I was maybe six years old the first time I saw a NASCAR® race on TV. I remember I was thoroughly unimpressed. The only thing that seemed to break the monotony of the cars driving around in endless circles for three hours was when they periodically had to stop and have helpers run around their cars in a frenzy. What really struck me as odd was that a high-speed race that ultimately came down to feet or even inches was so heavily dependent on how quickly the cars got in and out of “the pit.”

Over the years, I’ve come to have a greater appreciation for the precision, power and teamwork that goes into a NASCAR victory, but my early impressions of the importance of the pit were interestingly right on. “The pit” is often cited as the place where races are won or lost.

Why am I talking so much about NASCAR in a mortgage article? There are a surprising number of parallels between auto racing and mortgage lending. Originators are not unlike the “rock star” drivers. Processing managers are like the crew chiefs keeping the “pit crew” processing team accountable to high levels of performance. Mortgage executive leaders are the savvy owners, steering through the twist and turns of the market from a big picture perspective. Perhaps the strongest parallel is the idea that victory is won by the whole team and not by any individual.

In this article, we dig into the key roles and tools that go into designing a race-winning Customer Experience (CX) strategy, and how each contributes to the overall victory. If mortgage lender employees can work together like a top-tier NASCAR team, they just may be able to edge out the competition in this race of dollars and basis points (bps).

You might think that a NASCAR team owner has a pretty easy job — find a great driver and a good sponsor and “get the wheels in motion.” Then just sit back and let the machine go to work, right? Not exactly.

The best owners are top-tier strategists, planning and maneuvering with extreme precision and forethought. Mortgage executive leadership needs to operate with this same strategic vision if they want their companies to lead the pack.

What follows are some questions that best-in-class mortgage leaders can answer about their CX strategy, from vision to processes, technology and people. Do you have answers to these questions for your company?

A successful CX strategy begins with a well-articulated customer experience vision. Employees want to follow leaders who have a passion for providing excellent customer service, but you cannot just assume that everyone knows what your vision is. When it comes to customer-first messaging, just follow the mantra: “Repeat yourself until you are personally annoyed with yourself. Then repeat yourself some more.” That is about the time it finally starts to sink in for your team.

For a customer experience vision to take hold, there needs to be some baseline assessment of where things currently stand. This, unfortunately, cannot be determined with a short three-to-five question, post-close survey. It is not enough to simply know that “communication” was poor or that there were “closing issues.” The details matter if you want to create loyalty and advocacy. Did the originator set poor expectations around the closing timeframe? Did the processor take too long to respond to questions? Did they ask for documents after they were already provided? Did anyone make a call prior to closing to review the final numbers and answer questions? Were any closing documents inaccurate or confusing?

In short, if you are not asking the questions and collecting the data, you are missing major opportunities to course correct. Going deeper with your survey questionnaire will lift the hood, so to speak, and expose any leaky hoses.

Two other tactics lenders can employ here are secret shopping and customer journey mapping. Secret shopping helps you get inside the customer’s mind, in a context that is distanced from the shine of the loan closing. It also gives you deeper insights into the point-of-sale phase, which is often a distant memory by the time the loan closes, but still colors the overall delight of the loan process. Customer experience journey mapping forces your team to practice empathy as they put themselves in the borrower’s shoes and imagine the pain, frustration and anxiety that the process often produces.

Next, mortgage leaders must address the problematic question, “How high is up?” In other words, where is the right place to set the bar? To answer that, they need visibility into how their peers are performing. At present, STRATMOR offers the largest National Benchmark for customer experience in originations, by a factor of about 50x, through our MortgageCX program. We have collected more than one million surveys over the past 10 years and have identified 30 data points with the highest impact on loyalty and advocacy. If you haven’t checked out the program yet, contact STRATMOR to inquire.

Just as a NASCAR race isn’t won by the driver alone, a mortgage loan isn’t closed by the LO alone. A top-performing racecar driver needs a meticulous crew chief and a fast and efficient pit crew if they want to be first across the finish line. In the mortgage industry, LOs similarly need detail-driven loan manufacturing leadership and a fast and efficient back-office team.

Speaking of speed and efficiency, did you know that NASCAR pit crews can change four tires and refuel a race car in around 13 seconds? And they accomplish that feat 10 or more times in a single race! This simply would not be possible without exceptional communication.

Poor communication, including a general lack of it, is the problem most frequently cited by borrowers in the mortgage origination process. Breakdowns in communication around document collection also rank near the top in frequency. Both are extremely damaging to borrower sentiment and advocacy, with the former dropping the Net Promoter Score (NPS) to -61 and the latter to -30. In fact, the most damaging miscues cited by borrowers can all be traced back to communication issues.

Chart 1

A great crew chief in NASCAR holds their team to the highest level of performance. How? By measuring everything down to millimeters and fractions of a second. Processing managers can do the same, but it requires asking more than just a handful of questions on the post-close borrower survey. As the saying goes, “You can’t change what you don’t measure.”

On the flip side, you can change what you do measure. Deep-dive data is essential to creating visibility, which leads to widespread awareness, which leads to change. The mechanisms for parsing the data into easily digestible and compelling segments is crucial here. Executives need to see slicing by channel, product, and loan type. They need to see trends for each, as well as regional and branch-level breakdowns. They need visibility into processor and even underwriter performance as related to the overall customer experience. Sound complex? It is. The team needs transparency via an FTE handling reporting or a tool like the MortgageCX program to provide it all.

But before you start collecting a mountain of data points, it would be wise to know what you’re going to do with the data once you have it. Start by educating your processing team about their crucial role in the delight of your borrowers. Show them empirical data (STRATMOR can assist with this) about the importance of the loan process over the loan originator in driving customer delight and advocacy. The battle for raving fans is won in the trenches just as NASCAR championships are won in the pits.

The best car doesn’t always win the race, but it would be impossible to win a NASCAR race if you are driving an old jalopy. In the mortgage world, this means providing technology that helps employees be more accurate, efficient, and communicative with their borrowers. Creating visibility for the borrower throughout the loan process is the fastest path to customer delight and it always requires a balance of technology and personal communication. Executives who can strike that balance across their organization are a rare breed. But then, not everyone can stand atop the winner’s podium.

Perhaps the most crucial role on a NASCAR team, aside from the driver themselves, is one that few people are aware of — the spotter. The spotter’s job is to watch the driver’s blind spots and let the driver know when to make a move. Spotters also keep the driver aware of track conditions and developments like crashes, helping the driver to anticipate changes and react quickly.

Most mortgage lenders don’t have a dedicated FTE role that is able to take on this level of observation and constant feedback. It would be a 24/7/365 job. Lenders must look to technology to fill in this gap — in other words, lenders need a customer feedback mechanism. More specifically, they need a survey, data analytics and meaningful reporting to serve as their spotter.

Historically, lenders looking for technology tools to help their customer experience strategy were limited to choosing just one of the following:

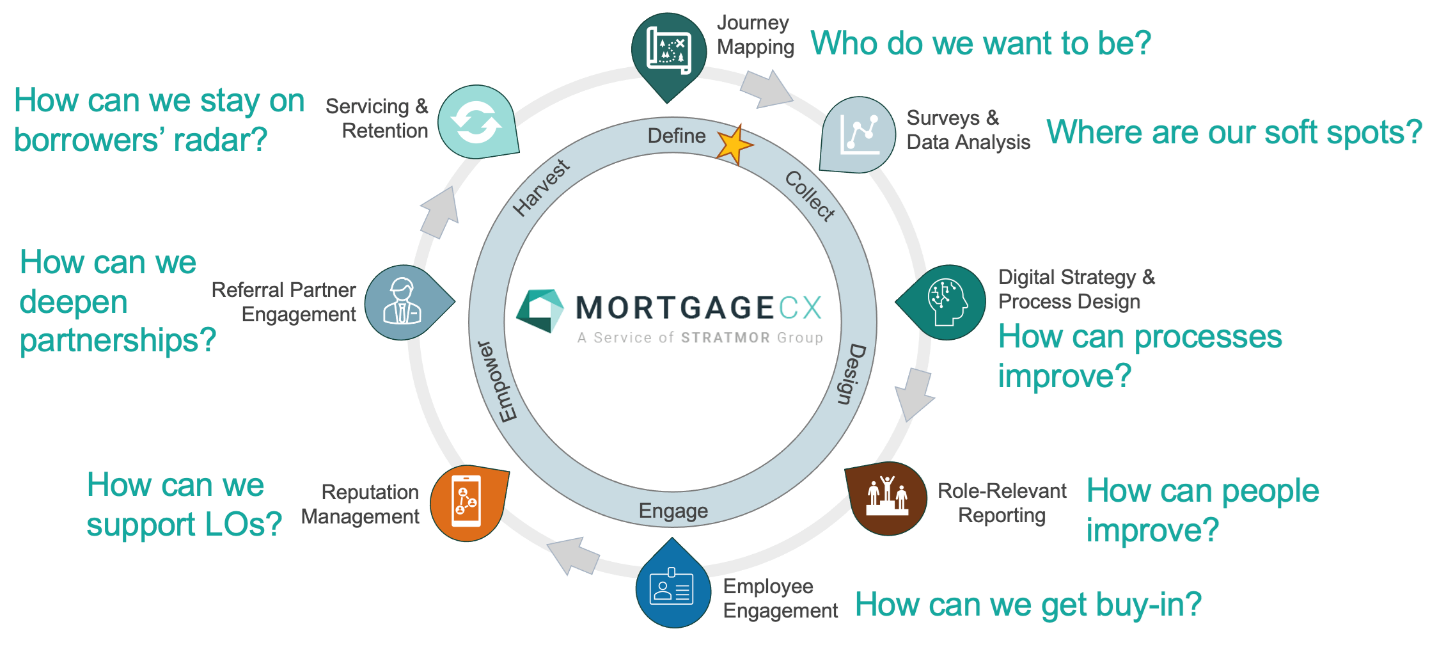

For years, none of the vendors wanted to play in each other’s sandbox. It was not until STRATMOR’s MortgageCX program came along — allowing lenders to have all three — that a truly holistic approach to CX strategy was born.

In its role as a “spotter,” the MortgageCX program identifies blind spots for LOs and processors on an ongoing basis with motivational CX scorecards. Separate manager reports help leaders quickly identify areas in need of attention and provide coaching tips they can pass along to their team members. Executive reports show revenue opportunities and other big-picture metrics to help them steer the whole organization towards success.

Everyone on a NASCAR team wants to win, but no one more so than the driver. Think about what’s on the line for them: a nice payday, recognition and competitive pride. The same financial motivation exists with originators when it comes to closing loans. But what about motivation to achieve CX excellence? It is not like you have NASCAR’s celebratory champagne bottles and fireworks at each closing. What’s more, most originators tend to have a pretty high opinion of themselves and can back up their opinion with high star-ratings from borrowers. How can a lender expect originators to change if they don’t perceive any need for change?

The answer? Show them the WIIFM (What’s in it for me?).

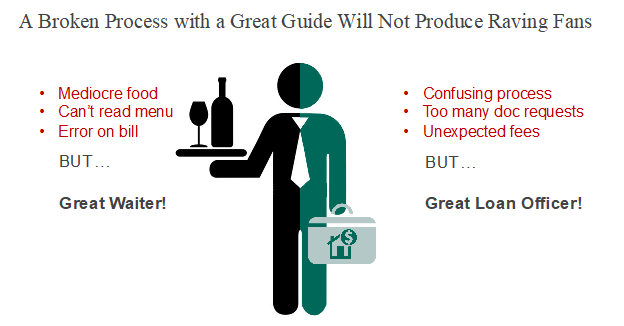

This tactic has been a game changer for multiple lenders STRATMOR has assisted with CX services — show originators that X plus Y does not equal Z.

Chart 2

Source: © 2022 STRATMOR Group.

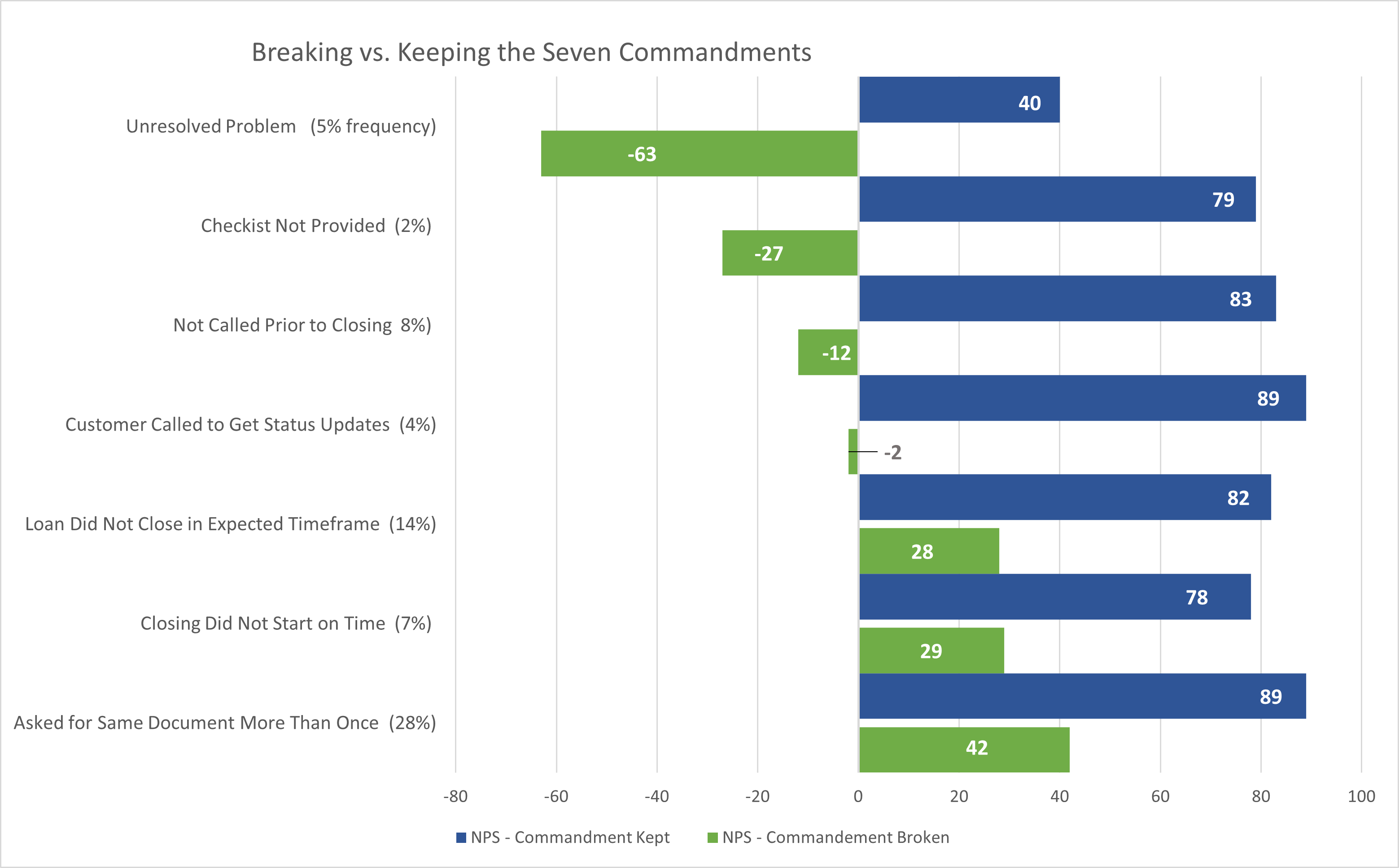

Source: © 2022 STRATMOR Group. When loan officers begin to understand that process miscues may be forfeiting their potential referrals — despite their best efforts and likability — there can be a seismic shift in the LO’s attention to the details of the process that make, or break, raving fans. Here are seven of the most impactful miscues that impact the borrower’s likelihood to recommend. STRATMOR calls them The Seven Commandments for Optimizing the Customer Experience.

Chart 3

Source: © 2022 STRATMOR Group.

Source: © 2022 STRATMOR Group. In NASCAR, every team member wakes up with the same goal in mind: WIN THE RACE. In the mortgage industry, priorities are not as aligned. A CEO’s main driving motivators are revenue growth and equipping leaders. A manager is primarily concerned with recruiting and retaining top talent, and coaching others to excellence. A processor’s top priority is to get their work done accurately and efficiently. An LO is doing whatever they can to get the next deal into the pipeline. So how do you speak different “dialects” of motivation to these team members with differing priorities? The answer is through role-specific reporting.

Originators are no doubt motivated by money, but they are also highly motivated by recognition and their love for competition. Reporting should speak to this with elements like badges (e.g., “Top 20 Loan Officer”) and internal rankings. STRATMOR’s MortgageCX program has monthly LO scorecards that monitor and motivate in exactly these ways.

Like originators, your processing staff also loves recognition and a little friendly competition, so scorecards with badges and rankings work well with them too. Once again, STRATMOR’s MortgageCX program offers monthly scorecards that monitor and motivate in these ways.

Manager reports should include all the same ranking and competitive elements as well as coaching tools and advice that they can use to encourage and motivate their teams to better performance.

Most importantly, employees will give 100 percent when they feel supported, recognized, and part of something bigger than themselves. As you hire, look intently for things like emotional intelligence, work ethic and excellent communication capabilities. Knowledge is easy to acquire, but these softer skills are harder to teach and essential for customer delight.

Sponsors in NASCAR amplify the success of the team and go to great pains to elevate the general reputation of the driver. That is the role of social proof tools (a.k.a., reputation management) in the mortgage world. Without a consolidated plan for brand management aided by testimonial sharing tools, you are simply behind the curve, as STRATMOR’s Technology Insight® Study (TIS) shows that more than half of lenders are employing this tactic already.

Important to note: While STRATMOR data shows a low correlation between testimonials and top-of-funnel leads, there is a strong correlation between testimonials and pull-through. In essence, borrowers use relationships to curate their options, then use testimonials to help confirm their final selection.

Just as NASCAR promoters fill the seats of the stadium, lenders need referral partners to bring people to them. In today’s purchase-centric market, referral partners are truly the hand that feeds you. Helping your originators deepen their relationships with these “promoters” is to help them survive in these lean times. One of the best ways you can deepen any relationship is to listen –and listen often. STRATMOR’s MortgageCX program offers periodic surveying of referral partners to help uncover pain points before it’s too late and they just stop calling.

Another idea: Consider asking the borrower for feedback about the Realtor®(s) involved in purchase transactions. Then arm the LO with some (hopefully) good news they can share with their existing or potential Realtor partner(s).

If you want to stay on a borrower’s radar post-closing, you must actively pursue the relationship. Letting “a sleeping bear lie” is not the best strategy here. Reaching out to borrowers at least twice per year for feedback (annual escrow analysis and roughly six months later) with a brief survey is a proven way to show them you care and that you are listening. They will see your logo and phone numbers and often save it “just in case” they need to contact you. Servicing retention hovers around just 18 percent industrywide because lenders are simply neglecting the extremely valuable asset that is their servicing portfolio. Can STRATMOR help with this too? You guessed it — YES.

Here is a shorthand map for how each of the questions asked in this article correlates to STRATMOR assistance with CX strategy design.

Chart 5

Source: © 2022 STRATMOR Group.

Source: © 2022 STRATMOR Group. In the world of racing, you can have an amazing car without an amazing driver, or a top-tier driver with an uninspiring car, or a great car AND a great driver, but a lackluster pit crew. Simply put, you need all the pieces working together in harmony if you want to achieve world-class results. The pursuit of CX excellence in the mortgage industry is no different. Executive leadership needs to cast a compelling CX vision, gather the right people and provide the best technology solutions. Processing leadership needs to set a high bar for communication and efficiency and hold their teams accountable. Loan originators need to expand their focus to the bigger picture of the loan journey rather than just their own likability. If any of those parts fall flat, so will overall customer delight — and believe me, the competition will take any opportunity they can to zoom ahead.

I’ve still never been to a live NASCAR race (I’m told you really must be there to experience the rumbly awesomeness of it), but I have a much greater respect and appreciation for the talent and speed with which both the drivers and the pit crews operate. It is a beautifully complex concert of sound and skill, power and precision — but a car race will never compare to the euphoria of helping a family into the home of their dreams. That is the victory we are truly chasing, and it is better than any combination of cash, championship trophy or fame. Seminari

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.