As many businesses scrambled to stay afloat and many employees struggled with job security in the past three months, the mortgage industry has been on a wild run, producing both record volumes and impressive customer satisfaction metrics.

Even so, it is not all good news. While rates may remain low for the duration of 2020, the booming refinance volumes will inevitably slow to a simmer and then dry up, leaving purchases to once again drive the mortgage market. If the economic bounce-back ends up taking more than a few months — which is highly likely — lenders may find themselves in a bit of a pinch. As business returns to usual, they may find that formerly qualified loan applicants are now unemployed, have depleted their down payment savings, or have struggled to make credit-affecting payments during the downturn. None of this bodes well for lenders, borrowers or the housing market in general.

Lenders can get ahead of the curve by going back to the basics. Borrowers overwhelmingly choose their lender based on a referral or existing relationship — 87 percent of the time according to MortgageSAT year-to-date data, even in the current refinance-rich environment. Creating a delightful loan experience is the surest way to garner a client referral, and lenders can create that delightful experience by following the tenets of exceptional borrower satisfaction that seem to remain constant no matter how the economic or political winds are blowing.

Many lenders have been thrilled to see their teams achieve higher borrower satisfaction metrics in the past 60-90 days, but few are asking themselves, “What have we been doing better to earn these higher scores?” Now is the time to ask, “How can we keep the momentum of this positive customer sentiment going?” Without self-examination and proactive improvements in the process and additional customer satisfaction training, the spike in customer sentiment could well be short lived. Recognizing and building upon customer experience success creates an environment that fosters repeat and referral business, which comes in very handy in leaner months. Without pursuing this strategy, lenders could be in for a rough fall and winter this year.

Going back to the basics means revisiting the tenets of customer experience that simply do not change over time. These are highly sensitive aspects of the loan process that are quite binary in their effect. Get them right and you’re almost guaranteed to receive customer accolades, if not word-of-mouth referrals. Get them wrong, however, and not only do you forfeit a referral opportunity — the customer is highly likely to poormouth you to their friends.

The following three rules have stood the test of time. Incidentally, all relate to the importance of clear communication with a personal touch:

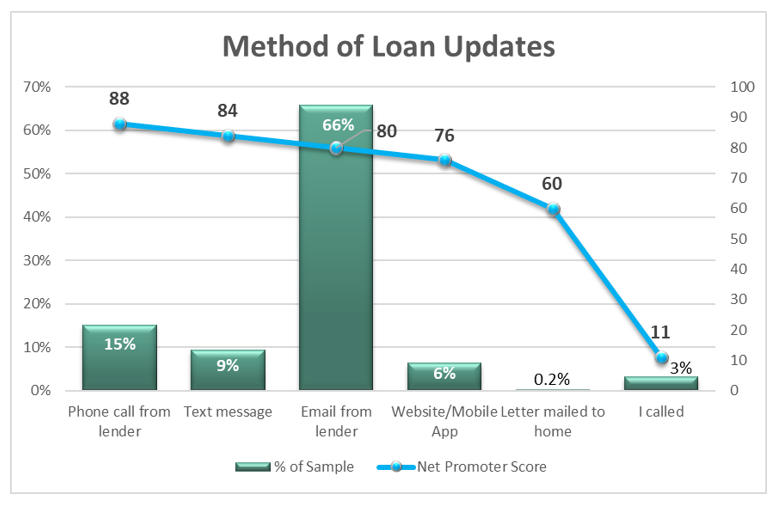

Chart 1

Source: MortgageSAT Borrower Satisfaction Program, 2020.

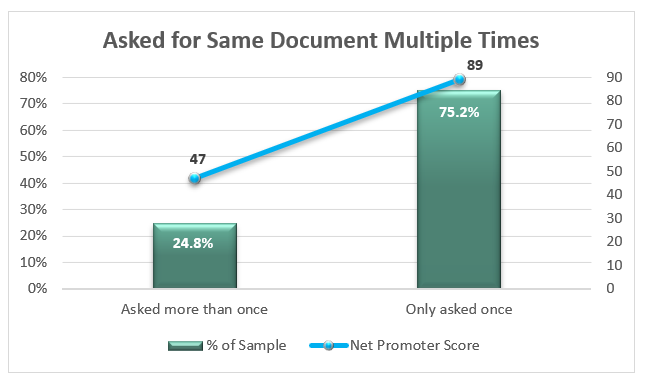

Source: MortgageSAT Borrower Satisfaction Program, 2020.Chart 2

Source: MortgageSAT Borrower Satisfaction Program, 2020.

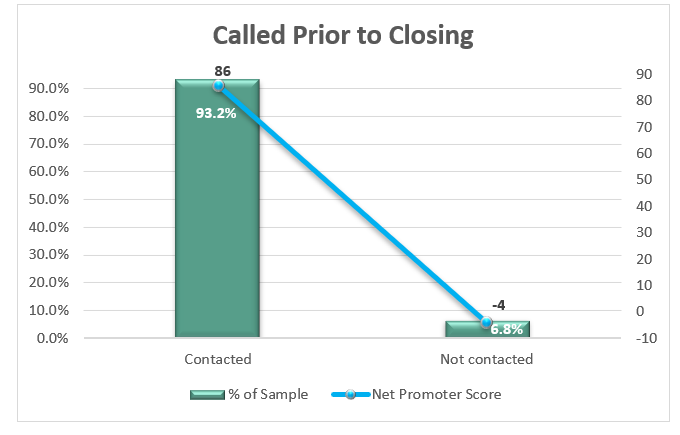

Source: MortgageSAT Borrower Satisfaction Program, 2020.Chart 3

Source: MortgageSAT Borrower Satisfaction Program, 2020.

Source: MortgageSAT Borrower Satisfaction Program, 2020.Each of the above metrics showed slight improvements from Q1 to Q2, which suggests that loan officers and processors have stepped up their communications game during the pandemic era. Once the crisis subsides, make sure you keep the momentum going with these tips:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.