As the clouds of the COVID-19 storm continue to roll, one of the areas of the mortgage industry that will take a big hit is servicing. After years of low delinquency, stable servicing values, and a very liquid servicing market, mortgage servicers are facing a host of issues not seen since the 2008 financial crisis.

The years from 2009 to 2012 (the last crisis) brought a great deal of pain and confusion to the mortgage industry, and it took courage and perseverance to survive the fallout. The fallout was so severe that some servicers from that time are not even in the industry today.

The question now is how servicers are going to handle this virus-driven crisis.

In STRATMOR’s opinion, we need to learn from our past and proactively help servicers today to prevent history from repeating itself in light of this pandemic.

“We can and will survive the time of COVID-19 by being smarter, more proactive and more disciplined with our response to the change in market conditions,” says STRATMOR Senior Partner and CEO Lisa Springer. “The decisions we make now will be with us for at least three and maybe as long as ten or more years — we owe it to our borrowers to apply the lessons of the past as we shape a better future for them.”

Consider this: Back in 2009, the mortgage servicing industry was under substantial scrutiny. Servicers were perceived by many as unwilling to modify adjustable rate mortgages for borrowers on the verge of foreclosure. By 2010, this scrutiny expanded to include accusations of “robo-signing” and the mishandling of foreclosures moving through the court systems. Additional accusations against servicers included questionable paperwork, falsifying dates and other information in the foreclosure documents, and utilizing untrained staff during this plagued time. Further, illegal mortgage overcharges, fraudulent foreclosures, and rampant lawsuits tainted servicers and the entire mortgage industry’s reputation.

After the 2008 financial crisis, we had a reactive, costly, inefficient and nearly 100 percent manual response to the meltdown. Credit risk, regulatory fees, litigation and reputational damage hurt the whole industry, plus there was massive customer disruption and subsequent CFPB enforcement.

Today we face the results of a virus that has spread across the world, causing the U.S. to close its borders and to require “social distancing.” Passengers have stopped using air transportation, public transportation has slowed to a crawl and restaurants, hotels, and public venues have all ceased operations. The cessation of these consumer spending activities had an immediate negative impact on the global economy and created tremendous market volatility. U.S. unemployment claims have reached unprecedented levels.

“There are major differences between the current COVID-19 crisis and the previous recession,” says STRATMOR Senior Partner Garth Graham. “A major upside to our current environment is that borrowers have more equity in their homes and average credit scores are higher. Also, there are far fewer ARM loans now versus 2007 so there is less of a risk of payment shock when rates rise at some point in the future.”

“The COVID situation is much more like the disruption created by a natural disaster such as a hurricane,” says Graham (who lives in South Florida so knows something about hurricanes). “A hurricane is a major disruption to a localized economy and typically has a shorter-term impact than a recession. Of course, with COVID, it’s not local, and we really don’t know yet how long it’s going to be around. I am left wondering if we are in the ‘eye of the storm’ yet.

“We’re all trying to anticipate what will happen next and we are all hoping we are prepared, or can pivot quickly, to meet the next challenge,” says Graham “There are issues like forbearance, the potential for default and the need to consider retaining more servicing due to a market that has reduced the number of MSR buyers. Bottom line — if you own servicing now, you likely are going to have to work through the crisis, and if you are booking new originations, you are far more likely to keep the servicing since there are not as many attractive outlets to sell the servicing.”

Let’s examine what we know today:

As a result of COVID-19 impacts, from stay-home-stay-safe measures to business closures, job loss and market volatility, the government introduced a substantive stimulus bill meant to shore up the shut-down economy during the near-term disruptions.

In conjunction with this response, the servicing side regulatory landscape changes significantly:

Plus, evolving aggregator guidelines for eligible products are driving loan and servicing illiquidity to the forefront.

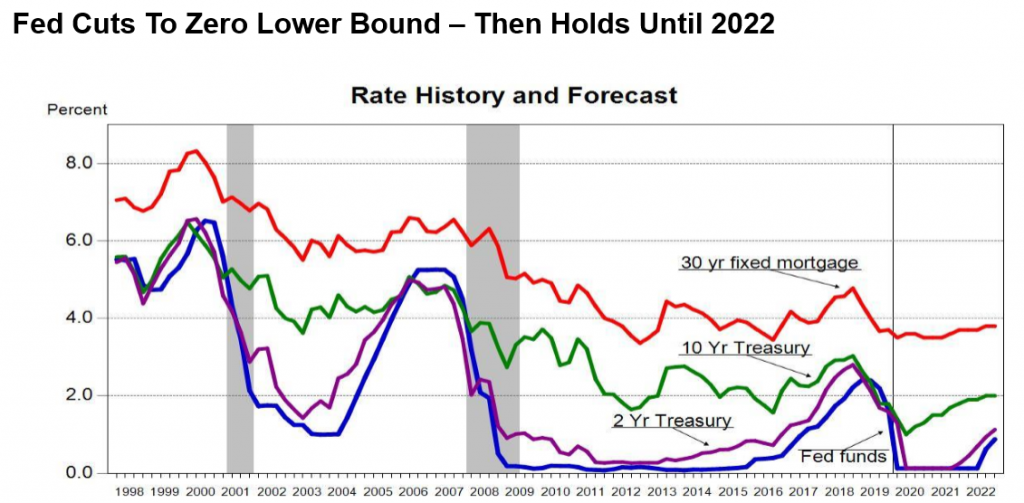

The MBA significantly revised its growth projections for 2020, adding a rebound expectation in 2021. According to Mike Fratantoni, chief economist for the MBA, the revised forecast anticipates a growth stall for 2020 with a rebound in 2021. The basis for this projection includes a -2.9 percent GDP growth assumption, 0.7 percent inflation for the balance of 2020, and unemployment reaching 6.3 percent. As a result, the MBA also forecast mortgage rates as follows in Chart 1.

Chart 1

Source: MBA Research and Economics, 2020.

Source: MBA Research and Economics, 2020.Additionally, emerging housing policies are generating future risk exposure (credit, regulatory, litigation and reputation):

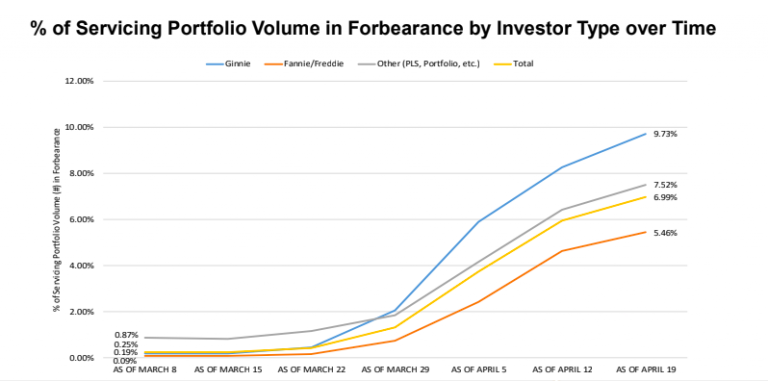

Forbearance is a major concern for most of our industry. The MBA estimates one-quarter of borrowers could request forbearance for six months or longer, advancing requirements on mortgage servicers could exceed $75 billion.

According to the MBA’s recent survey “% of Servicing Portfolio Volume in Forbearance by Investor by Type Over Time” shown below, as of April 19, 2020, forbearance requests continue to rise.

Chart 2

Source: MBA Weekly Forbearance and Call Volume Survey, as of April 19, 2020.

Source: MBA Weekly Forbearance and Call Volume Survey, as of April 19, 2020.According to this survey, the total number of loans in forbearance jumped from 5.95 percent in the prior week to 6.99 percent as of April 19.

At a recent PGR: MBA and STRATMOR Peer Group Roundtable meeting, mortgage servicers in attendance estimated that peak delinquencies could reach the 15-20 percent level, and some believed delinquencies will exceed 30 percent. After a decade of gradually trimming servicing staff as delinquencies declined from peak levels in 2010, servicers will need to:

“A good first step was the recent announcement that Ginnie was going to supply a facility to handle the principle and interest (P&I) advances and the Fed is hopefully going to step up for the taxes and insurance (T&I) portion and for the full payment advances on the Agency production,” says STRATMOR Principal Seth Sprague, CMB. “This certainly will help from a cash flow perspective, and hopefully help the servicers remain liquid and able to invest in the critical components to help the borrowers who need to address their personal situations.”

Additionally, the recent FHFA announcement to limit P&I advances to four months on securitized Fannie Mae and Freddie Mac loans in forbearance is another positive step to support servicer liquidity.

But even if the cash flow challenges are addressed through additional Treasury relief, the servicers will still be left to manage the process that is establishes through the change in policies. And this change will need to be managed across the entire spectrum of tools, including a commitment to people, process and technology.

Along with daunting internal staffing challenges, servicers will need to continue to supplement staffing using outsource providers. The challenge here is that many offshore providers in places like India and the Philippines have “shelter-in-place” rules that have prevented them from fulfilling their obligations. This means servicers have two challenges — ramping up staff AND converting offshore arrangements to onshore providers or covering with internal staff.

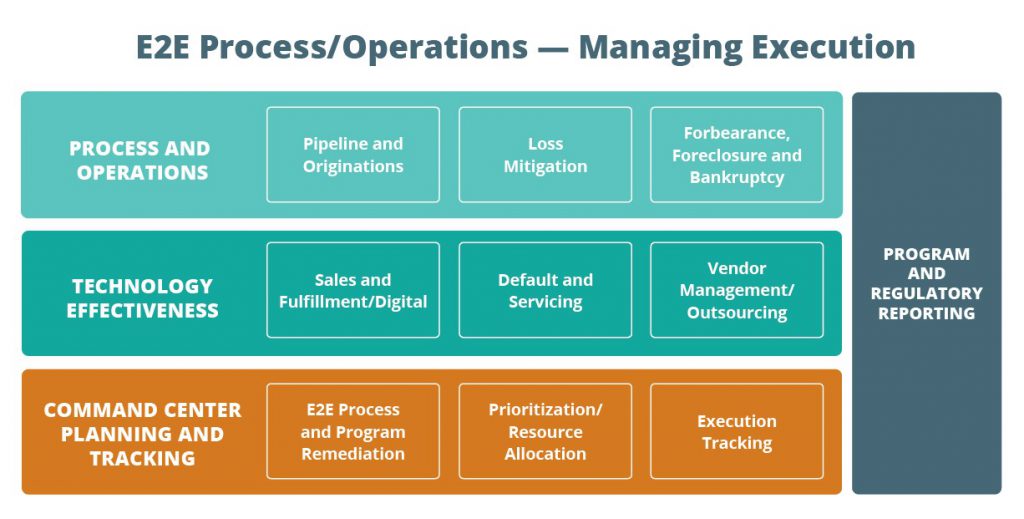

Chart 3 models an effective E2E process and operations execution plan.

Chart 3

Source: Copyright © STRATMOR Group, 2020.

Source: Copyright © STRATMOR Group, 2020.An important area of focus for originators is to help their teams understand the importance of the MSR market and its impact on its company’s cash flow position and liquidity. See our March In-Focus article for more information regarding critical factors that MSR owners should consider in today’s market.

From STRATMOR’s perspective, servicers should do the following to be prepared to manage through the current challenges and changes:

According to Michael Grad, senior partner with STRATMOR Group, “Proactive and rapid response for disruption response plans and requirements cannot be managed with a one-off approach. Successful response planning relies on managing and integrating across line of business operations, technology, risk, vendors and project resources, which makes solving enterprise regulatory and business challenges difficult.” Successful disruption preparation and execution require critical capabilities:

STRATMOR’s Disruption Response Governance Plan provides a framework of strategies and tactics that can be quickly implemented to improve your organization’s response to industry changes brought on by economic and pandemic influences. This includes:

STRATMOR proposes a default subject matter expert (SME) intensive triage approach to deliver relief in an accelerated timeline as seen in the chart below.

Chart 4

Source: Copyright © STRATMOR Group, 2020.

Source: Copyright © STRATMOR Group, 2020.More specifically, what STRATMOR can do to assist servicers.

As an industry, we need to learn from the mistakes made during the recovery period from 2009 through 2012 and proactively seek paths to avoid creating similar pain and confusion in our COVID-19 response. Our industry must make a concerted commitment to not go through that mess again. Last time, our industry came through the crises scathed but alive. With a candid, strong look-back and a forward-thinking game plan, our industry can avoid the mistakes of the past.

In other words, our response to the last meltdown was reactive, costly, and inefficient. We must be smarter this time, learn from our “school of hard knocks,” and be proactive and far more structured and disciplined with our disruption response. Let us proactively change how we deal with this current national disruption and take charge of our and our borrowers’ experience.

Armed as we are with the knowledge of what did and didn’t work after the 2008 financial crisis, and with the people, processes and technology advances of the last ten years, we are better able to weather the COVID-19 storm by executing intentional strategic initiatives to pave the way to a better future. Contact STRATMOR Group for assistance with your coronavirus response strategy and planning needs.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.