entrepreneur” magazine published an interesting article analyzing five years of franchise industry data. The Y-axis below shows the average percentage of franchise terminations and closures over a five-year period.

Source: https://www.entrepreneur.com/franchises/

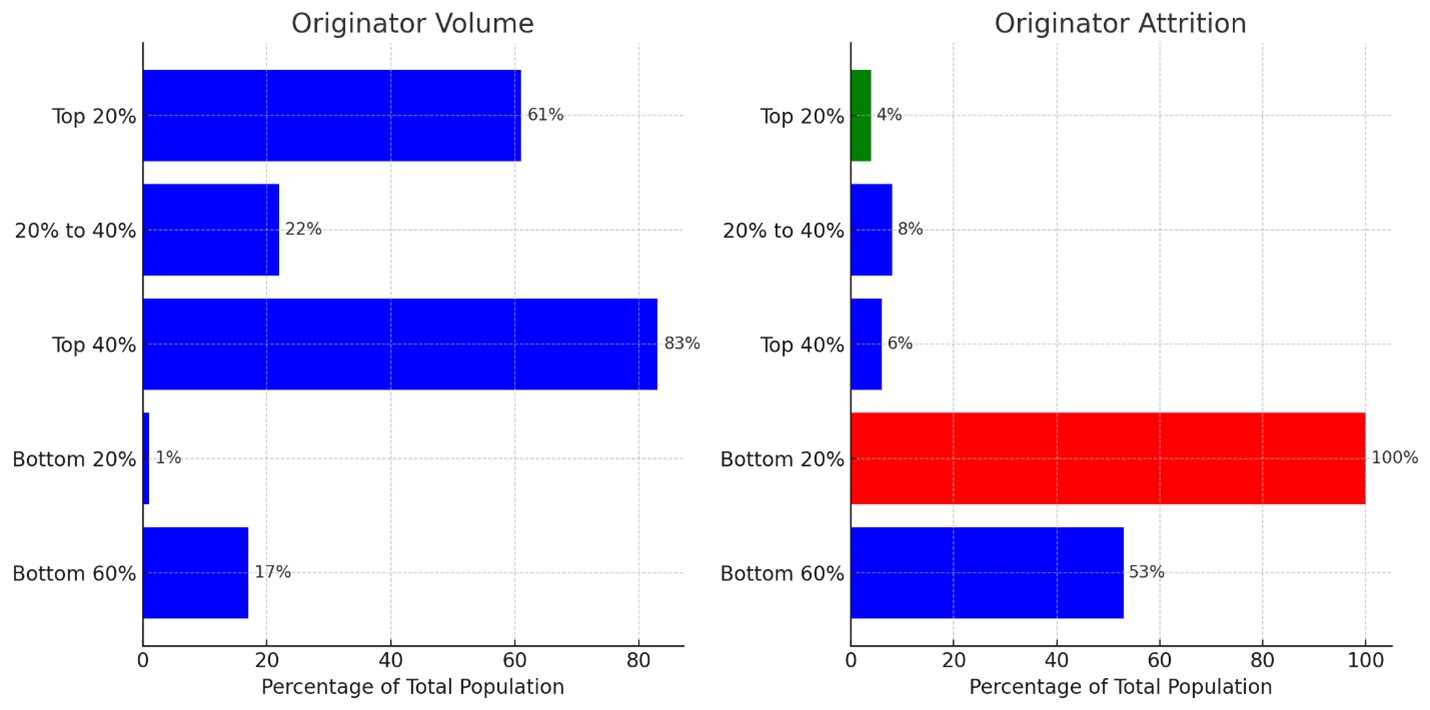

The average failure rate is just 3.9%! Or put another way, 96.1% of franchises survive their first five years in business. So, is there an analog in the mortgage space? My colleague Garth Graham conducted analysis on loan officer volume and attrition. The top 20% of originators generate over 61% of industry volume, while the next 20% generate 22%. Net, the top 40% generate 83% of the industry volume. And this top 40% only has a 6% attrition rate — meaning only 6% leave their company for another opportunity. They are the ‘low failure rate’ segment, often like a good franchise they have a system. But what about the bottom 60%? They generate only 17% of the volume and have an attrition rate of 53%. Over half of the bottom group leaves (or fails at their current company). Much like low failure rate franchises, top producers tend to have a repeatable system that attributes to their success.

So, why do franchised business models succeed? The structure of the franchise model provides entrepreneurs with proven operational systems and ongoing support on top of an established brand. Franchise owners do not have to reinvent the proverbial wheel. They benefit from a tried-and-true system that has already been refined through years of operation. Standardized processes and operational efficiency create a more predictable environment for business success. In other words, successful franchises sell consistency.

Have you ever heard of Ulysses Lee “Junior” Bridgeman? He played for the Milwaukee Bucks and Los Angeles Clippers from 1975-1987. He earned about $2.95 million over his entire twelve-year career. After retiring, he built an empire of more than 450 restaurants including over 160 Wendy’s and 118 Chili’s franchises with 11,000 employees. In 2016, Forbes ranked him as the fourth-wealthiest retired athlete at the time behind Michael Jordan, David Beckham, and Arnold Palmer. He has an estimated net worth today of about $600 million. Ex-athletes have seen the clear value of buying proven, franchised models by investing their on the field earnings and endorsement money while playing to realize monster returns owning franchises. Shaquille O’Neill reportedly owns 155 Five Guys, 17 Auntie Anne’s Pretzels, nine Papa John’s, 150 car washes, and 40 24-hour fitness gyms to name a few. When the operational model is implemented, profits follow.

So, how can mortgage lenders franchise their models to provide consistency with better economic outcomes?

A centralized strategy for a target operating model is key. This is how the most successful call centers operate today. However, traditional retail can still be built around a centralized operating model and have a reasonable level of flexibility and autonomy for branches on how they market and how they approach local market conditions. Where the model goes off the rails though is when branches want to own the core process and create disparate processes. Then everyone wonders why costs are so high to originate.

Consistent businesses tend to be successful because they build trust, reliability, and efficiency, which are key factors in attracting and retaining customers. When customers know they can rely on a business to deliver the same level of quality they expect every time, they are more likely to return and recommend the business to others.

A positive and predictable experience reduces the risk of a customer switching to a competitor.

Finally, consistent businesses are more likely to achieve sustainable long-term growth by delivering consistent value. It took McDonald’s 33 years to open its first 10,000 restaurants and 18 years to grow from 30,000 to 40,000 restaurants. At the end of 2023, McDonald’s said it plans to open 10,000 new stores globally by 2027. So, hey good news: if you find yourself in one of the greatest countries in the world for cuisine and feel a little uncomfortable ordering off the menu in the local language, there’s a good chance you can pick up a quarter pounder with cheese … and get exactly what you expect. Brett McCracken

Start receiving monthly Customer Experience Tips