When you fly as much as I do—many of our readers are frequent flyers too—you sometimes hit the bottom of the barrel for things to watch when you are finished with email, reading and contemplating the state of the industry.

On a recent flight, I was scrolling about for something I hadn’t seen before and saw a show called “Couples Therapy.” Judge if you must, but the combination of my boredom and my curiosity got the best of me, and I watched a few episodes. The show has real couples, with a real therapist, and what you watch is (*gasp*) the real therapy sessions they go through, no holds barred. But that’s not all—following the session, you hear what each of them have to say about the other outside of the session, including the therapist’s assessment of their relationship and their issues. Now I am certainly well aware this is a television show and presumably these folks are (hopefully) well-compensated for the somewhat horrifying level of disclosures. But it did get me thinking.

I’ve observed for a while the massive disconnect often seen between mortgage lenders and their technology partners, despite good intent from each party and the desire for a mutually beneficial outcome. And much like real-life relationships, some are staying in the partnership purely due to a contractual commitment made but they aren’t exactly happy. Some feel they made a good choice with the partnership, but there are recurring frustrations that seem difficult, if not impossible, to solve: poor communication, issue resolution or not living up to expectations. And sometimes you see a truly positive partnership, not entirely free of challenges, but where there is a healthy manner of resolving difficulties as they arise.

Like many of my fellow STRATMORians, I have worked as both a lender as well as a technology vendor, so at STRATMOR, we have not only witnessed these challenges firsthand, but we have also wrestled through them ourselves. And as consultants to the industry, we often find ourselves in a position not unlike a therapist: hearing valid frustrations from intelligent parties that seem difficult to overcome on their own. We have seen what works, as well as what doesn’t. Most importantly, we are well positioned to guide both parties to reach positive outcomes.

So, step into our office. No need to lie on a sofa, but we will unpack the key areas of disconnect that we’ve heard, outline what STRATMOR suggests to both lenders and their technology partners and share examples of how a few tech providers have already taken STRATMOR’s guidance to heart. Best of all, the session will not end up on an exploitive television network and will be much more valuable for those that participate.

STRATMOR Group launched its Technology Insight® Study in 2014—and for the last decade, we’ve been surveying lenders across the industry to find out what solutions they are using, which technology partners have won their loyalty (or their frustration) and why.

STRATMOR’s Technology Workshops are designed to provide a forum for lenders to come together to get important questions answered and work through problems. It’s also an excellent opportunity for lenders to share their challenges.

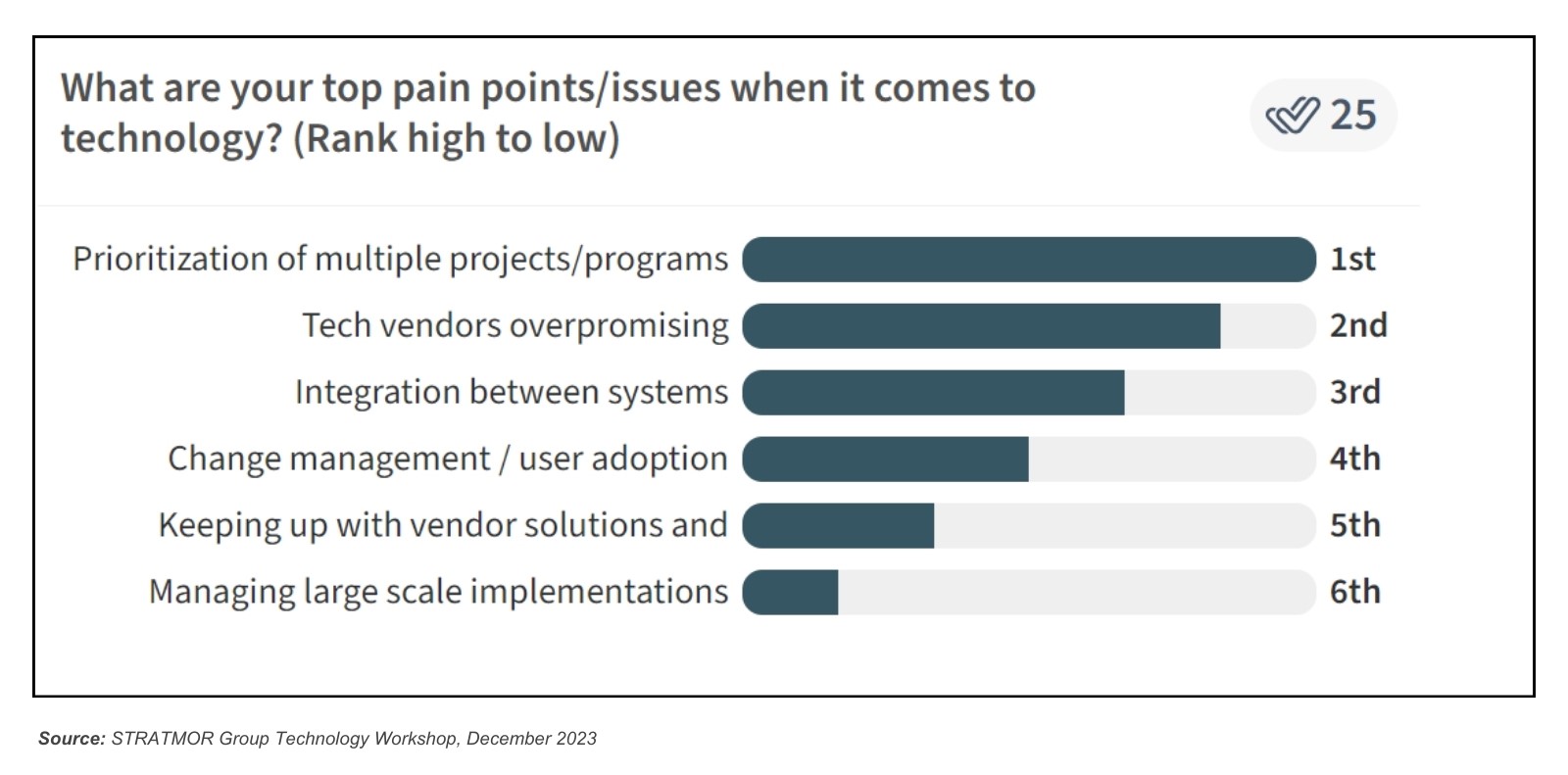

In our most recent Technology Workshop in December 2023, lending executives did not hold back when we asked them to express their biggest pain points when it comes to applying technology to solve business problems in the mortgage industry. Here are a few of the areas in which pain points were identified:

When we asked the group to prioritize their pain points, the results were telling.

Then, we took it a step further and asked the executives in the workshop what they would want their technology partners to hear if it could be totally anonymous—if they could say anything they want. They unleashed. These are direct quotes:

You don’t have to read between the lines to hear these executives loud and clear. If you are a lender, does this sound like it could be you? If you are a technology provider, does this ring true while causing a level of angst because there is another side to the story?

This kind of discourse is not new, but the frustration levels continue to simmer and boil, and are exacerbated by challenging market conditions.

And this is precisely why in 2023, STRATMOR launched its Solution Provider Advisory (SPA) program, which serves to help technology partners hear, understand and better respond to the needs of the lending community.

At STRATMOR, we are passionate about empowering our clients to succeed by utilizing our expertise and guidance to implement winning strategies. It’s why we do what we do. When we saw how the disconnect between lenders and vendors was hurting the success of both parties, we developed the SPA Program to connect lenders’ evolving needs and expectations with vendors with the capacity to meet them.

The following are some of the common themes that STRATMOR is working to address through the SPA program.

The advances in mortgage industry technology between 1980 and 2000 were akin to someone turning on the lights in a dark room. Advancement slowed during the crisis years as new requirements came into focus.

Over the past five years, numerous technology vendors have updated their code bases to benefit from open architectures, cloud computing and a robust API ecosystem.

Now we have AI making its way rapidly into many industries, including the mortgage business.

And of course, there’s been a dramatic shift in market conditions in recent years. When all of these factors are combined, it becomes very difficult for vendors to keep pace with the changing needs of their customers. Stakeholders often move in different directions, which can quickly throw a technology developer’s roadmap off course.

One of the benefits of the powerful new technologies we have today is that a development team doesn’t need to have decades of experience in an industry to create technologies that can benefit businesses operating there. The flip side of that is inexperienced developers may overlook crucial industry insights, leading to tools that fail to address lenders’ real problems.

New vendors often lack awareness of their blind spots, making it crucial for lenders to provide feedback. Without this input, vendors struggle to sell their products effectively. When new vendors offer flexible tools without a pre-configuration that allows users to get a quick start, there will usually be no start at all.

In some cases, technology developers may introduce new functionalities without adequately getting the word out to lenders, limiting their adoption. This goes beyond sending a software update notice to providing training material and other support to help users.

William Gillis, Senior Leader of Product Marketing for CoreLogic shares how his team approached related insights from STRATMOR through the SPA Program: “STRATMOR guided us in exploring innovative concepts like GenAI which included an in-depth examination of the complexities surrounding GenAI in the mortgage industry, potential early adopters, and the change management implications for mortgage lenders.”

One of the most significant problems is that vendor teams often approach lenders in the conference room with well-designed presentations and big promises that lenders just don’t believe. The sales team then leaves the room and celebrates because the presentation went off exactly as planned. What they do not know is they have already lost the deal.

Perhaps they didn’t take the time to really understand their prospective customers’ real challenges. Maybe they didn’t adequately address adoption, or how their solution will play with the many other technology solutions in the stack. Or, it could have been all about ROI: technology partners that are unable to clearly address the meaningful difference a lender can expect from their solution are going to be ushered out, politely.

Until tech vendors are aligned with their lender prospects, lenders may choose to make do with what they have, leaving tech firms in the dark about true market needs.

Laura Mighdoll, Director of Corporate Marketing for Snapdocs said that reviewing data with the STRATMOR team “revealed that not all lenders were even aware of Snapdocs’ three distinct products: Notary Scheduling, eClosing, and eVault. Discoveries like this have influenced our market perspective and approach.”

This might come as a shock, but sometimes, lenders aren’t completely honest with their tech partners. The feedback lenders give to third-party consultants often differs from what they tell technology vendors, or even development partners. It’s like having two different conversations with conflicting goals.

Great consultants only have one goal, and it is to align with the client they serve to achieve a desired outcome. Consequently, STRATMOR has a great deal of data that tells us exactly what mortgage lenders want, and where they are losing patience.

While each lender is unique and their specific feedback reflects that, we’ve observed some commonalities:

STRATMOR already supports lender clients with technology procurement. The SPA program was not designed to give vendors a seat at that table or a voice in any existing negotiation. Instead, it aims to convey insights about lender needs to assist vendors in developing tools that better align with those needs or in demonstrating how their current offerings already meet lender needs effectively.

The program is structured to offer data-driven advice to vendors, helping them gain clearer insights into the market they are targeting. It also assists them in formulating responses to the questions we know lenders are going to ask.

Ideally, vendor leadership will walk away with answers to some important questions, such as:

So far, over a dozen industry vendors have embraced the SPA program, representing almost every phase in the lending process. Interestingly, participation hasn’t been limited to start-ups but includes several very mature technology providers that are working to continuously up their game.

“STRATMOR provides a unique perspective of the mortgage industry because of its deep domain expertise,” said Stephen Epstein, Chief Marketing Officer of TRUE. “The TRUE team became interested in this capability as it allowed TRUE to expand its perspective of the mortgage market while providing a third-party, unbiased view of the emerging needs within this sector.”

Technology partners are well aware of the ongoing work STRATMOR does, supporting lenders throughout our 40-year history. They consider this experience essential to the value proposition of the SPA program.

“The ability to engage with industry veterans that are involved as a guide/consultant in technology reviews and purchases for lenders of all types is very attractive,” said Steve Sigaty, Enterprise Sales Expert at Lender Toolkit. “Lender Toolkit has a large number of products that impact the origination process and we were looking to STRATMOR’s SPA program to help simplify our messaging without watering it down so prospects can quickly understand what we do.”

Alison Flaig, Vice President of Marketing at Mortgage Cadence, offered a similar reason for engaging in the program.

“Like any company trying to sell a service amongst many competitors in the industry, you begin believing your own press around the market, your capabilities and impact on the business,” Flaig said. “We were hoping, and it was delivered, to get a true view of the market, understanding on where we stand and excel, and assistance in planning a road map that allows us to compete with our competitors and meet the market needs as it changes.”

Every participant in the program realized from the beginning that the support STRATMOR was offering was specifically intended to drive value to the mortgage lending industry. It’s core to everything we do. The participants embraced this and the results have been impressive.

Perspective is one of the most valuable qualities a sales organization can possess. By truly understanding the needs of the buyer, the sales process can be designed to move prospects quickly into the fold. This approach builds stronger relationships and enhances value for all parties.

“We felt that we were too close to the business and that we could do with help to refine and improve our approach, messaging, and value proposition,” said Rajan Nair, CEO of Indecomm Global Services. “We did not have the full perspective of how decision makers go about evaluating the kind of solutions we were offering in the market. At the end of the engagement, we were able to come up with a comprehensive list of action items across multiple areas of our business. We changed how we present our capabilities to new clients to hit home the impact that our solutions have made with our existing clients.”

In many cases, the program has allowed vendors to create solutions that better align with the needs of lenders.

“There were some eye-opening areas that we didn’t think were that important and have now realized are important and have influenced our strategy moving forward,” said Colby Berger, Chief Operating Officer, and Melissa Grindel EVP, Head of Compliance with ActiveComply. “Changing our feedback collection structure allows our team to dynamically pivot resources to meet the emerging needs of the market more quickly than our competition.”

In virtually every case, vendors looked to gain a complete view of the industry.

“We sought a comprehensive understanding of the market opportunities that lie ahead,” said William Gillis, Senior Leader of Product Marketing for CoreLogic. “We were able to gain outside insight into roadmaps and priorities, which helped our future priorities. We expanded use cases of current CoreLogic offerings that, when brought together collectively, demonstrated value for our clients and stayed true to our mission of infusing data and analytics within a lender’s workflow to drive business efficiencies.”

Gillis added, “We plan to continue collaborating with STRATMOR to further refine our roadmap and future vision. STRATMOR’s assistance in refining our value proposition and positioning our Point of Sale in the marketplace was invaluable.”

Now that the industry has a method of getting important lender feedback to the vendor community, lenders must make certain that their voices are heard. The best way to do this is by participating in STRATMOR’s annual Technology Insight Study. The next opportunity to participate is coming up in just a few weeks, and all lender participants will get a full copy of the study and its insights. If you don’t receive your invitation to participate via email, reach out to us: the better the input, the better the output.

Attending one of STRATMOR’s Technology Workshops allows lenders to share best practices, go deeper on individual technology challenges, gain peer group data and perspective, and problem solve with fellow industry executives.

Whether you are a lender or a technology provider, you should be talking regularly to each other. Make sure you have communication lines open and clear, and ideally, have scheduled business reviews on your calendar. If not, reach out and say, “we need to talk.” Be honest and share frustrations you have. Squashing concerns often leads to the unnecessary end of a partnership, while airing issues can lead to positive growth.

And lenders, if you know a technology partner who might benefit from participating in the SPA Program, send them this article and encourage them to reach out to STRATMOR for more information — or to me directly at sue.woodard@stratmorgroup.com.

For some technology teams who participated in the program, the acronym of SPA wasn’t lost on them …

“Ah, the SPA program. Who knew this “SPA” would be more about strategic rejuvenation than hot towels and cucumber water? Big thanks for your straight-up feedback in sharpening our product roadmap and zeroing in on our strategic targets — keeping the wheels of innovation turning is what’ll keep us cruising ahead. STRATMOR insights are like gold around here, and we’re seriously grateful for the energy you’ve put into this ride with us. Thanks again for being a core part of our team’s strategy moving forward — without the fancy robes and slippers, of course.” Blake Boss, EVP Sales for ActiveComply.

Yes, there are vendors in the industry actively working to innovate and resolve today’s pain points. They are open to making the necessary adjustments to meet lender needs and are eager to improve communication. Their aim is to help lenders achieve their goals and ensure mutual success, ultimately serving homeowners and homebuyers in the best possible way.

The industry now has a feedback mechanism for participants to provide input in a candid but highly effective manner to better align industry partners. The new SPA Program is in line with STRATMOR’s ongoing commitment to enhancing value within the lending industry.

We hear you. And we are here to help.

To find out more about the Solution Provider Advisory program or to discuss specific lender needs, contact STRATMOR today. Sue Woodard

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.