With so much emphasis on the Millennial buyer (25-39 year-olds), some of the other major buyer blocks — Gen Z (under 25) as well as the two largest buying blocks, Gen X (40-54) and Baby Boomers (55-75) — have taken a backseat in many lenders’ marketing efforts. However, STRATMOR has recently seen an uptick in the number of lenders asking how they can craft a marketing-communications and technology strategy that caters to all age groups. To answer that question, we must start with a more pointed one:

The 55+ home-buying market is very substantial. In 2018, this group comprised 27 percent of all mortgage loan transactions. If your marketing-communications and technology strategy is aimed primarily at younger buyers, it may cost your company serious revenue (Generation Z, the under 25-year-olds, comprised just three percent of mortgage loans in 2018).

As technological advancements continue to drive change in the mortgage industry, STRATMOR’s MortgageSAT Program — which surveys 100,000+ borrowers annually — has been tracking acceptance of (or resistance to) the changes in several areas:

1. Preferred Method of Status Updates

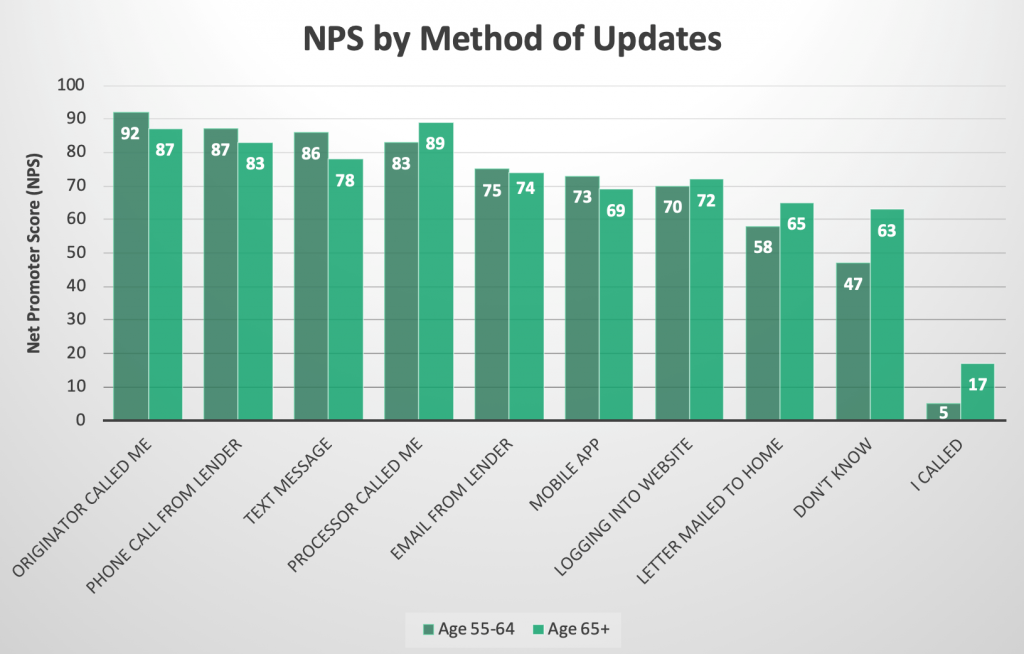

While a proactive call from the lender produces the happiest borrowers in all age ranges, older borrowers are not as tech-resistant as was once thought. The chart below shows the Net Promoter Score (NPS) results for preferred Method of Updates for the two oldest age groups of borrowers:

2. Satisfaction with Online Tools

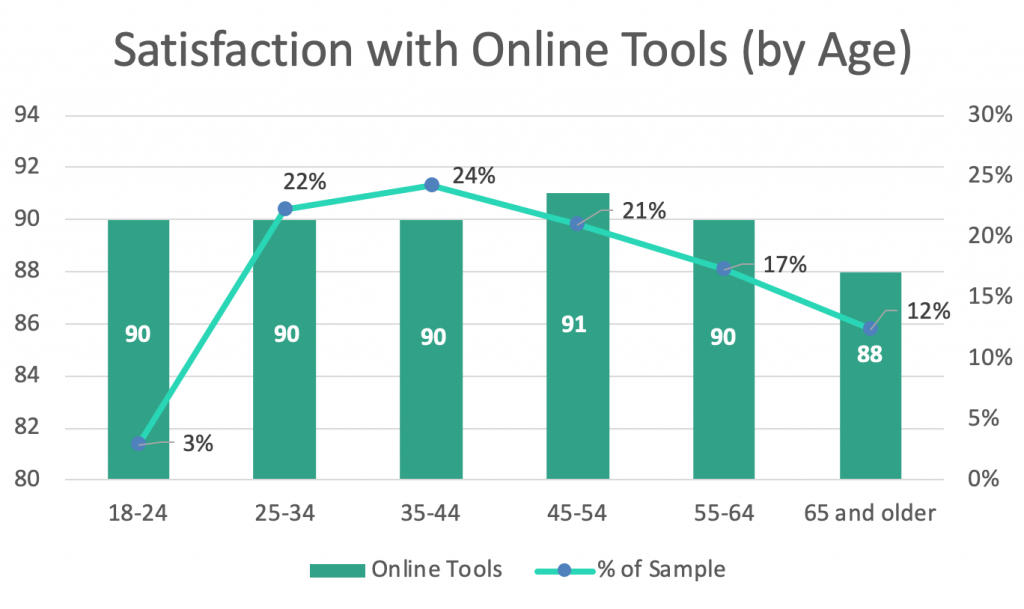

The younger segment of Baby Boomers was equally as pleased with their lender’s online tools (Satisfaction 90) as Gen Z and Millennials. Satisfaction dipped only slightly (88) for the 65+ age segment. These metrics suggest that the Baby Boomers are quite comfortable with recent technological advancements.

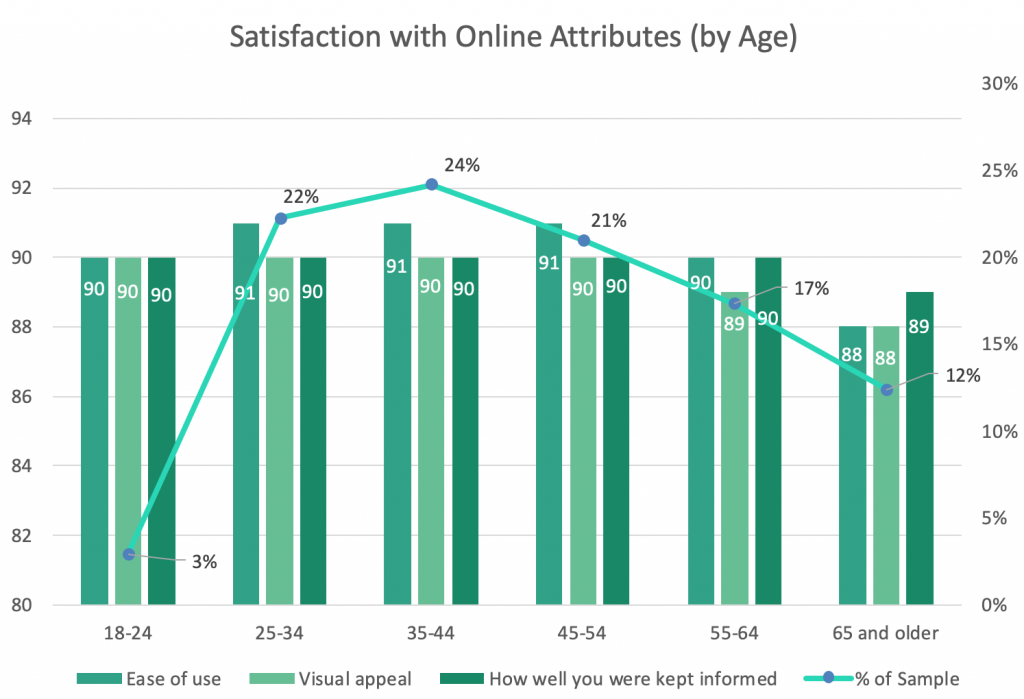

Looking at borrowers’ perception of individual attributes of lenders’ online tools, we again see little difference in satisfaction between age groups, with only a slight dip at age 65+:

3. Reading Social Media Reviews

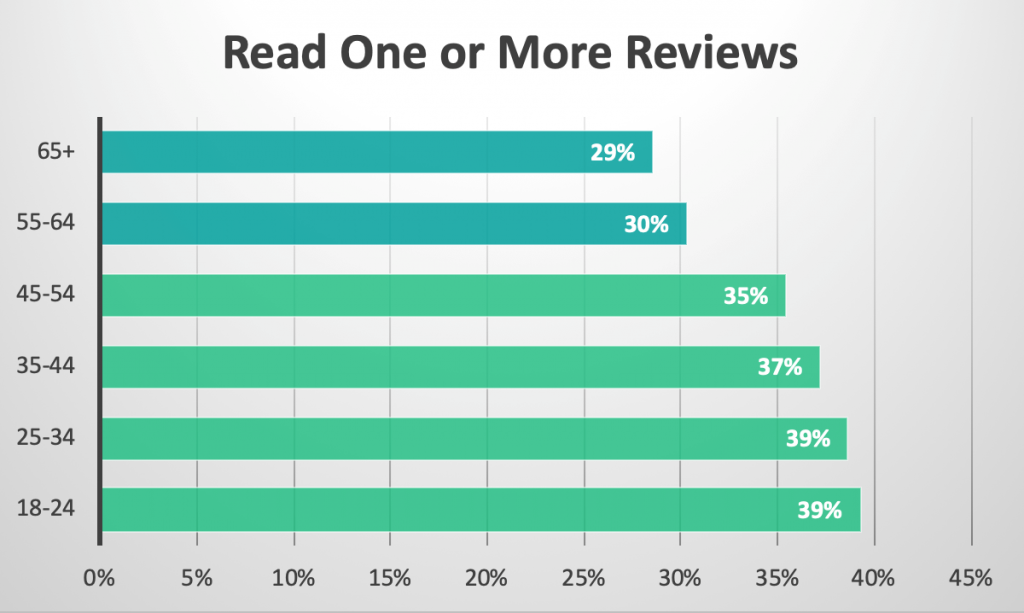

While it’s no surprise that Gen Z and Millennials show the greatest propensity for reading online reviews, it may be surprising to some that nearly one in three Baby Boomers is also reading reviews.

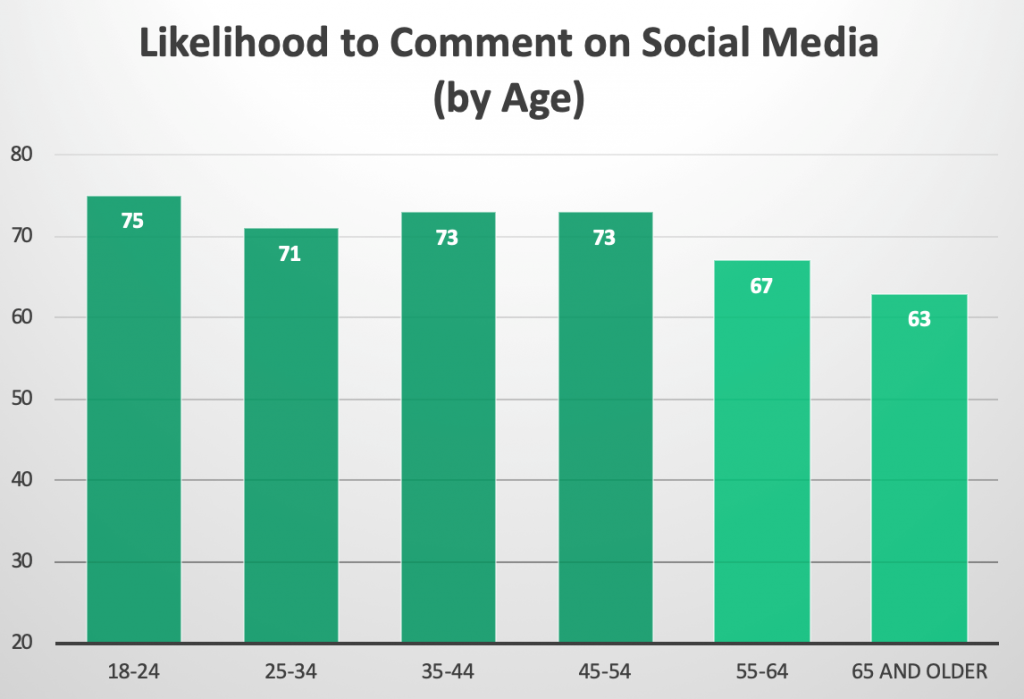

4. Likelihood of Commenting on Social Media

Who comments on social media posts? Lots of people. It turns out Baby Boomers are engaging in social media (Likelihood to Comment 67 on a 100-point scale) only slightly less than younger generations (71-75):

Older borrowers are more than adjusting to new technology in the mortgage industry — they’re embracing it. This new paradigm has ushered in a time in our industry where the old fears of moving too fast have now turned into a scramble to catch up with the rest of the world.

Lenders who embrace this new reality will be the ones who survive and flourish in the years to come. A successful marketing-communications technology strategy will be one that balances personal touch with innovation, and that trusts customers will keep up with continuing technological advancements.

Here are three ways you can begin to craft strategies that cater to your specific borrower-age mix:

Find out more about STRATMOR’s MortgageSAT Borrower Satisfaction Program, and how rich, drill-down data can help your company. Contact MortgageSAT Director Mike Seminari at mike.seminari@stratmorgroup.com.

To see how improving your NPS score translates into real revenue dollars, try our new MortgageSAT calculator.

To find more MSAT Monthly Tips, click here.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.