“Grab a water, grab a towel, get your life together, boo.”

— Cody Rigsby, Peloton® instructor.

If you are able to read and hear that in Cody’s voice like I do, you have ridden a Peloton exercise bike and had the opportunity to meet the most famous instructor in their crew. But how many well-intentioned folks buy the bike, shoes, weights, subscription and yet a year later, have not accomplished their fitness goals?

I think we can all relate at some level. We buy the equipment with the image in our head of the outcomes — healthier heart, stronger muscles, weight loss, increased stamina — one or all those things are the ROI that we expect for investing in fitness technology. But the only way we’ll see those meaningful changes is with a partnership between the technology and services being provided (in this case, by Peloton) and ourselves the riders, via changes in our own habits, routines and disciplines.

Sometimes it means getting additional support from the provider with training or guidance, and sometimes you need support from other people around you to help make space in your home or to help keep you accountable. Realistically, sometimes the expected outcomes are oversold (anyone else expect to get six pack abs from the battery operated “ab cruncher?”), and sometimes our level of enthusiasm to adopt new fitness habits fades and we don’t do our part. Still. the results can be amazing when all the pieces come together.

So, let’s take it to the mortgage world, boo.

When you ask a mortgage lender what they want from their investments in mortgage technology, they’ll tell you they want a return on that investment. But what does that actually mean? And how can a lender truly feel they are getting that coveted ROI? Pretty much anything a buyer says they want to get out of their investment falls into their expected ROI. In the case of lenders, the return they are looking for goes well beyond a return of their capital investment.

There are four categories of benefit that contribute to overall ROI:

Lenders would like to see a return in all these areas. Who can blame them? But when they don’t get it, they often blame their technology partners.

Here’s an uncomfortable truth: the lender and the vendor both share responsibility for making technology deliver.

Wait, what? Did you just read that right? It may not be a popular opinion, but experience tells me this is solidly true. Think about that Peloton story: you’d have to agree that both the fitness technology vendor as well as the would-be rider bear some responsibility for the ROI and expected outcomes.

Now, let’s nail down what a realistic yet meaningful technology investment ROI actually looks like, and how you can take steps toward unlocking the ROI of your own tech stack.

Source: Marketoonist, Marketing Babble, used with permission.

Source: Marketoonist, Marketing Babble, used with permission. In looking at the four categories where lenders should see benefits from new technology investments, notice that there are a lot of metrics one could measure in the search for those results, not to mention a lot of acronyms.

Profitability seems straightforward, until you try to determine how much of the lender’s increased profits were the direct result of the new investments. It’s the same case with expense reduction. It’s far too simplistic to state that any increase in profits or reduction in expenses is due to any one factor with the market constantly in motion. Think of any tech acquired in the early part of 2020: would it possibly be fair to look at the production levels following and solely credit that technology purchase? No, but it doesn’t mean that it didn’t play a part.

Likewise with the other categories. A lender must determine what to measure and then determine what levers are moving the metric, not to mention that an initial baseline is needed to mark the change against. It makes achieving or at least quantifying an “acceptable” ROI very challenging.

And it gets tougher. If the lender finds that a new technology investment is not delivering a return, can they fairly determine why it’s not doing so? The knee jerk reaction is to blame the technology or the vendor who developed it. But that creates a blind spot that can prevent even the best technologies from delivering benefits to the lender.

It’s easy to understand the Peloton analogy and how both parties bear responsibility, so why do lenders often have trouble feeling the same way about the technology they buy for their businesses?

Before we can answer that question, let’s make sure we’re on the same page about technology return on investment in the mortgage space.

When it comes to the success of our fitness equipment, a measuring tape, bathroom scale or that pair of jeans we haven’t worn in a few years will pretty much tell us what we need to know. Life is not so simple in the mortgage lending world.

Typically, if you ask a lender to calculate the ROI for a recent technology investment, the CFO will be summoned to explore some numbers. To be fair, it’s not just lenders who turn to the numbers first. Most companies do. But remember, the ROI from technology isn’t just about the numbers, even if we could be sure that our new investments were the primary contributor to the increase in profit. When being quizzed by a conservative CMO about the ROI of social media, entrepreneur and digital marketing guru Gary Vaynerchuk famously replied, “What is the ROI of your mother?” His point was that not everything of highly significant value has a specific dollar sign attached to it. And he was right.

Let’s look at both financial and non-financial returns as they each are attributed as meaningful measures by lending executives who are successful in their quest for mortgage tech ROI.

Financials first.

STRATMOR research indicates that lender spending on technology per loan unit is up, year-over-year. While this may have a lot to do with fewer units to spread across their fixed costs, it’s still going to jump out at the lender’s CFO.

Chart 1

While the first half 2022 data includes only Large Banks and Large Independents who spend more per loan on technology, the trendline is clear. All peer groups saw an increase in tech spend per loan in 2022 due to the sharp drop in units.

At the same time, other members of the C-suite are pointing out that lenders, as an overall group, are underspending on technology.

Why do we say that? Since 2014, STRATMOR has used its Technology Insight® Study to survey lenders about how they use technology in the loan process. There is no doubt that lenders are implementing technology at a rapid pace, and each of these technologies is designed to provide better outcomes for a lender on one or more of the areas noted above, from profitability to risk prevention.

Technology investments have gone up over time, yet only five to ten percent of the total expenses at IMBs are on technology costs. That’s a very low number. When the industry is spending, say, $11,000 to produce a loan, only about $500 to $1,000 per loan is going to technology.

Chart 2

The industry is spending 60 percent of the total cost to close on people. That makes technology a relatively small lever to use to increase the overall profitability of the institution, at least in comparison.

STRATMOR utilizes a Total Cost of Ownership approach, usually over a five-year window, looking at increased revenues, lower cost, higher productivity, better pull-through rates, more repeat and referral business, as well as shorter cycle times which can allow for better secondary execution — and less time for things to go wrong, which is a meaningful benefit as well.

Now let’s look at non-financial measures of ROI.

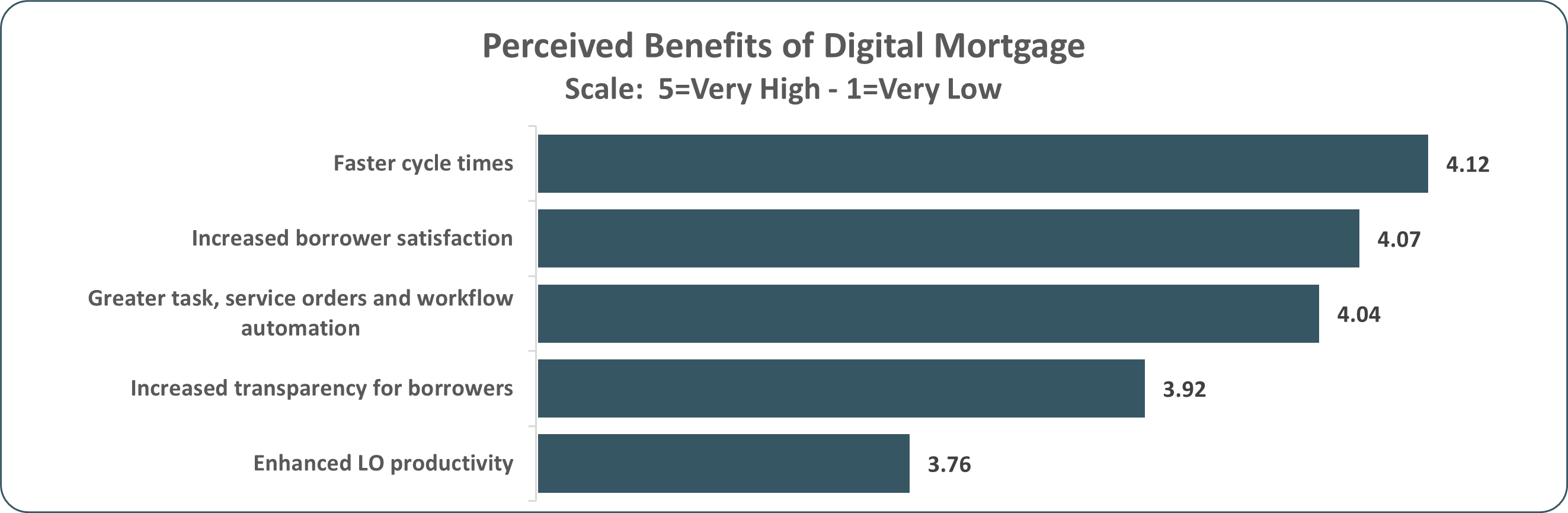

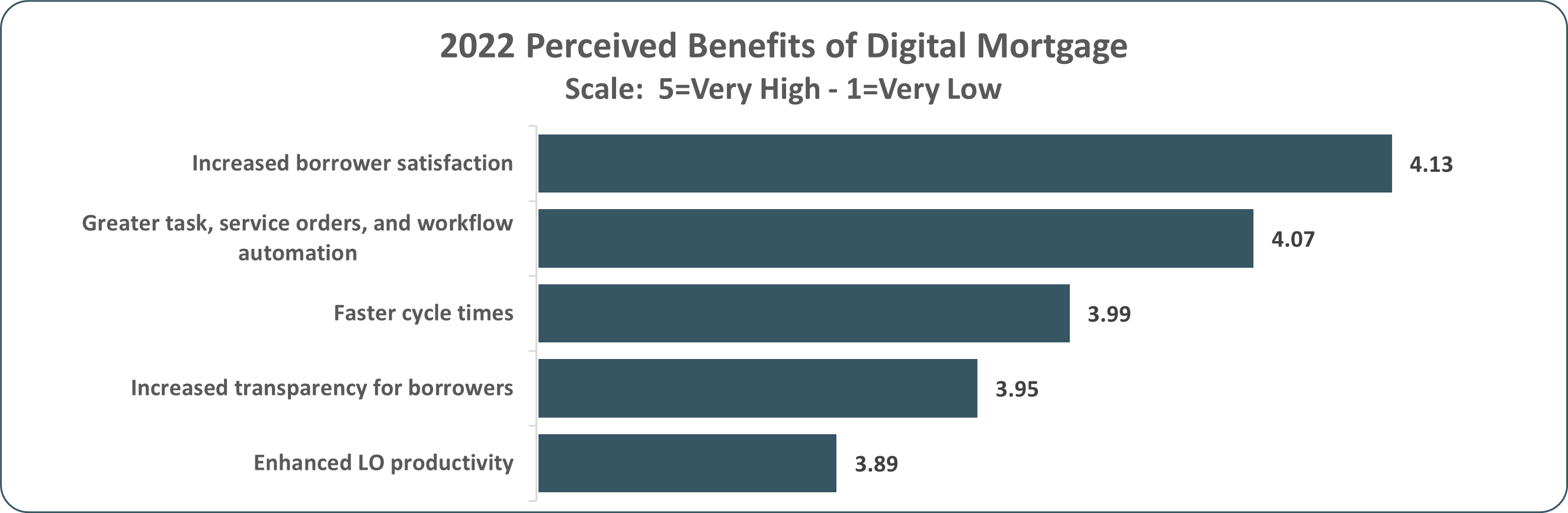

In STRATMOR’s 2022 Technology Insight® Study, lenders listed the benefits they expected to receive from digital lending technology. Faster cycle times dropped from first to third place between 2021 and 2022 and increasing borrower satisfaction moved up one place from second to first, which makes perfect sense in the new purchase-centric market.

Chart 3

Source: © 2021 STRATMOR Group, Technology Insight Study.

Source: © 2021 STRATMOR Group, Technology Insight Study. Chart 4

Source: © 2022 STRATMOR Group, Technology Insight Study.

Source: © 2022 STRATMOR Group, Technology Insight Study. In each of the factors, the metrics are measurable – but as we stated earlier, with many moving parts, other factors can impact the numbers. How much of any improvement the lender measures can be attributed to a particular technology, and how much of a lack of improvement could be blamed on a technology? The answers won’t be hiding in a spreadsheet, but on the lender’s front lines where the technology is being employed by the lender’s staff in service to its customers.

In an interview I gave to HousingWire magazine in the summer of 2022, I was asked what metrics lenders can use to measure the effectiveness of their fintech solutions, I explained it was as much about the questions they asked and their answers, as it was about the specific financial metrics.

I pointed to a series of questions lenders should ask about each technology they are evaluating or utilizing:

If you can answer these questions positively, you have found meaningful non-financial metrics for success and ROI.

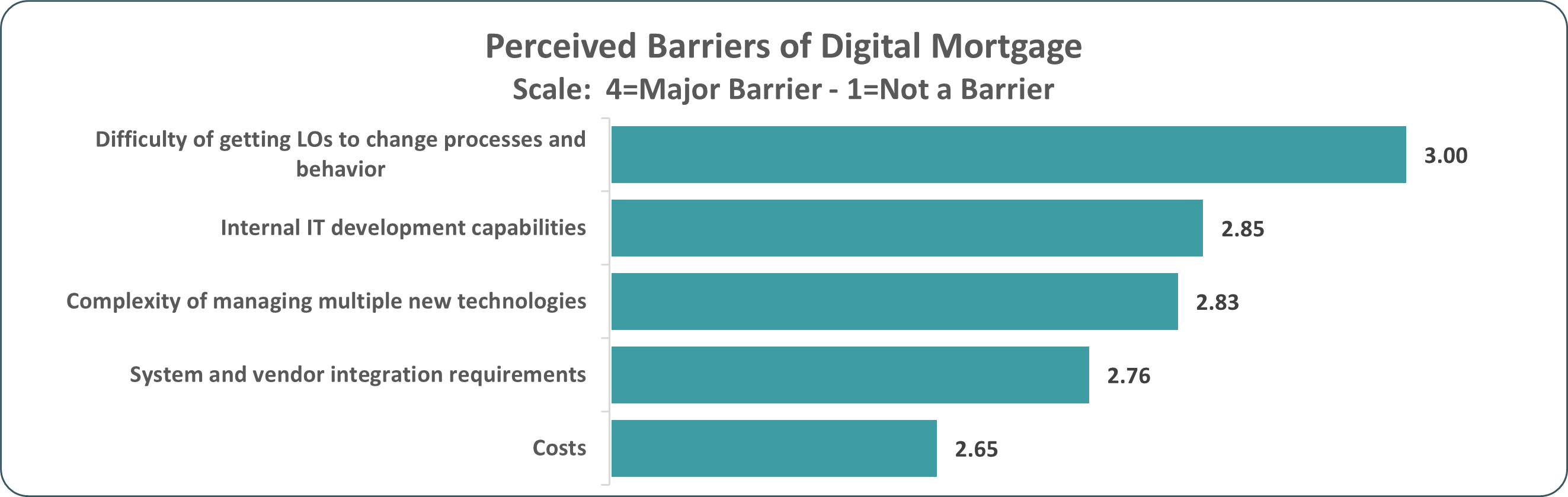

When STRATMOR asked lenders about the barriers standing between their businesses and digital lending in 2021, the number one challenge was getting people to change their process. Lenders are talking here about their internal teams, not their customers, who have had much less trouble adopting newer technologies.

Chart 5

Source: © 2021 STRATMOR Group, Technology Insight Study.

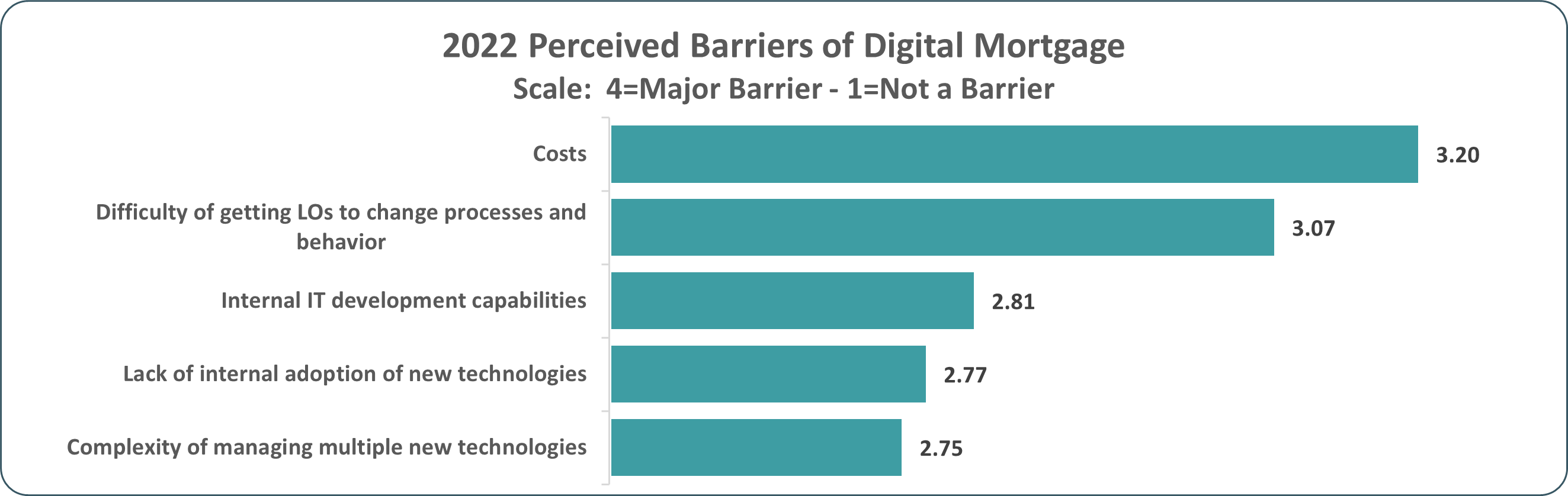

Source: © 2021 STRATMOR Group, Technology Insight Study. In 2021, lenders ranked costs in sixth place. By 2022, costs had moved to the top issue cited. This suggests that the previous year, when historically high loan volumes gave lenders plenty of money to invest, cost was not considered a significant barrier.

Chart 6

Source: © 2022 STRATMOR Group, Technology Insight Study.

Source: © 2022 STRATMOR Group, Technology Insight Study. Today, with profits falling, lenders are working hard to justify their investments. Losing an average of $624 on loans originated in the third quarter of 2022 — down from $5,535 in the same quarter of 2020 — has made it a priority.

While it’s not a shock that lenders are currently placing cost concerns as number one in their perceived barriers of digital mortgage adoption, cost is only an issue if value or ROI isn’t present. In surveying and talking with lending executives nationwide, STRATMOR continues to hear that adoption and change management are the most pressing issues in gaining that ROI.

And when lenders wonder why things didn’t go as planned after an initial buying decision, it is often in retrospect. Do not overlook this as you contemplate new technology, and if you need to consider an internal relaunch of a technology with a better change management strategy now that the market has slowed — do it.

Christy Soukhamneut, CMB, CMP and senior vice president of mortgage banking for Texas Capital Bank is working with a group of people on a report about mortgage technology for the Mortgage Bankers Association’s CMB Technology Committee. They too are looking at the ROI, and according to Soukhamneut, establishing a base ROI may be tough, but it is crucial.

“In order to determine ROI, you have to determine what you’re trying to change, the impact it will have, and how you will measure success,” says Soukhamneut. “Determining the variables and how they will be impacted is a must-do up-front exercise. There must be a clear picture of how you do things today and what costs exist, human capital or otherwise. Once implemented, diligence in tracking the same efforts must be made.

“ROI killers are not looking at your numbers up-front, not getting the right stakeholders involved, and not having a change management process,” says Soukhamneut. “As the process moves forward, employ the Kaizen method of continuous improvement — Define. Execute. Measure.”

The MBA report will be released in the first quarter of 2023.

While there is no industry-wide training regimen that can prepare a lender’s team to get the most out of any new platform, there is help.

First, lean on your vendor partner. No one wants to see you succeed more than they do. Be clear about your needs and enlist them for help and best practices, learning what has worked for other lenders that are like you.

Next, take internal responsibility. STRATMOR Principal Tom Finnegan also wrote about this in his Insights Report article, “Mortgage Psych 101 FOMO,” in which he says: “Don’t just buy the technology. Be the kind of company capable of working toward full adoption and implementing process change that will enable the best use of the technology. Follow through with the implementation for enough time to make sure that it is optimized and achieves the intended goals, and that adoption across the company is high.”

Written another way, “Don’t just buy the Peloton. Be the kind of person who is committed to their health and fitness.”

In my June 2022 Insights Report article “Light a Fire Under Your Digital Adoption Plans,” I listed a number of highly specific tactics that lenders have used to increase adoption of technology. Give it a good read, as it’s loaded with adoption tactics that you can implement immediately for existing tech or new investments being considered.

Internal change management and adoption are only part of the reason that the lender cannot abdicate responsibility for achieving a mortgage technology ROI to the vendor. Of course, there is much more involved in achieving success than ensuring adoption.

To unlock ROI, both lender and vendor must both take more responsibility for:

A true partnership between lender and technology provider is the key to unlocking ROI. Responsibility must be shared, and both the lender and the tech vendor must put in the effort to make the partnership a success. And much like that Peloton sitting over in the corner, the best time to get started is today. Woodard

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.