This year marks my twelfth-year teaching the MSR Servicing class for Mortgage Bankers Association’s School of Mortgage Banking II (SOMB II). I wish I could say that I remember each class and every one of my more than 2,000 students, but there have been so many faces, and places — one class was even held at the American Airlines Training and Conference Center in Dallas where they had a mock-up of an airplane within the facility. (I wish we could have gained access to the plane!)

While every class is different, one thing remains constant: even with 25 years of experience in mortgage banking, I continue to learn from each new group as I teach and explain Mortgage Servicing Rights (MSRs), servicing operations and how a complete servicing strategy fits in with an overall corporate plan for Banks and Independent lenders.

In this article, I’ll share some of my answers to the most common questions of SOMB II students, the interesting mortgage lending experiences they’ve shared with me, and what I’ve learned from these students.

There are a few very specific issues that come up in most of the classes, and I can always tell what is going on in the industry — and sometimes at the students’ companies — when they ask questions. In the twelve years that I’ve been teaching, the industry has faced a number of challenges: the delinquency and default crisis, the MSR asset becoming illiquid due to a lack of buyers, the emergence of independent mortgage bankers retaining servicing, elevated prepayment speeds, Fannie Mae and Freddie Mac being placed in conservatorship and the mortgage industry almost losing the tax benefits associated with MSRs late in 2017.

The most common questions center around retaining servicing, prepayment speeds, how to determine when servicing become unprofitable, and escrows.

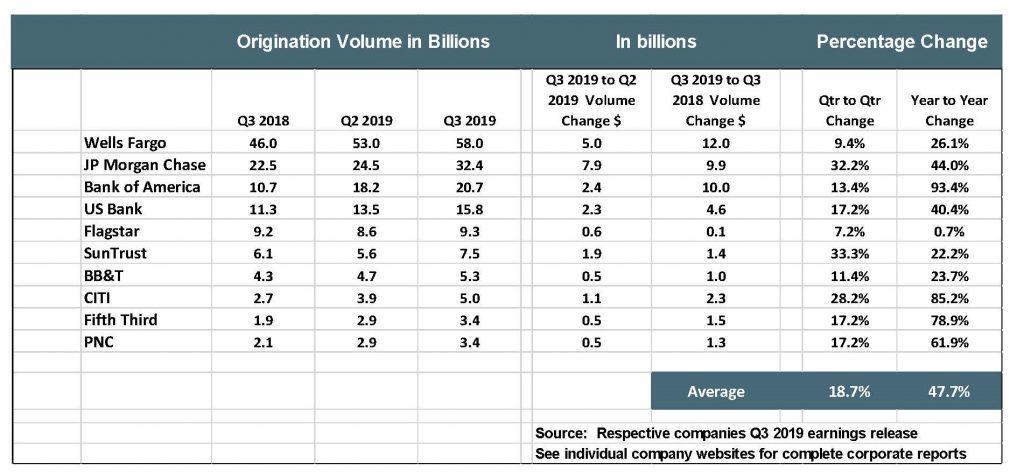

The topic of whether to retain servicing permeates most class discussions. This decision is usually determined by a company’s overall business strategy, its cash flows and the value of the customer. Chart 1 is quick summary of the MSR values reported by large banks as of the third quarter of 2019. The MSR is represented as a percentage of the servicing unpaid principal balance.

Chart 1

Please note: most banks do not disclose their weighed average service fees, therefore a true comparison of servicing multiples across banks is not possible.

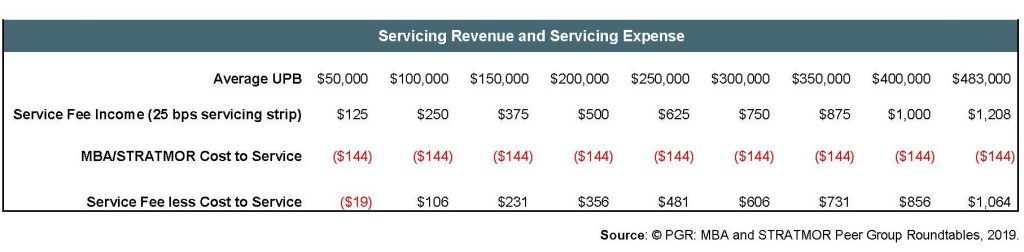

Frequently, the classroom discussion leads to the role that Correspondent aggregators play in terms of buying servicing via a service released premium (SRP) and the overall impact that volume and margins have on the ability to retain servicing. As we discuss servicing values and cash flows, I try to connect the dots to explain why values differ across the outstanding balance of the loan and why an unpaid balance of $50,000 often does not have an SRP value. Chart 2 shows the significant impact that different average UPBs have on the service fee income when using the PGR: MBA and STRATMOR Peer Group Program average direct cost to service.

Chart 2

Students learn that the decision to retain or not retain servicing must be viewed within a company’s overall mortgage strategy. For Banks that strategy focuses initially around the capital to retain servicing, and for Independents, the decision is around the cash. Through this discussion students gain an appreciation for the complexities around the MSR valuation process and what it means to servicing loans.

Students learn that the decision to retain or not retain servicing must be viewed within a company’s overall mortgage strategy. For Banks that strategy focuses initially around the capital to retain servicing, and for Independents, the decision is around the cash. Through this discussion students gain an appreciation for the complexities around the MSR valuation process and what it means to servicing loans.

Quite often the class realizes that they know more about servicing than they thought they did. The discussion really gets lively when students share their experiences, particularly when we start talking about prepayment speeds and the factors that cause prepayment speeds.

Typically, students think that the prepayment speed section of the class will be all about formulas and calculations. The prepayment speed assumption (PSA) is the most critical assumption, but the actual formula is far less important than knowing which factors impact prepayment speeds. When I started teaching, we used to spend the better part of an hour with the actual calculation. Today, we spend that time on the concept and the factors impacting speeds, instead of the calculation for translating a CPR (Conditional Prepayment Rate) to a PSA (now students receive a table).

The prepayment discussion focuses on the impact on originations, customer retention and the overall impact on earnings. This leads to a deeper discussion of the long-term strategy side of the mortgage business and how the mix of refinance versus purchase production, margin (gain on sale) and servicing must be viewed holistically. Students learn that generally:

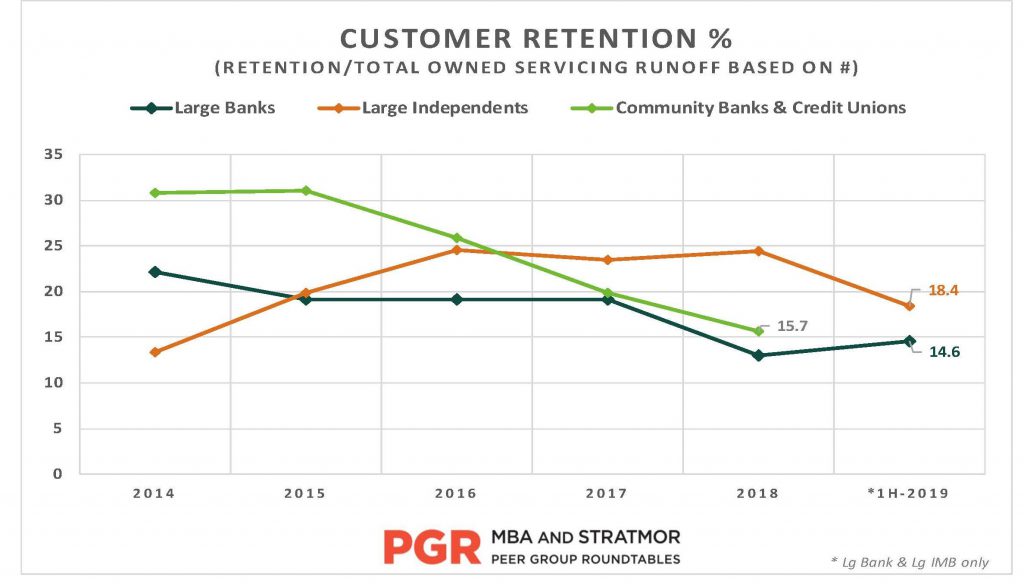

The graph below shows a trend of recent recapture.

Escrow balances are another area that tends to spark conversations in the classroom — you can almost see the wheels turning in the heads of the students who have a mortgage. Personally, while I know that the servicer holding my escrow funds is investing the float, I like not seeing the bill and having the servicer pay my taxes and insurance.

Students learn that the value of the escrows is tied to the potential earnings credit, which highlights a major difference between banks and non-banks: the ability to earn credit on escrows. Banks have a real advantage compared to non-banks in that regard, although non-banks can receive credit for their warehouse banks or MSR financers.

The escrow balance discussion allows me to bring additional concepts, such as warehouse lending and MSR financing, into the more comprehensive mortgage strategy conversation.

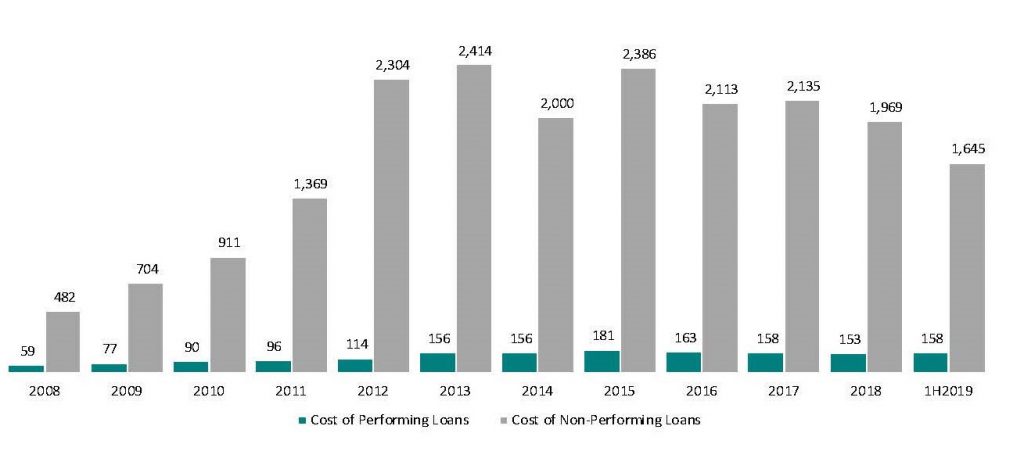

This question is often asked, and while difficult to answer, students learn that whether servicing become unprofitable depends on the facts and circumstances of the individual portfolio and servicing operations (or the use of a sub-servicer). In general, delinquent servicing is a liability as the servicer does not earn its service fee income and incurs elevated expenses. We also discuss how low balance servicing and activity-based costing play into profitability

Chart 3 is from the MBA’s Servicing Operations Study and Forum and shows the dramatic increase in cost to service for delinquent loans.

Chart 3

I use many real-world examples and a little humor to make servicing education as entertaining as possible. These stories help illustrate how critical it is to have a well-defined servicing strategy and how that servicing strategy ripples across the entire organization. I share stories from my career at large banks, such as Bank of America and SunTrust where I managed their MSR assets, and from the hundreds of client meetings and on-site visits from years working as a consultant and business advisor.

Often, the stories the students tell about their real-world experiences have increased my mortgage knowledge, and servicing default is one area where the students have sometimes become the teacher. Default servicing and foreclosures are highly specialized areas, and while I can teach the basic concepts (which are taught in-depth in a different SOMB II section), I call on the experts in the room to help with answers when questions come up on these topics.

For example, the level of foreclosures is different from state to state and, at a high level, revolves around whether the state is a judicial or non-judicial state in their foreclosure process (some states have both). In one class, several student/foreclosure experts were able to provide detailed information about foreclosures in Washington, D.C. and New Jersey. It turns out that Washington, D.C. does not force delinquent borrowers from their homes, and therefore, foreclosures tend to linger. New Jersey, as a result of the robo-signing issues experienced across the industry post-financial crisis, kicked all active foreclosures out and made companies document and prove that servicers had operationally fixed the robo-signing issue. The New Jersey decision slowed down the foreclosure process and increased their timelines.

The students’ experiences have also surfaced issues that prompted me to communicate their concerns with industry regulators. One such issue is a real drain on cash flows and potentially creates payment shock for borrowers — RESPA rules on the timing of the escrow analysis.

This issue is about timing of the initial RESPA-driven escrow analysis and when the tax information is updated. The borrowers impacted often suffer payment shock as the loan is closed with an escrow calculation that does not include the full value of the property. The servicer is responsible for the escrow analysis, and must fund the short-fall, but in doing so also must alert the customer that their T&I payment is changing. The owners of the servicing know the misery this timing issue causes borrowers. The issue was initially raised by the Correspondents in the classroom that were faced with needing to fund the shortfall, spurring me to speak directly with the FHFA to raise awareness.

Another important lesson I’ve learned from the students: Servicing is often behind the times in bringing on new technology. Some of the most used servicing systems are over 30 years old, and companies will often focus their IT investment dollar on more consumer-facing products or services, like a loan origination system. To remain profitable, servicers need to invest in optimizing the borrower experience and to making information more accessible to consumers.

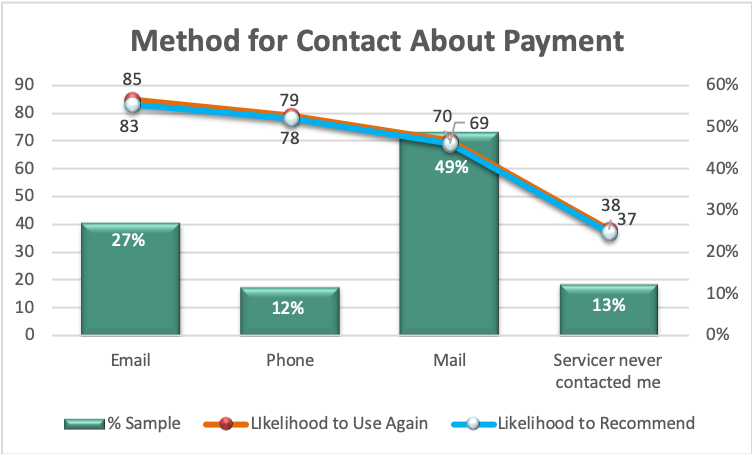

STRATMOR’s MortgageSAT Borrower Satisfaction Program is one way to collect information on the servicing experience and supports the need for lenders to learn more about their servicing customers. For example, the chart below shows borrower satisfaction based on method of contact for payments. Note that when postal mail is used, the Net Promoter Score (NPS) is an unimpressive 18 (NPS a measurement of the borrower’s likelihood to recommend the lender). By contrast, the most technology forward option on the list, contact by email, receives an NPS of 53. Interestingly, this is even higher than the NPS for borrowers who received a personal phone call (46).

Chart 4

Mortgage education is serious business.

In the late 90s, I had the great fortune to work with Tom Cronin, a Master Certified Mortgage Banker (CMB) who was — and still is — actively involved with the Mortgage Bankers Association. He told me that if I was serious about being in the mortgage industry and wanted to try to make a difference, that I needed to get involved with the MBA and get the CMB designation. At SunTrust, I was able to take part in the MBA Future Leaders Program, and in the same year earned my CMB designation. I am also likely in the last group of CMBs to take a written test versus the online CMB exam, which means I can talk to SOMB students about the good old days when I had to walk uphill to CMB school in the snow!

The mortgage business is continually evolving, especially now as the digital mortgage experience has amped up the speed of change, and the competition, markets and borrowers push our evolution along. Continuing education for mortgage professionals to stay up-to-date on the industry’s progress is essential.

In addition to the courses offered by the MBA’s School of Mortgage Banking like the SOMB and Mortgage Banking Bound Programs, there are many other educational resources for mortgage professionals. For example, STRATMOR Group offers a series of workshops for lenders where they can exchange ideas and talk about their real-world experiences to gain insights about their own businesses. STRATMOR Workshops are facilitated by the STRATMOR team, are function- or channel-specific, and include Consumer Direct, CIO and Operations workshops.

I might have driven a few folks out of the business, or at least to not retain servicing, but all joking aside, hopefully I’ve driven more toward pursuing mortgage industry knowledge and certification in this business discipline. SOMB students know that education is not just a worthwhile endeavor but also serious business!

While at SunTrust Mortgage in 2007, I began teaching for the MBA in its SOMB program to give back to the industry and the MBA and stay involved. Now that I am with the STRATMOR Group, I feel that teaching is more important than ever as it helps to foster knowledge transfer to rising CMBs. If we, as an industry of professionals, want to continue to attract high-quality professionals, we need to do our part to lead the next generation along this path.

I admit: teaching an eight-hours session is challenging, both mentally and physically. I’ll also admit that I do tend to drink my fair share of Diet Coke® throughout the day, and the MBA staff is very kind in making sure that I have enough to get through the whole class. But the reward is so worth the effort — teaching helps keep me sharp and in tune with how servicing fits in with a larger corporate mortgage strategy.

I’ve gotten so much more than I’ve given. I’ve met more than 2,000 mortgage professionals as students, and many have become close business contacts and resources. Many have gone onto more complex jobs within their companies.

The opportunity to spend an entire day with a group of mortgage people has provided lasting memories and the opportunity to develop future business opportunities. Former students have provided internal feedback to their co-workers and bosses and as a result, I have received my fair share of calls and emails from students’ co-workers seeking assistance with business needs. I have gained access to the highest levels within companies as a result of teaching its employees.

For my former students, hopefully this article brings back fond memories of MSR day in SOMB II. For future students — I look forward to meeting you and to sharing my latest opening monologue. For those that have not taken SOMB II, hopefully this article and my previous Insights Report article, “Finding Balance: Servicing in the Mortgage Banker’s Strategy” has you thinking about how servicing fits in with your company’s overall mortgage strategy. Also, follow me on LinkedIn where, almost daily, I post useful industry information.

The message I hope that everyone takes away: Servicing cannot be viewed in isolation and must be part of a more comprehensive strategy that includes the tax impact of retaining servicing, the cash consequences, the potential value change, the potential value of the customer, and the long-term value of the customer to your company. I encourage lenders to contact STRATMOR Group for assistance in defining and implementing your comprehensive servicing and origination strategies.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.