The wild ride of 2020 continues to bring us new and unexpected turns. Most recently, mortgage rates hit a new all-time low at 3.07 percent, which is allowing lenders to sustain unprecedented refinance volumes into the summer months. To quote 90’s rap legend Vanilla Ice, “Will it ever stop? I don’t know.”

With credible sources like the MBA saying we can expect rates to remain low through the end of the year, lenders may be able to ride the refinance wave well into the fall and winter months. Sooner or later however, the refinance windfall will dissipate, and originators will once again have to go back to the purchase well. When that happens, the ones who survive — and thrive — will be the ones who continued to build up purchase-centric relationships throughout the refinance boom.

Just about any originator can thrive when rates are rock bottom and refinances are booming, but the most successful originators know that longevity and consistency in the mortgage industry comes with your ability to build and sustain a strong referral network. When rates go up, or just stop falling for a couple consecutive quarters, we always witness contractions in originator staffing, presumably because the “easy money” goes away and the commissions dry up for the unprepared and uninitiated. It’s for this same reason that the STRATMOR Originator Census data consistently shows that 80 percent of the volume is originated by just 40 percent of the LOs.

Knowing this valuable information is only half the battle. Executing on a strategy to strengthen existing referral relationships and build new ones is much harder. With many of the old school tactics like buying gifts, meals and rounds of golf now frowned upon — or worse, illegal — by regulatory standards, many originators feel ill-equipped to add value to their referral partner relationships. After all, how much goodwill can you engender with an occasional text, phone call or email? Thankfully, there are not only other options, but better, more effective ones.

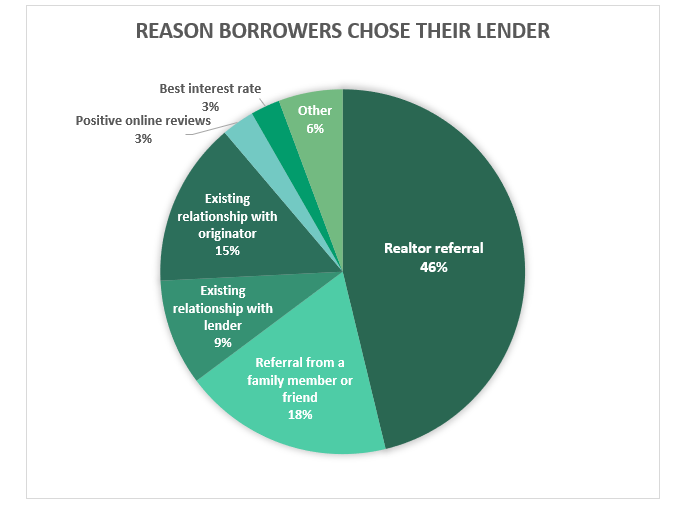

In 2019, 46 percent of purchase loans came via a real estate agent referral, which means half of lending revenue in a purchase-driven market is dependent upon keeping these referral partners happy. Keeping real estate agents happy involves keeping their customers, the borrowers, happy. That is partially why we stress the need to delight borrowers, as this is what drives referrals from friends and family, not to mention repeat business down the road. In fact, 88 percent of borrowers choose their lender based on a referral or an existing relationship with the LO or lender. So, what this means is that EVERY refinance is an opportunity to create a raving fan and thus a chance for repeat business and referrals. But don’t ignore the real estate agents, who still account for nearly half your volume.

Source: MortgageSAT Borrower Satisfaction Program, 2020.

Source: MortgageSAT Borrower Satisfaction Program, 2020.When it comes to referral partner relationships, the depth is far more important than the breadth. In other words, you don’t need gifts and lunches and golf outings to win the esteem of your referral partner. The real currency of a referral relationship is in transparency, trustworthiness, and reliability.

If an originator wants to delight a referral partner, transparency is paramount. Originators must make a habit of looping partners in on all major milestones, especially if the loan hits a major bump. This may sound counterintuitive to originators, who often consider it part of their job to shield referral partners from having to worry about loan issues and process missteps. However, relationships live and die with effective communication, and transparency breeds trust. According to MortgageSAT data, roughly three in five loans experience at least one critical error in the loan process that jeopardizes the likelihood for a referral. Originators fare much better with their referral partners when they are open and honest about these issues in real time than when their referral partners end up hearing about problems later from their borrowers.

Gaining a referral partner’s trust goes beyond transparency, though. The most successful originators strive to be a trusted source of knowledge and wisdom on all things mortgage-related and even finance-related. In a word, they are trustworthy. It begins with being well-versed in all options available to borrowers, not to mention underwriting guidelines. From there, originators can begin to share curated information with their referral sources about the economy, forbearance, mortgage industry trends and capital markets. This is a great way to grow into a trusted advisor and to build sustainable loyalty. Lenders can help the cause by gathering and sharing this kind of thought leadership with all of their originators on a regular basis.

As originators look to improve reliability with their referral partners, they should think of how they can set proper expectations and then deliver on these expectations. A good place to start is to create touch points that are easy and predictable. “I’ll call you when the loan is approved.” Or, “I’ll email you each Friday with an update on our client’s loan.” The more touch points you can create, automate, or place into habit, the more you’ll reinforce your ability to deliver on expectations. At STRATMOR, we advocate for personal calls to update referral partners once per week.

Here are three things you can do to ensure your referral partners keep sending business your way:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.