Editor’s Note: As many of our readers know, STRATMOR’s team has some of the most respected and experienced mortgage banking professionals in the industry. Many lenders have benefited from working with us on origination strategies. To meet the needs in our current lending environment, we have expanded our expertise to include MSR asset and liquidity strategies.

And, in keeping with our mantra to recruit the best of the best, enter our new Principal Seth Sprague, CMB, an industry veteran who has spent the bulk of his career focused on the servicing asset, servicing valuation, bulk and flow sale strategies.

With the addition of Seth, STRATMOR is now able to advise our clients about:

Until recently, mortgage servicing operations have played a secondary role to sales and production operations in the organizational hierarchy of most mortgage lenders. At STRATMOR, we’re excited to see the industry’s focus shifting. More lenders now appreciate how a superior servicing operation — one that maintains a strong borrower relationship and delivers high borrower satisfaction — can enable lenders to increase customer retention, even if increased borrower satisfaction results in higher servicing costs.

In the following In-Focus article, Seth addresses top-of-mind concerns for mortgage bankers in today’s evolving Servicing environment.

“Seth, given the current industry environment, would you recommend a lender retain more or less servicing?”

I’ve heard this question many times in the last year, not only from the people taking part in the Servicing classes I teach for the MBA School of Mortgage Banking, but also from someone in the audience at every presentation I’ve given.

While we all wonder when originations margins will improve (hopefully through the summer months this year), the question of what to do — retain more, or less, servicing — is top of mind for many lenders. Banks and Independents alike are looking for the best way to maintain profitability in the current environment. So, what’s a lender to do?

In this current lending environment, having a clearly defined servicing strategy is imperative. The ultimate decision to retain servicing and, therefore, create the mortgage servicing right (MSR) asset should be driven by the lender’s overall mortgage strategy. This strategy should include both a comprehensive review of originations and servicing and incorporate an understanding of the risk and rewards of servicing. These key decision points must be continually tested, evaluated, challenged and supported by current data and analyses.

For Banks, the decision about whether to retain more, or less, servicing focuses initially around the capital required to retain servicing. For Independents, the decision is around the cash. If the respective capital and cash hurdles are cleared, then lenders need to balance the benefits of servicing against the risks while also considering servicing’s fit within their overall mortgage strategy.

Banks are the traditional investors in servicing and they face numerous challenges around the MSR capital requirements. While the ability to generate fee income, earn float on escrow deposits and retain potential customers for cross-sell and retention purposes are the major benefits of a servicing-retained strategy, these positive elements must be evaluated in terms of the (MSR) capital rules of today. Currently, there is a great deal of uncertainty around capital rules as final BASEL III rules are still not implemented and the industry continues to propose alternative solutions while we wait. There’s more on the mortgage policy discussion later in this article.

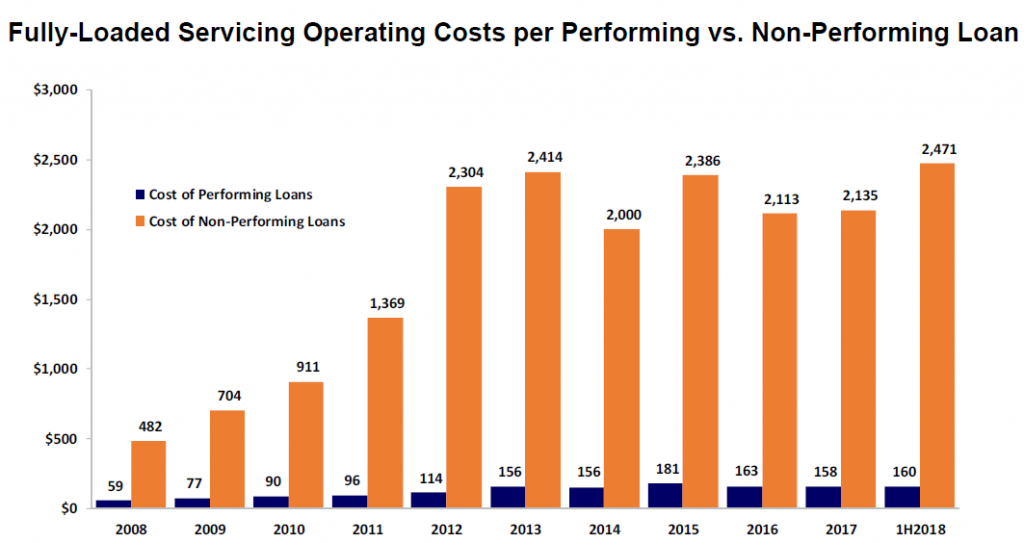

For Banks that own servicing operations, the challenge of maintaining servicing efficiencies can be a struggle. Banks are largely beyond the negative financial and operational impacts of the servicing created pre-2008 financial crisis, but they are still faced with elevated servicing costs from pre-crisis levels. The ability to maintain servicing scale and efficiencies while controlling the long-term servicing costs presents an additional risk in the current origination environment. As shown in Chart 1, in recent years and post-recession, non-performing loan servicing costs are at an all-time high. Combined with tighter origination margins, these costs can compromise a bank’s ability to meet its capital requirements.

Source: SOSF: MBA Servicing Operations Study and Forum, PGR 1H2018.

Source: SOSF: MBA Servicing Operations Study and Forum, PGR 1H2018.

Retaining servicing and giving up the cash in today’s origination environment of lower margins and volumes presents the largest obstacle to invest in servicing for Independents. As noted previously, Independents must evaluate their ability to retain servicing first and foremost in terms of their cash position, and maintaining liquidity is critical. While retaining servicing represents a cash deferral, it does allow the non-bank to retain the customer and hopefully enjoy the annuity stream of fee income created by servicing. Further, MSR financing is increasingly available for Independents to help retain servicing and provide additional liquidity. MSR financing costs have increased as rates have risen, applying more pressure on the cash position. Supply and demand of MSRs, along with the overall level of interest rates and expected prepayment speeds, will be the primary drivers of the prices paid in the MSR market. If the price of servicing declines, retention (or acquisition of servicing rights) becomes more attractive to servicers whose costs are lower and customer retention is higher.

It should also be noted that marginal production costs are a major consideration in developing a retain vs. sell servicing strategy. Average direct retail production costs, excluding corporate costs, run about $8,000 per loan. A lender that can originate a loan at $6,000 per loan retail — and according to PGR: MBA and STRATMOR Roundtables data one of six retail lenders do — can retain much more servicing without incurring cash flow problems than a lender that has retail costs of $8,000 or more.

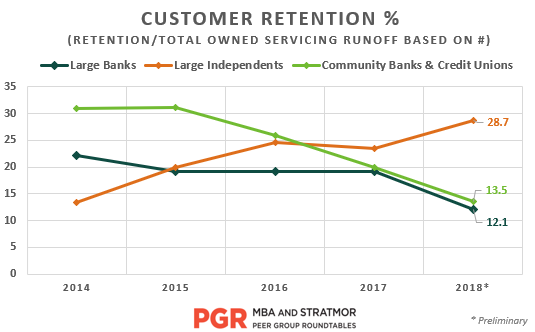

Chart 2 shows PGR: MBA and STRATMOR Roundtables Program findings from 2014 to preliminary 2018 data of retention percentages and total owned servicing runoff for large banks, independents, and community banks and credit unions. Traditionally retention is more successful on Ginnie Maes, and with Independents generally having a larger concentration of Ginnie Maes, retention efforts are more successful.

There are tax benefits to retaining servicing. At a minimum, retaining servicing represents an efficient tax deferral vehicle, and depending on the timeframe the MSRs are held before a sale occurs, possibly a lower tax rate when the MSRs are sold in the future. There are drawbacks for Independents, too. Those that service in-house often face a more significant servicing scale/cost challenge than Banks, mostly because of their greater concentration of Ginnie Mae servicing. Also, Independents that utilize a sub-servicer must have a clear understanding of the pros and cons of the servicing relationship as it impacts retention and customer service.

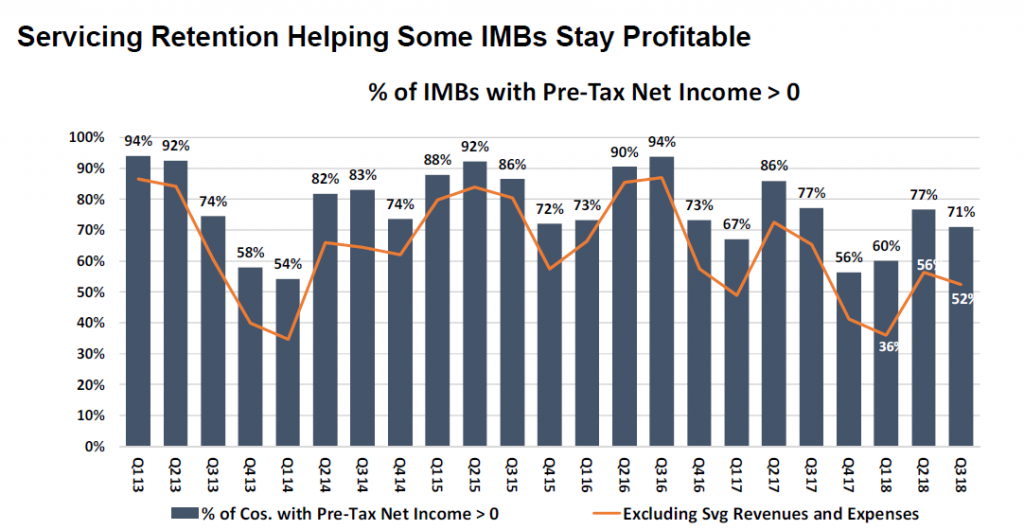

Source: Source: MBA Quarterly Mortgage Bankers Performance Report.

Source: Source: MBA Quarterly Mortgage Bankers Performance Report.Whether Bank or Independent, all lenders must understand the potential risks of servicing. Management must actively engage in understanding the servicing cash flows, the best practices around accounting and valuation, and MSR market conditions. Traditionally, the largest risk with a servicing portfolio involved voluntary prepayments negatively impacting the servicing cash flows. While the prepayment assumption remains critical, understanding the actual cash flows are paramount today. While servicers currently may not be in an actual cash advance position on their servicing portfolios because of “paid in full” status masking advances, if prepayment speeds continue to slow, servicers will find themselves in an actual cash advance position. Understanding the difference between the cash position of servicing revenues — less expenses less advances — is a metric that must be monitored and understood.

The accounting rules related to the MSR asset can create confusion as it represents large number of cash and non-cash elements that may seem to some like voodoo accounting. The accounting rules dictate that the MSR asset must be initially recorded at fair value. Prospectively MSRs can be accounted for under either the fair value or lower of cost of market (LOCOM). Fair value prospective accounting means the income statement is immediately impacted by MSR value changes and often causes fair value companies to use or consider using financial hedges to mitigate the income statement impact. Prospective LOCOM accounting tends to be less volatile, however if the financial statements value of the MSR is not reflective of fair value in periods of large rate declines, impairment occurs. The cash and non-cash elements of servicing manifest themselves in several areas across the balance sheet and income statement and can create confusion and angst for CEOs.

Understanding the potential risks of the MSR valuation process and its impact on the financial statements requires active monitoring by management. Banks are more likely than Independents to use financial instruments to hedge their MSR asset against changes in interest rates. Best practices in the valuation process often include obtaining more than one independent valuation, along with using a suite of scenarios to help quantify the potential MSR value change by shocking the portfolio based on different valuation assumptions.

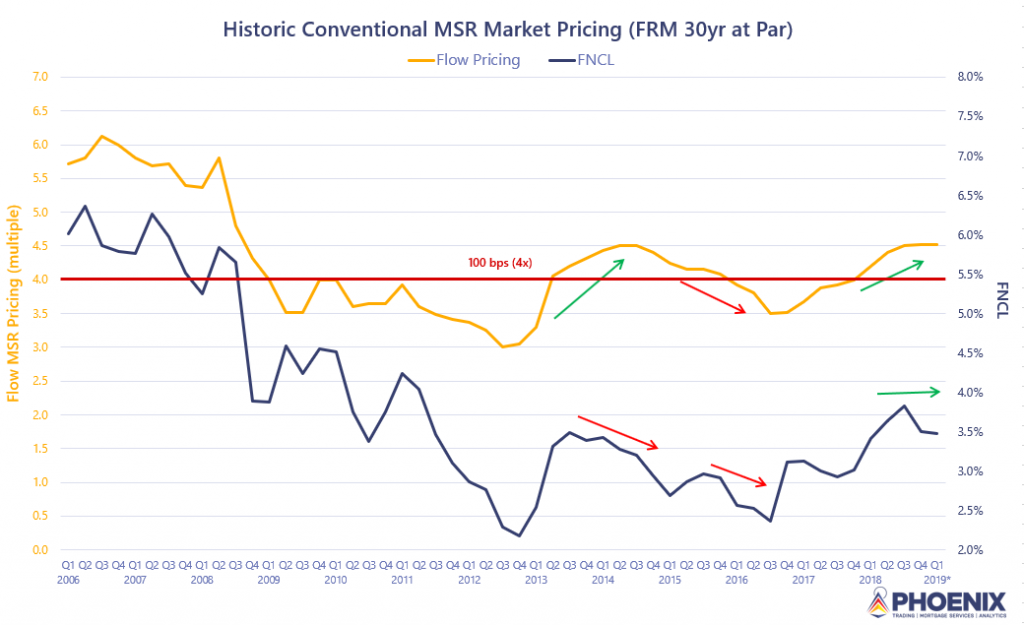

The MSR market is made up of two segments, the co-issue (for Ginnie Mae’s PIIT) and the bulk market. A record number of transactions occurred in 2018. The co-issue MSR market provides originators with the ability to maintain a relationship with the Agencies by selling loans directly to the Agencies, but not investing in the servicing asset. In a co-issue transaction, the servicing asset is immediately sold for cash to an MSR buyer and therefore taxes are paid. Unlike bulk transactions, co-issue transactions involve selling future production and the pricing is based upon a complex grid that contains numerous buyer specific adjustments. Some larger co-issue sellers deliver servicing to multiple buyers. Chart 4 from PHOENIX shows the historic pricing for Fannie/Freddie 30-year-fixed par rate servicing and assumes a national geographic distribution.

According to Stephen Fleming, EVP of Trading at PHOENIX: “In the context of the continued rate trends we’ve seen sustained in 2019 thus far, the co-issue/PIIT market remains vibrant and active. The PHOENIX MSR desk currently manages ~$3B to $4B+ in co-issue transactions each month, and we anticipate that volume to increase throughout 2019 as originators are interested in maintaining their direct Agency relationships while also monetizing the servicing asset.”

The decision to retain servicing does not preclude a future MSR sale. The MSR bulk market provides servicers with a potential source of liquidity to sell servicing via a bulk trade. The overall level of interest rates, origination environment and supply and demand greatly impact the MSR market. While 2018 represented the most active year of MSR transactions since the financial crisis, historically the buy side demand for MSRs has ebbed and flowed. Generally, however, when mortgage rates decline, and prepayments are expected to increase, the MSR market becomes less active. Technology improvements with the third-party providers of risk management (pipeline advisors) along with technology driven solutions from Fannie Mae and Freddie Mac will continue to provide new vehicles for liquidity for originators to explore and utilize.

At the heart of the question of retaining more, or less, servicing is the lender’s relationship with the borrower. Servicers are a bit behind the rest of the industry in terms of embracing a “customer first” approach to retain borrowers. Data from the PGR: MBA and STRATMOR Peer Group Roundtable Program shows a combined retention rate for Banks and Independents at 17 percent.

Higher retention rates effectively extend the life of a servicing asset and increase the its servicing cash flows. When a lender has exceptional retention, it can price more aggressively (considering economic value), however from a fair value perspective, cash flows from retention are typically not allowed in the MSR capitalization. From STRATMOR’s perspective, the primary goal of successful servicers should be retention. Some ways to ensure retention include surveying borrowers whose loans are being serviced to identify the gaps in your processes and correct them. These gaps include poor communication, errors in billing, billing methods (paper or paperless), escrow expectations, and, circling back to communication, not proactively reaching out to the borrower when issues are identified. STRATMOR’s MortgageSAT Servicing Survey enables lenders to quickly identify such gaps and make changes to promote healthy, long-term relationships with their borrowers. See this month’s Borrowers Experience article, “Retain Your Servicing Customers and Gain Their Referrals” for additional insights.

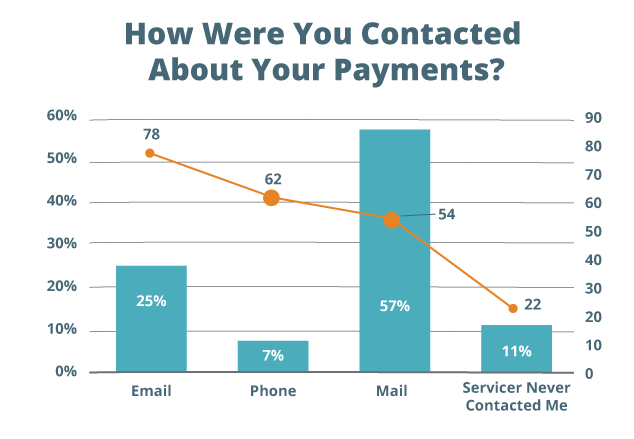

Additionally, regular communication with the borrower to discuss their current mortgage, interest rate activity, and the borrower’s plans to remain in the home ensure early identification of possible relocation or refinance opportunities for the lender’s origination team. Again, good communication is the “make or break” difference in a successful servicing retention strategy. As shown in Chart 5, borrower satisfaction drops dramatically when the borrower is never contacted about their payment status.

Source:MortgageSAT Borrower Satisfaction Program, 2019.

Source:MortgageSAT Borrower Satisfaction Program, 2019.As the industry approaches the Mortgage Bankers Association’s National Advocacy Conference in early April, it is imperative to recognize that changes in mortgage policy can have a material impact on both the ongoing origination and servicing business lines.

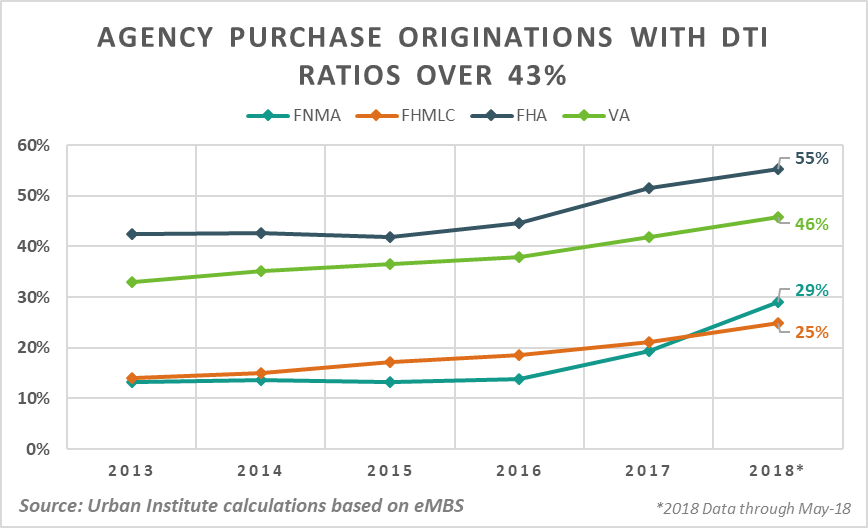

On the origination side, the incoming director of the FHFA (Mark Calabria) could limit the scope of Fannie Mae and Freddie Mac eligible products, and once installed as director, the White House is likely to release a more formal GSE reform plan. While there are no certainties around potential eligibility changes, part of the discussion has been about cash out refinances, second homes and investment properties. Changes in the product suite of eligible Fannie and Freddie loans could potentially impact future volumes, so understanding how these potential changes impact the origination channels and product mix is required. While longer term GSE reform is unlikely to occur in the 2019 Congress, the uncertainty remains as to their long-term future and structure. In addition to potential GSE reform, the current GSE QM patch will expire when the GSEs exit FHFA conservatorship or January 10, 2021, whichever is earlier. The expiration of the GSE QM patch would have a material impact on reducing the portfolio of GSE eligible products and materially impact the origination business, as a greater share of the GSE purchases have DTIs over 43 percent.

As I mentioned earlier, the servicing industry continues to wait for the regulators to deliver on potential MSR BASEL III capital rule changes. Various ideas and proposals have been presented, but no real progress has been made over the past six months. While the MBA continues its efforts to obtain relief for the BASEL III MSR capital rules, without a final and clear capital rule, Banks continue to be impacted by the lack of clarity around capital. The next round of onsite meetings with regulators is scheduled for early April.

Numerous articles have been published over the past year related to the concentration of servicing at Independents and focusing on risks. The MBA has recently released a white paper highlighting the importance of Independent originators and servicers to the mortgage market environment. Ginnie Mae has also published recent All Participants Memoranda (APM) highlighting its desire to scrutinize issuers further and potentially roll out liquidity testing requirements in 2019. In early March, Ginnie Mae issued an APM stating it is now requiring that its servicers maintain at least a weighted average servicing spread (servicing fee strip of interest) of 25 bps on their retained Ginnie Mae servicing portfolios.

For both Banks and Independents, the question of whether to retain more, or less, servicing in the current mortgage environment really depends on capital/cash, accounting, risks and mortgage policy. It’s not an easy road to navigate, and it requires having data driven solutions to understand the current and potential impacts on your originations and servicing.

STRATMOR believes that it is critical for lenders to position their companies to thrive. To do this, it is imperative to have a sound, long-term strategy that includes both an origination and servicing game plan. Lenders who already have servicing as part of their strategic objectives should conduct an efficiency review to ensure they are optimizing outcomes from their servicing portfolio.

If your plan is to invest in servicing rights (MSRs), the right strategic and tactical positioning will help to optimize your transactions. Being superior in servicing efficiencies, and customer retention and having a thorough understanding of the cash flows can create a competitive advantage. And, as cash is king for Independents and capital is king for Banks, make sure you have the right liquidity strategy in place to optimize your cash or capital position. STRATMOR Group is now positioned to advise our lenders in each of these areas. If you would like to discuss this article or your overall mortgage strategy, give us a call today.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.