It seems like the wholesale channel — and thousands of mortgage brokers around the nation with it — has garnered the lion’s share of the press in recent years. But does this channel “have any traction?” Will it grow to dominate the industry, or fade away?

In many ways, it boils down to originators and their determination of where they can earn the most money and best serve their customers while considering their appetite for risk. See STRATMOR’s recent InFocus article, “Thinking About Wholesale? Considerations for Mortgage Originators and Lenders,” for a more detailed look at the relative economics of retail originators, retail branch managers and mortgage brokers.

Those in residential lending know that there are four basic channels from which to originate home loans:

To avoid double counting, I’ll focus on the first three channels, since the correspondent channel involves purchasing closed loans from lenders operating in the other channels.

A wholesale mortgage lender is an institution that funds mortgages and offers them to third parties, such as a bank, credit union, mortgage broker or independent mortgage company or professional. In wholesale lending, the borrower typically doesn’t have direct contact with the lender; instead, the borrower interacts with the third party, usually the broker, who is responsible for facilitating the loan origination and application process and communicating throughout the loan’s underwriting. A wholesale lender lets these third parties know what the loan options and terms are, and the third party then matches borrowers with an appropriate loan. Once the loans close, or fund, wholesale lenders typically sell them in the secondary mortgage market to free up capital to fund more mortgages as do retail, consumer direct or correspondent lenders.

But while wholesale lenders provide loans through third parties (brokers), retail and consumer direct lenders cut out the middleman and connect with borrowers directly. In addition, many retail lenders have arrangements with wholesalers to broker loans to them if the rate and price are better. When working with a retail lender (such as an independent mortgage banker (IMB), bank, or credit union), borrowers can usually pick from multiple home loan products which are underwritten, processed, funded, and then serviced in-house by the lender. In other words, borrowers interact directly with the company that provides their loan, and not a third-party broker. And if the program changes, usually the IMB or bank can continue processing the loan versus a broker who may have to change the wholesale lender.

Brokers are quick to point out the benefits of working with them versus a retail or consumer direct operation: Brokers:

In addition, wholesalers may have a lower cost structure, and those savings can be passed along to borrowers, and brokers can “do the legwork” in terms of finding them the best loan program. Wholesale mortgage lenders frequently partner with banks and credit unions to make their products available to consumers. But more commonly, they offer loans exclusively through mortgage brokers. Wholesale mortgage lenders may offer products with different rates and terms than what is available through retail lenders and have more options for borrowers with lower credit scores.

Proponents of the broker model suggest that using a mortgage broker can make sense if the borrower:

On the other side of the coin, critics of the broker model state that:

Retail lenders may have wholesale divisions that work with mortgage brokers while also maintaining offices and staff that take applications directly from consumers. They will say that the broker’s role is simply to connect borrowers and lenders, and little more. And a certain percentage of consumers want all their accounts (checking, savings, business loans, and mortgages) with the same company.

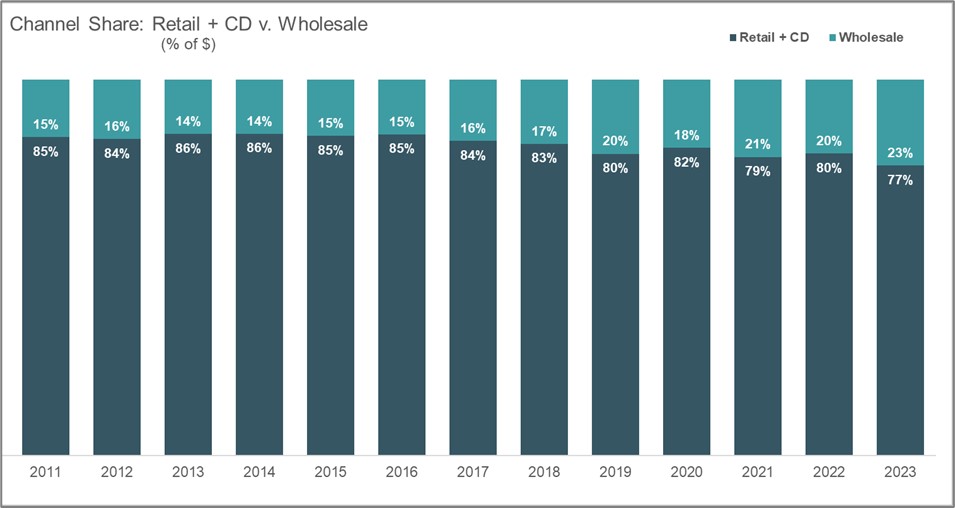

When we’re talking about a $1.5 to $2 trillion residential loan market, the stakes are high. In 2023, the wholesale channel accounted for 23% of direct first lien originations (excluding correspondent purchases of closed loans), up from 20% the prior year, according to a ranking and analysis by Inside Mortgage Finance. Wholesale channel share percentages are shown below.

Source: Inside Mortgage Finance, First-Lien Mortgage Originations by Production

While wholesale averaged about 20% from 2019-2022, it did increase by three percentage points in 2023. It is hard to say what drove that increase, but it likely included the success of the larger players such as United Wholesale Mortgage in gaining share by offering competitive prices, products, technology, and marketing support.

While there are literally thousands of retail lenders, the number of sizeable wholesalers is much smaller. Several, such as loanDepot, Caliber, Finance of America, Homepoint, and Fairway, have changed their business model or product mix, exited the business in recent months, or were acquired. Companies come and go all the time from the various origination channels. Wells Fargo left wholesale in 2012 and it was a year ago that they exited correspondent as well. Chase exited wholesale in 2009, citing compliance and regulatory burdens, along with their business goals. Guaranteed Rate closed Stearns two years ago, and Citizens Bank exited wholesale.

The current wholesale lender group includes, in no particular order, United Wholesale Mortgage, Rocket, Orion, American Financial Resources (AFR), Kind Lending, Newrez, Pennymac, Freedom, Plaza, JMAC, Paramount Residential Mortgage Group, Angel Oak, Homebridge, LoanStream, Emporium, NewFi, Click n’ Close, Deephaven, Quontic, Oaktree, Carrington, Visio, Flagstar, American Financial Network, BluePoint, Acra Lending, Canopy, CMG, Change, and A&D. (Lenders looking for wholesalers offering a specific program in a specific state are encouraged to visit ).

The wholesale channel is not immune to the business cycle. For example, United Wholesale Mortgage (UWM) lost $461 million in net income in the fourth quarter of 2023 and a loss of $69.8 million for the full year. The company attributed the loss to the decline in the value of mortgage servicing rights and has been strategically selling servicing rights. In 2022, the company had a net income of $931.9 million.

UWM Chairman and CEO Mat Ishbia said, “Our recipe for success has not and will not change and we are currently doubling down on investing in our people, our products and our technology so that we can continue to provide the broker channel with the tools needed to win. I believe that 2024 is a tremendous opportunity for both UWM and the broker channel.”

The ultimate goal of the industry is to help consumers finance homes. How that is done will ebb and flow, and be dependent on margins, volumes, legal and compliance risk, and the long-term objectives of the company. There is no one “right way” for a borrower to finance their home, and it is always in the best interest of the borrower to receive referrals from their family and friends, logically compare programs, look at costs, and make a decision. Whether this is done with the help of a mortgage broker, a retail loan officer, or the internet will continue to shift over time.

Lenders, if you need help in developing your mortgage banking strategy, including channel selection and focus, STRATMOR can help. STRATMOR consultants have deep experience in mortgage banking and leverage real-world data derived from proprietary data products and programs. Contact STRATMOR for more information.

Would you like to speak to STRATMOR about our services? Contact us today!

Let us light up your strategy discussions.