2020 was a very busy year for those of us tasked with advising mortgage lenders and loan servicers on their servicing retention strategy. By the looks of things, 2021 will be even more busy, but with new and different challenges. If you started to retain servicing last year or increased the percentage retained because it seemed like the right financial decision, today you’re surely looking at retaining servicing and asking yourself, “Does it still make sense to do this?” In this article I’ll ask the questions and offer insight into the issues that servicers should consider in setting a servicing strategy for 2021 and beyond.

Naturally, many originators who had the ability to retain servicing in 2020 did so because, at the time, it looked like best execution. It wasn’t until the end of the year, or in the first quarter of 2021, that a few learned it might have been cheaper and easier to pay someone to take the loans when they were originated in the instances where elevated levels of delinquencies or forbearance occurred.

It is critical that originators understand the quality of the loans that are going into their servicing portfolio. Loading up a servicing portfolio with 620 FICO and below, 97% LTV, or FHA servicing that may be 10-15% in forbearance by the end of the year may not turn out to be a successful long-term strategy.

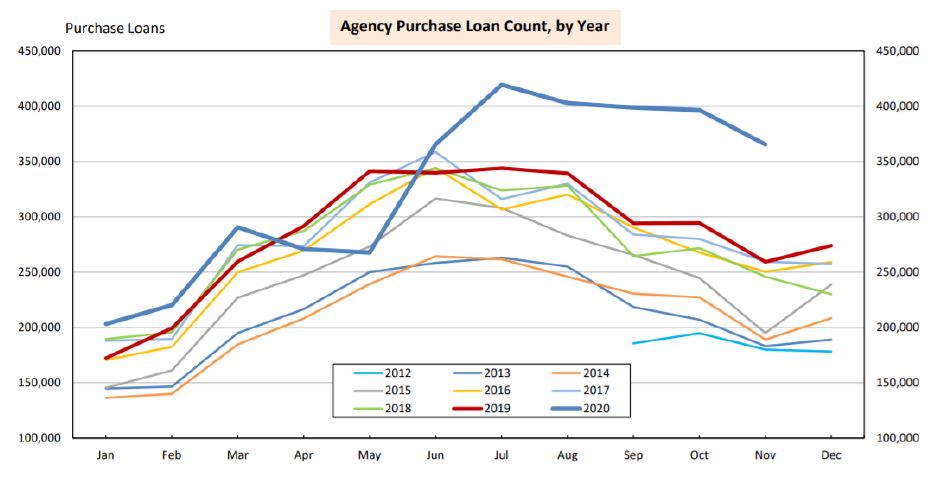

Chart 1

Source: AEI Housing Center www.AEI.org/housing.

Source: AEI Housing Center www.AEI.org/housing.But it’s easy to see why some lenders loaded up on servicing. When the pandemic broke and aggregators shut down / restricted purchases and the MSR market collapsed, originators with the ability to deliver to the agencies did exactly that, often holding onto the servicing rights and typically engaging with a sub-servicer to perform the majority of the servicing operations.

As a result, companies that began to retain servicing or those that incrementally increased their servicing retention in 2020 are now faced with at least four areas of on-going incremental risk.

1. The future risk of repurchase / indemnification from the GSEs

Fannie Mae and Freddie Mac are experienced investors. They have their delivery requirements that are mainly data requirements and ensure that every loan they purchase checks all the boxes before they buy it. But the timing of their due diligence and feedback on compliance doesn’t really match that of the immediate feedback found in the aggregator model.

Aggregators will do a detailed analysis of each loan they buy, putting each deal through strict quality control. STRATMOR data indicates that somewhere between 20 and 30% of the loans offered to an aggregator are not immediately purchased due to ”issues” or areas that need further clarification. The “pended” loans are eventually sold after the items identified are cleared.

Now, imagine that those loans were purchased instead by the GSEs during the COVID crisis. What does that suggest about the repurchase / indemnification risk these lenders face when the GSEs find out that up to 20 to 30% of the loans didn’t make the grade of aggregators?

2. Market Liquidity Risk

Lenders that retained servicing in the hopes of selling it in the MSR market at a later date may learn a difficult lesson. The value ascribed by an independent valuation firm in terms of fair market value and the cash received from an actual bulk sale may be materially different. Differences can arise for a myriad of reasons and the actual execution of the sale may take more effort than initially thought. More importantly, not all servicing may have a buyer, and certain products could be excluded from a sale.

While mortgage capital markets areas are designed to obtain the best execution, best execution in the long run could be different.

Last year, many originators retained more servicing than they ever have in the past. Did they understand the short-term and long-term cash flow impacts? On the cash flow side, originators were flush with cash from exceptional gain on sale margins. What was the longer-term strategy to handle advances and ensure the servicing retained would be liquid for a future bulk sale? Word on the street is that auditors and accounting firms are dealing with many companies that have MSR assets on their balance sheets for the first time. Holders of servicing are learning that simply obtaining an independent valuation and recording the MSR value on their financials is not adequate.

Additionally, the incredibly long refinance wave we’ve had has made it difficult for servicers to keep borrowers in their portfolios long enough to earn an appreciable return. The cost of continual churn results in higher servicing costs. But with rates up above 3% and projected to go higher, long-term portfolio runoff is lessening somewhat as a concern.

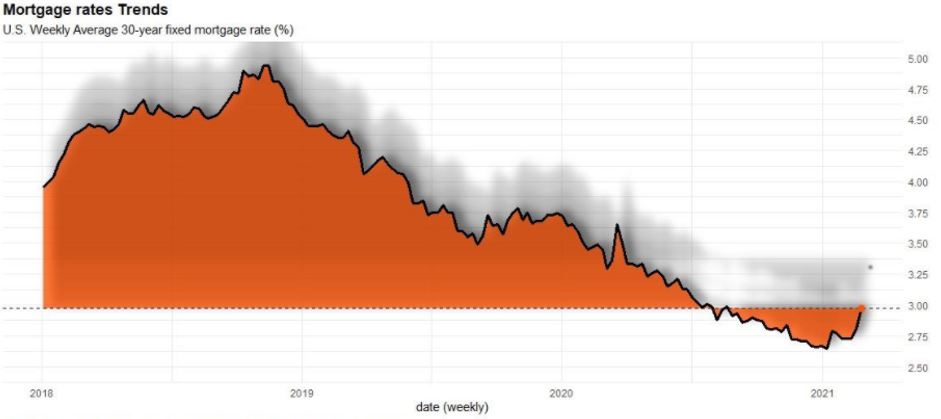

Chart 2

Source: Leonard Kiefer. Freddie Mac Primary Mortgage Market Survey through February 25, 2021. Dotted line at latest value.

Source: Leonard Kiefer. Freddie Mac Primary Mortgage Market Survey through February 25, 2021. Dotted line at latest value.But even if it takes a while for the last of the “fence sitting” refi transactions to close, there is a very good reason that portfolio churn and prepayment speeds will slow during the second half of 2021. It appears that the prepayment experienced in March of 2021 will be the high-water mark for 2020 and 2021.

In a normal marketplace, companies with higher prepayment speeds would receive poorer execution in the bond market. Bond investors have a wealth of data available to them to compare prepayment speeds across issuers. While the bond market may not be fully pricing these issuer prepayment speeds, potential MSR buyers most certainly would include issuer specific speeds into their MSR bids and impact execution.

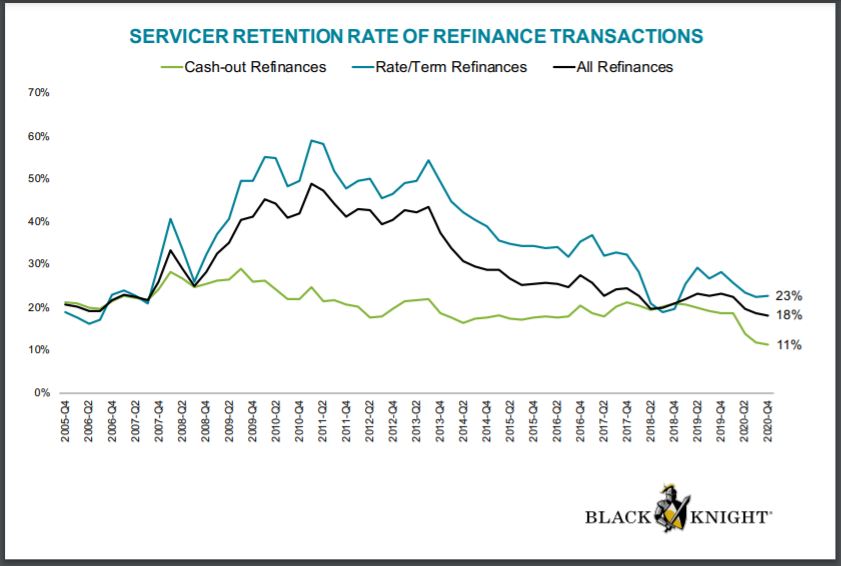

Chart 3

With the Fed being the primary buyer of Fannie and Freddie Mortgage-Backed Securities, all issuers are generally receiving the same execution. As the Fed backs away from buying true MBS, investors will return to the market. When this happens, interest rates could rise and more issuer specific bond execution will likely return.

3. Portfolio Retention

This may seem like a tall order as there is plenty of data in the market that shows that our industry is generally sub-optimal at recapturing borrowers in portfolio. The latest data from Black Knight suggests that the overall portfolio retention is around 18%. But we’re beginning to see some companies that are getting it right, and while the average is in the high teens, there are some companies that are two to three times the industry average. Still, others are well below 50% of the industry average.

Chart 4

Source: Black Knight January 2021 Mortgage Monitor.

Source: Black Knight January 2021 Mortgage Monitor.In Consumer Direct channels, better data analytics and more active borrower communication channels are changing the way mortgage borrowers see their servicers, albeit slowly. Servicers that get very good at recapturing borrowers who prepay from their portfolios will be far more successful in the days ahead. Data is King!

Some shops that have both origination and servicing teams will handle this internally. Others will form partnerships with other originators or sub-servicers that have loan origination capabilities.

Either way, prepayment speeds, looking forward, should slow and despite more data, companies need to be nimble to manage their portfolio retention and consumer direct channels. It is imperative that an investor in MSRs understand the potential value of having an active portfolio defense strategy.

4. Is Servicing Enough of an Offset to Declining Origination Margins?

Meanwhile, all servicers must review and evaluate the actual cash return on servicing and the projected cash return in future years. What is the cash give up today to retain versus the potential servicing income? What cash is the current MSR portfolio generating? Servicing is traditionally a narrow margin business and any improvement in financial performance is often tied to higher loan balances. The incremental revenue of the higher service fee income has been offset by the elevated decay as a result of higher prepayments. Additionally, many IMBs do not apply financial hedges to their MSR portfolios, which resulted in poor overall performance as rates fell in 2020.

The management of servicing costs remains a constant pain point. Servicing costs are elevated and will remain above average until the forbearance loans are worked out. The churning journey is expensive: boarding new loans, releasing them, and then putting them back. Loss mitigation efforts related to the end of forbearance are going to be expensive. Paying for the staff you added last year, or the subsequent incremental sub-servicer fees, are a cash drain. Compliance expenses, in general, are likely to continue to remain elevated.

Servicers must understand the true cash return on servicing and evaluate the cash implications of servicing in terms of offsetting the anticipated decline in origination income. Having a properly modeled, calibrated, and continually tested and verified view of the actual MSR cash return is critical to understand whether the best execution decision results in an adequate cash return.

When COVID struck, many government officials, to their credit, rushed forward to help. In the process, they unleashed a wave of unintended consequences. Such is the nature of government savior efforts.

When the government pushed the CARES Act through, many worried that 50% of all borrowers would go into forbearance, creating a crisis 500% worse than the Great Recession. Our own STRATMOR simulations predicted that if a servicer reached 25% forbearance rate in their portfolio, they would run out of cash and fail. If we had reached these levels, many thought we were looking at the end of the mortgage industry.

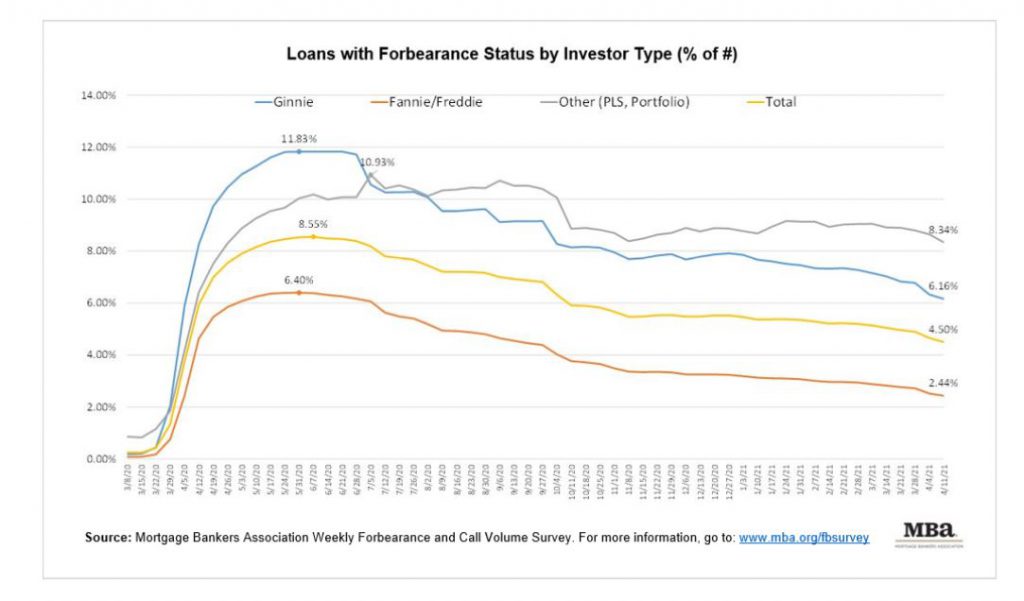

The Mortgage Bankers Association started the Weekly Forbearance and Call Volume Survey at the start of the pandemic. The most recent data shows that approximately 4.5% of the mortgages today are still in forbearance.

Chart 5

The problem is that there are homeowners who have been in forbearance for 12 months or longer. These borrowers that tend to be in the extended forbearance plans who are more likely FHA borrowers and may be more challenged to become current. What does their outcome look like? Probably not very good despite the efforts made by the FHFA and HUD to offer a wide range of loss mitigation options.

Any minute now their servicer is going to send back their annual escrow analysis. This report, showing how close their escrow payments came to paying off their taxes and insurance, is going to show that, by making no payments over the past 12 months, their mortgage payment will have to increase to make up the difference. Servicers may not obtain their advance back for several years; this was less of an issue during a period or record origination volumes and gain on sales.

But now, these borrowers are being asked to pay more to cover escrows when many still aren’t working and can’t afford to pay their other bills. What’s that narrative look like in Washington, D.C.? How can servicers tell that story when they are called in to testify before Congress? If the government says borrowers don’t have to pay these taxes, what will the bondholders say, and where would mortgage rates go? (The answer is mortgage rates would sky-rocket if the mortgage bond holders require a higher yield to cover the risks.)

The new rules allow servicers to extend the forbearance period beyond 12 months, but to do so they must contact the borrower and verify the hardship. If they can’t reach the borrower, or the borrower refuses to allow the servicer to engage, the borrower will come out of forbearance.

Borrowers that avoid their servicers will find a monthly mortgage bill in their mail, and when they fail to pay it, they will be reported delinquent. The stories of moral outrage that will surely reach the willing ears of the CFPB staff are not likely to paint the servicing industry in a good light.

Now, on the positive side, unlike the last financial crisis, property values are at all-time highs. The housing market is super-hot. The folks in forbearance are in a better equity position than when they started. With the appropriate servicing outreach and counseling, borrowers can sell their homes quickly, clear up their debt and everyone wins…if the servicers can make that connection with their borrowers.

Lenders retained a lot of servicing rights last year and then dropped it onto sub-servicers. These companies had been getting a few loans a year from these originators and suddenly they were getting hundreds or thousands on a monthly basis.

Do the originators know how to work effectively with their sub-servicers at this level? Is their oversight properly structured? What will happen if they are audited? If the sub-servicer fails to treat borrowers fairly, are they ready to welcome the CFPB into their home office and explain it to them?

Sub-servicers, like the rest of the world, had to pivot to a work from home model while receiving record inflows from their customers. In addition, sub-servicers are dealing with customers who are less experienced in managing servicing portfolios, thereby further stressing their resources. The flood of incoming volumes, payoffs and forbearance creates a perfect storm.

Whatever servicing issues were created by this storm will only be amplified by the new CFPB.

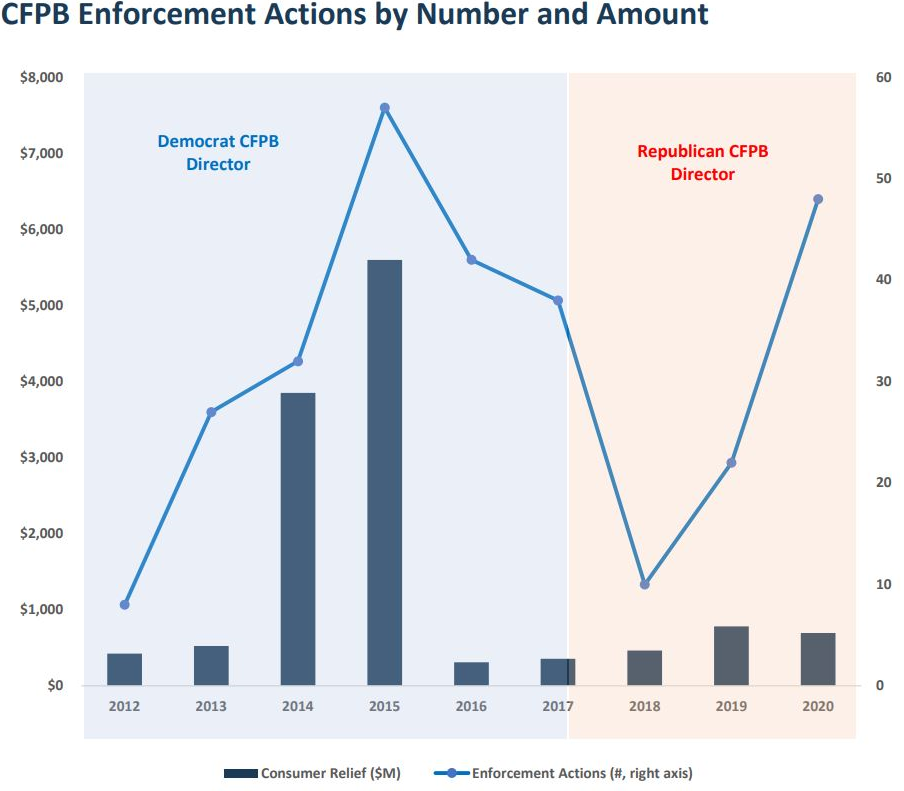

Regulatory expectations are always good for a sleepless night, but the initial view of the new Administration is a not a reason to lose sleep. That said, we expect the CFPB to be more active this year and in the upcoming years with its servicing oversight. The 2021 and forward CFPB is likely to revert back to the Richard Cordray years.

Chart 6

Source: Compass Point Research and Trading, LLC. The Week Ahead in Financial Policy — April 19 to 23, 2021.

Source: Compass Point Research and Trading, LLC. The Week Ahead in Financial Policy — April 19 to 23, 2021.Though it may surprise many, 2020 was the second most active year in history in terms of enforcement actions taken by the CFPB. Even so, the fines were de minimis, especially when compared to the extreme fines the industry saw in the bureau’s early days. Under the new administration, it is quite likely that the high fines we saw in those early days will return, with a vengeance.

One of the reasons this may be true is that the staff we see moving into positions at the CFPB under the new administration share many of the political leanings of the CFPBs original architect, Senator Elizabeth Warren.

This is important not only because the bureau has immense power to levy debilitating fines, but also because it will be on the front lines when it comes to creating the narrative that will be delivered to Congress in the event of another foreclosure crisis.

You may recall that during the most recent foreclosure crisis, the industry went into crisis control mode. The narrative in DC told a story about mortgage companies that were making huge profits by forcing American homeowners into foreclosure and then selling their properties. The stories cited field services firms that weren’t paid to maintain properties in certain neighborhoods. It was a conspiracy without any actual conspirators.

Could it happen again?

The good news is that the CFPB has a number of expected targets that are likely a higher priority than mortgage servicing, such as PayDay lenders. But that could change in a heartbeat if the end of forbearance marks the beginning of problems for mortgage borrowers.

This is a very important question to answer. Putting a value on a mortgage servicer’s portfolio and understanding the supporting cash flows that will result from the servicing is core to the business and a measure of their success. When COVID struck, everything we knew about traditionally valuing these assets suddenly went out the window, and while some traditional assumptions have returned, others have not. Generally speaking, servicing values declined approximately 30% in the first quarter of 2020 across a wide set of banks. For example, if a MSR portfolio had a value of 100 bps at the end 2019, it was valued around 70 bps at the end of the first quarter of 2020.

What happened?

Contrary to what some have written in 2020, servicing values did not go to zero when COVID struck. While they dropped precipitously during the first quarter, across a wide swath of banks, MSR values were basically flat in the second quarter and then began to appreciate in the second half. By year end, as a result of adding record low mortgage rates to the MSR portfolio, servicers had materially changed their portfolio characteristics.

In the aggregator (Correspondent) market, many of the large aggregators hit pause on buying specific loans. Some loans carried too much uncertainty for aggregators. For originators that did not have a direct relationship with Fannie Mae, Freddie Mac or Ginnie Mae, they suffered from overall illiquidity for a period in the Spring of 2020.

The picture was a little different in the co-issue and bulk MSR market. When COVID struck, some of the large buyers backed out of the market and the value of MSRs went to zero or negative in some cases. Other MSR buyers, especially in the co-issue market, lowered their bids but continued to offer critical lifelines of liquidity. In addition, the more automated delivery servicing sale options offered by Fannie Mae and Freddie Mac provided liquidity for some originators that had established pre-COVID ability to deliver at a critical time. The overall bulk MSR market was very quiet as buyers hit pause for a combination of reasons during most of 2020.

Simply obtaining an independent valuation and recording the value in the financials is not likely enough to demonstrate proper oversight of the valuation firm. Understanding how to analyze and validate the cash flows and assumptions is required. The more material the MSR asset is to the financials, the greater oversight and effort is needed to validate the value for auditors and regulators.

If after considering the actual financial results from a cash perspective and assuming the resulting associated risks of retaining servicing make financial and strategic sense, continue to execute the strategy. If there is a gap in the analysis, or the analysis of the retained decision has not been validated, it is critical to close the gaps and potentially get some help. Here are some things lenders can do:

Whether you decide to retain servicing or not, when you face uncertainty, call upon the STRATMOR Group to help you make sense of the data and so you can make better decisions for a more successful integrated servicing strategy. Seth Sprague

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.