We finally did it. My fiancé and I excitedly talked about it, consulted with family and friends, set a date and made a plan. The big day finally arrived just a few short weeks ago and goodness! It was such a happy occasion, unforgettable and magical, everything we had hoped for and more. That’s right, we finally pulled the trigger on purchasing our new Ultra Deluxe Smoker Grill 9000.

Soon after we unboxed it, I found my fella staring intently at a chart on his phone, which I thought was describing gas prices, inflation or interest rates. He explained this was “the app” for said Ultra Deluxe Smoker Grill 9000.

“The APP? Good gravy. I guess I’ll never be able to just throw a burger on the grill again. This is too high tech.” He then reminded me of the number of times I’ve gone out to throw a burger on the grill in recent days (zero), and he offered me implementation and training on the app. Turns out, it’s not that hard, and wow! If you are a meat eater, there’s just nothing like it. I can definitely say our ROI is already off the charts, and we’re just getting started.

But before I go throw a burger on the grill, let’s talk about this issue of mortgage technology adoption.

I’ve talked to a lot of lenders and vendors as I’ve traversed the country, and it is hardly news to anyone that the market is changing, and challenging. We’ve experienced rapidly rising interest rates with a side helping of inventory challenges, resulting in a competitive purchase market. And we’re coming off the sugar rush of the refinance-heavy volume of the past two years. So, we’re experiencing a reality check as lenders continue to pivot to purchase and retrain their refinance “muscle memory” for a new way of doing things.

As lenders analyze their businesses to address the new reality, a big frustration point is the lack of adoption and engagement with the many technology purchases made over recent years. The frustration is understandable. Smart lenders have invested in smart tools, designed to allow their teams to operate more efficiently, drive more volume with less work, create excellent customer experiences, bring in repeat and referral business — the list goes on and on.

So, where’s the rub? (Grilling pun fully intended.)

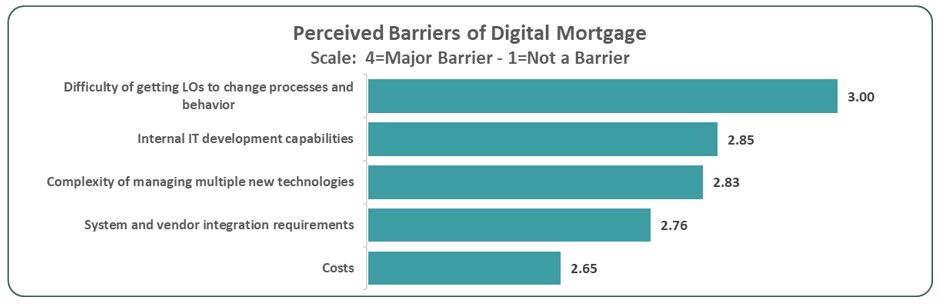

Technology adoption and engagement numbers are indeed low. According to STRATMOR Group’s most recent Technology Insight® Study on Digital Innovations, the reason most often stated as a barrier to adoption of digital mortgage technology is “Difficulty of getting LOs to change process and behavior.”

Chart 2

Source: © 2022 STRATMOR Group Technology Insight® Study 2021.

Source: © 2022 STRATMOR Group Technology Insight® Study 2021. One reason for the resistance may be the lending environment itself. Remember that your team has barely had time to floss their teeth over the past two years, so give them a bit of a grace period. They will need some time to make the adjustment and to lean into the tools, resources and solutions you have at the ready.

And don’t throw the baby out with the bathwater or eliminate solutions that don’t have heavy recent usage. Just because your people haven’t used them much over the past two years does not mean these solutions are useless. In fact, these solutions may be exactly what is needed to meet the current challenges.

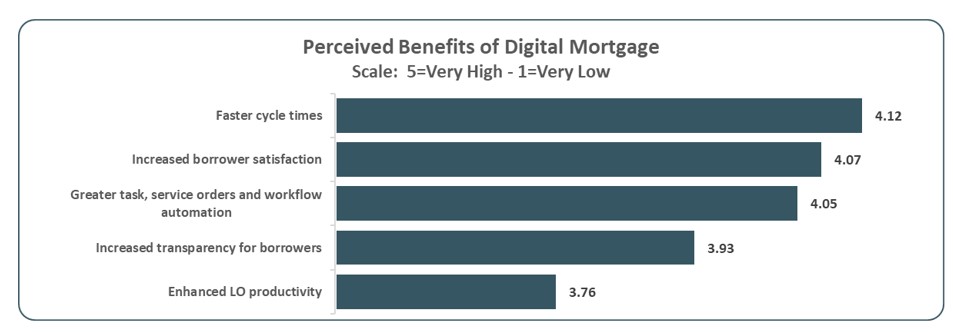

The Technology Insight® Study also indicated that the benefits of adopting digital mortgage technologies are certainly clear, with speed to closing and increased borrower satisfaction topping the list. Notably, enhanced LO productivity ranks highly overall.

Chart 3

Source: © 2022 STRATMOR Group Technology Insight® Study 2021.

Source: © 2022 STRATMOR Group Technology Insight® Study 2021. The time to focus on this issue of adoption is not only now, it is right now. It surely is no surprise to your team members — production and operations — that the market has changed, and their world has changed right along with it. Where you might have been met with resistance a year or even six months ago, you may be surprised to find an audience much more eager to adopt and adapt.

Admittedly, change isn’t easy for your team members or for you as a leader. Why?

First, the pace of digital change is ever-quickening. The pandemic accelerated digital transformation, with changes that would normally have taken years happening in months or even weeks. Recent research by IBM shows the pandemic sped up digital transformation by more than five years. It should be no surprise that your team may need help to catch up.

Furthermore, your production teams are often heavily commission-based, if not 100 percent commission-based. This can make adoption of new technologies and tools challenging, especially when you have a highly productive LO saying “thanks but no thanks” to being asked to change the way they are currently running their business.

Also, remember people are people, and human nature is at play. As much as we all want to be seen as an agent of change, an early adopter and a forward thinker, in real life, most humans just don’t operate that way. Change is hard, and we naturally resist it in favor of the most powerful force on earth — inertia. But we also know that all the good things we may have in our lives — relationships, children, health, financial success, comfortable homes, and in my case, delicious smoked brisket — all came from changes we made, some of which may have been uncomfortable at the time.

So, whether you are right in the middle of kicking off and rolling out a technology investment, or if (like many) you have a technology solution in place that just doesn’t have the adoption you want, here are six key insights from the STRATMOR Group team that can help you cook up a better experience for your team. I like to refer to these insights as the sizzling Six Technology Engagement and Adoption Keys (S.T.E.A.K.)

Plenty of money is being invested in technology, ranging from five percent to even 12 percent of overall company costs. Yet very often we find lenders are unclear on the “why” behind their investment, as well as the expected ROI.

As you make and implement technology decisions, or even contemplate decisions made in the past, your why must be crystal clear. “Because I said so” may work well for parenting up to a certain age, but it is a terrible strategy for change management. You must know and be able to communicate the reasons why adopting a piece of technology is so important to your team and the company overall.

Smart leaders learn how to make it all about the team by defining how the technology will improve their workload, increase their business and save them time, and by being very specific about what problems it may solve. Remember that the changing market may mean that the benefits and problems solved may be different than when you originally invested in the technology, or the benefit may be the same, but with increased importance.

Imagine a world where everyone has fully adopted the technology. Envision success, and then list out all the benefits gained, and pain points removed, making sure that these are not purely leadership or company level perspectives. Focus on how it will directly benefit the people who will be putting their hands on the keyboards to execute.

Your pain points might be scattered data, manual workflows, poor follow up on leads or siloed communication. Once you are clear on what the technology can help you do, write out a clear statement or specific bullets on what success looks like and why it is important for your team and company. If you are struggling with this, reach out to your vendor partner. They are invested in your success and may even highlight additional benefits that may have slipped past you in the past few busy years.

Be realistic about outcomes, success, and ROI. No technology out there is a magic bullet that will instantly make your company triple profits, eliminate all waste and ensure your employees and customers are uniformly happy, healthy, wise and good looking. Every successful company implementing technology is doing so with eyes wide open and realistic goals. This applies equally to hard fiscal numbers, customer experience metrics and employee feedback tracking. Make sure you have the right surveying structure in place to gather feedback and measure towards these goals — even better if you can get a before/after perspective supported by data. STRATMOR’s MortgageCX program can help with all of that.

You should certainly lean into your solution providers and vendors to help with best practices for implementation, adoption and ongoing engagement. They are pros, and they want your team to win, so ask how they can help you gain the outcomes and results you want to see from their solution. But it’s far more important to identify your internal stakeholders and participants. You must be ready and willing to invest in people and their time, and to focus leadership before, during, and after the technology purchase decision. The vendor cannot move the needle in your business without your participation and commitment. A few key components:

In his recent article on the fear of missing out, STRATMOR Group Principal Tom Finnegan noted, “The secret sauce for successful companies is very rarely (if ever) about finding the best possible technologies to employ and more often in the areas of organizational structure and planning, people and process (execution).”

Another topic lenders have mentioned frequently of late is integrations. During the wild ride of the past few years, many lenders acknowledge that they purchased or inherited technology solutions without enough of an eye towards how all the shiny pieces of technology would all work together. Ultimately, this resulted in some data silos or broken process flows.

STRATMOR Group Senior Partner Garth Graham shares wise words on this topic: “When considering adding a vendor, lenders should carefully consider whether the new vendor integrates well with the existing technology. If not, you should carefully think about whether you will get the level of adoption to make it worth it. Lenders also need to be very candid about their ability to support integrations. For example, we see clients who have implemented technology and assumed that they could leverage the vendor APIs to make it all work together. Some of these lenders are still waiting for their own staff to tackle these integrations.”

But hope is not lost. Solution providers have made remarkable progress on this front over the past few years, so it may just take a renewed focus internally to ensure the pieces of the integration puzzle are snapped into place.

Remember that adoption, and engagement, aren’t a one and done exercise. There’s a reason that working out needs to be done regularly to be effective for your good health; it’s a good consistent habit, not a box to check. Adoption and engagement work the same way. You aren’t done when implementation or training is finished, you are just getting started with helping your team develop new habits and strengthen new muscles.

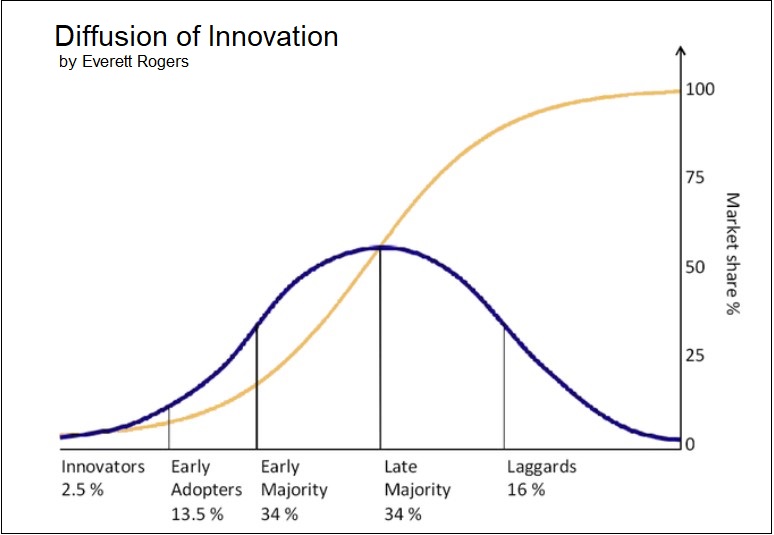

This familiar chart is called the “Diffusion of Innovation” by Everett Rogers, first published in 1962 and one of the oldest social science theories. It describes well how adoption of anything typically works, led by the innovators and early adopters, and finally those poor laggards come dragging in the rear. Side note: who would ever want to be described that way, a “laggard?” Not me, and likely not your LOs.

Chart 4

Source: Diffusion of Innovation, Fifth Edition, 2003. Everett Rogers.

Source: Diffusion of Innovation, Fifth Edition, 2003. Everett Rogers. While this primarily shows what happens when something new is implemented, it still holds true today for technologies that don’t have high levels of adoption or engagement … yet. And while the focus of this article is engagement and adoption rather than the implementation process itself, you can read exactly how a successful process-led implementation plan works in this article by STRATMOR Senior Partner Michael Grad.

Here are a few specific tactics I’ve seen lenders use successfully in driving adoption, even getting those laggards excited and ready to engage:

These days, influencers seem to play a role in everything from insurance to ice cream to iPhones. Why? Because it works, and we can and should use this to our benefit when it comes to technology adoption.

For each piece of technology you currently have or are contemplating acquiring, think about who your internal champion could be. In some cases, it may be an LO power user, or it may be someone else internally — a trainer, marketing team member or part of your IT crew. Recently, I’ve seen an upswing in both lenders and vendors investing in team members whose entire focus is to “evangelize” technology and make adoption and engagement not just a chore but engaging and fun.

Ideally, you will find champions who are admired by other employees to demonstrate and exemplify the real benefits of the technology. But don’t pressure them into volunteering — present the opportunity and let them decide for themselves. If your champion is in fact a power user LO, they often appreciate and respond to being recognized. They also tend to enjoy helping others within the company “see the light” relative to a tech they are using successfully, particularly if they also had to go through a learning curve or habit change to see results. Top producers generally don’t rest on their laurels but tend to seek out ways to continuously improve, including adopting new technologies, which is why they are successful.

Need an inspirational example? Look no further than Tiger Woods. Golf aficionados know that even when Tiger was at the top of his game, he thought he could do better and changed his swing not once, but multiple times. He did keep improving, and that’s why Tiger is … well, Tiger.

Source: Alamy.

Source: Alamy. Finally, it takes leadership. When the industry is turbulent, your team is looking to leaders to lead. It is a fundamental truth that it is somewhat easy to lead when times are good, with abundant business and continued tailwinds towards success. But now is the time when leadership is needed most.

Lead with strength and confidence, and once you have gathered input, communicated your plan, assembled your team and made an enterprise level decision — don’t be afraid to roll technology out with an “all in, all on” philosophy. You can always carve out those special LOs who may need special treatment. I have seen magic happen when leaders make these decisions and lead the way, rather than asking busy LOs to opt in and allowing inertia to rule the day.

Legendary STRATMOR Group Partner Emeritus Len Tichy says that “Accountability for performance at all levels, starting with executive responsibility for providing leadership, is critical. The inevitable priority conflicts that arise in large complex projects do not resolve themselves — it takes leadership to help people cope with change and guide them over the chasms of misunderstandings. One of the best concrete examples we’ve seen of senior line executive leadership in a successful project can be summed up in four words: ‘walk the talk weekly.’”

Use these insights to help you take action to engage, adopt, and practice exactly what you would like to see in your team. As for me, I’m off to fire up the Ultra Deluxe Smoker Grill 9000 with my cool new app … and see what I can burn for dinner. Woodard

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.